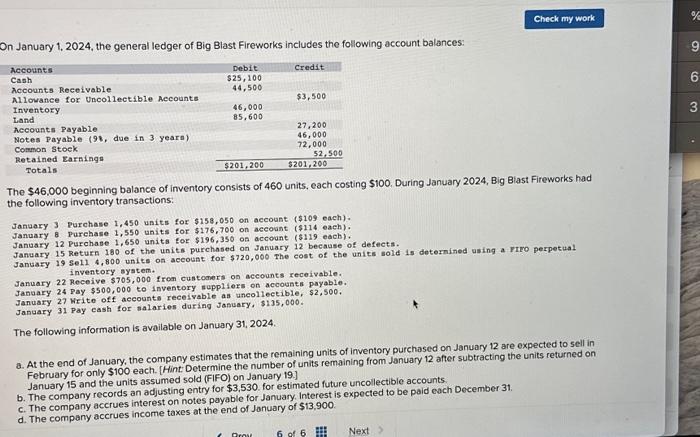

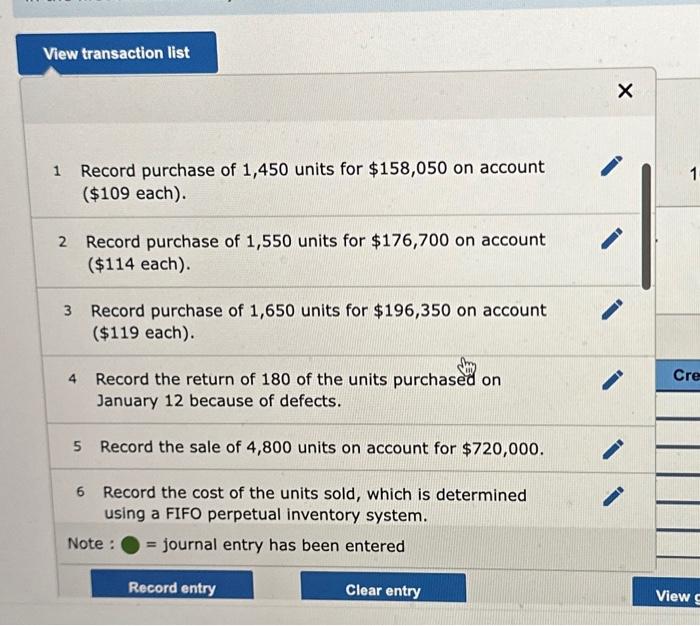

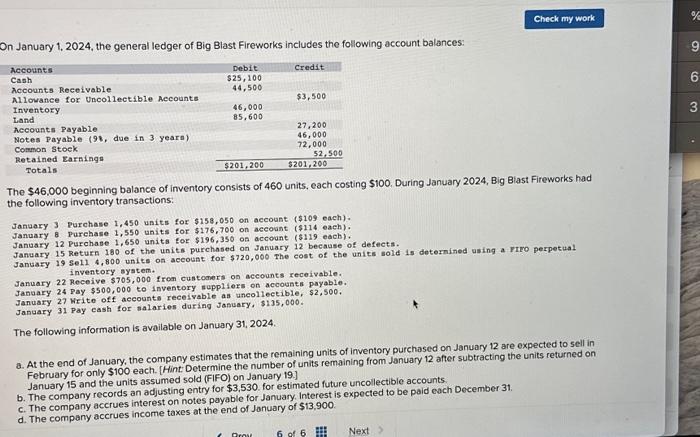

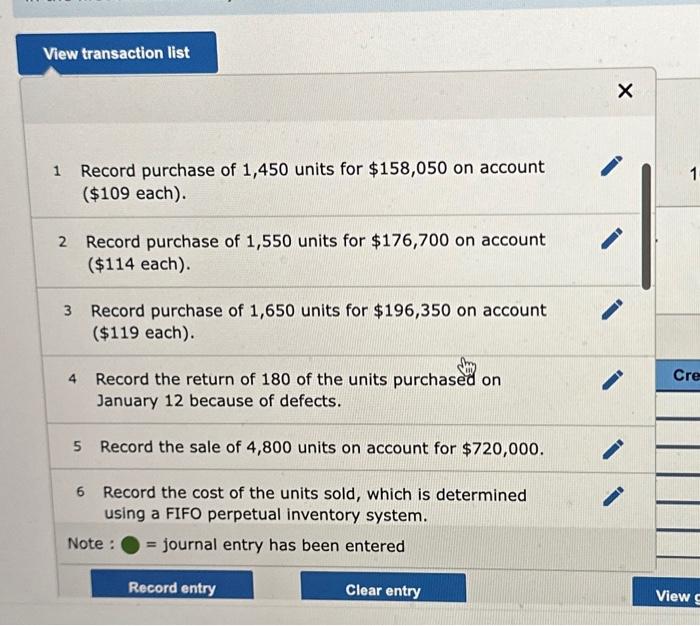

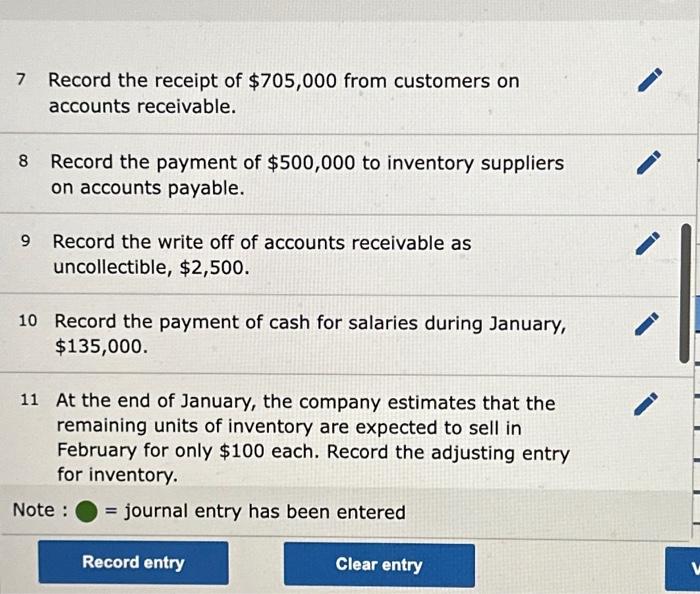

On January 1, 2024, the general ledger of Big Blast Fireworks includes the following account balances: Accounts Cash Accounts Receivable Allowance for Uncollectible Accounts Inventory Land Accounts Payable Notes Payable (9%, due in 3 years) Common Stock Retained Earnings Totals Debit $25,100 44,500 46,000 85,600 $201,200 Credit $3,500 27,200 46,000 72,000 52,500 $201, 200 Prox The $46,000 beginning balance of inventory consists of 460 units, each costing $100. During January 2024, Big Blast Fireworks had the following inventory transactions: January 3 Purchase 1,450 units for $158,050 on account ($109 each). January 8 Purchase 1,550 units for $176,700 on account ($114 each). January 12 Purchase 1,650 units for $196,350 on account ($119 each). January 15 Return 180 of the units purchased on January 12 because of defects. January 19 Sell 4,800 units on account for $720,000 The cost of the units sold is determined using a FIFO perpetual inventory system. January 22 Receive $705,000 from customers on accounts receivable. January 24 Pay $500,000 to inventory suppliers on accounts payable. January 27 Write off accounts receivable as uncollectible, $2,500. January 31 Pay cash for salaries during January, $135,000. The following information is available on January 31, 2024. a. At the end of January, the company estimates that the remaining units of inventory purchased on January 12 are expected to sell in February for only $100 each. [Hint: Determine the number of units remaining from January 12 after subtracting the units returned on January 15 and the units assumed sold (FIFO) on January 19.] b. The company records an adjusting entry for $3,530. for estimated future uncollectible accounts. c. The company accrues interest on notes payable for January. Interest is expected to be paid each December 31. d. The company accrues income taxes at the end of January of $13,900. Check my work 6 of 6 Next % 9 6 3 .

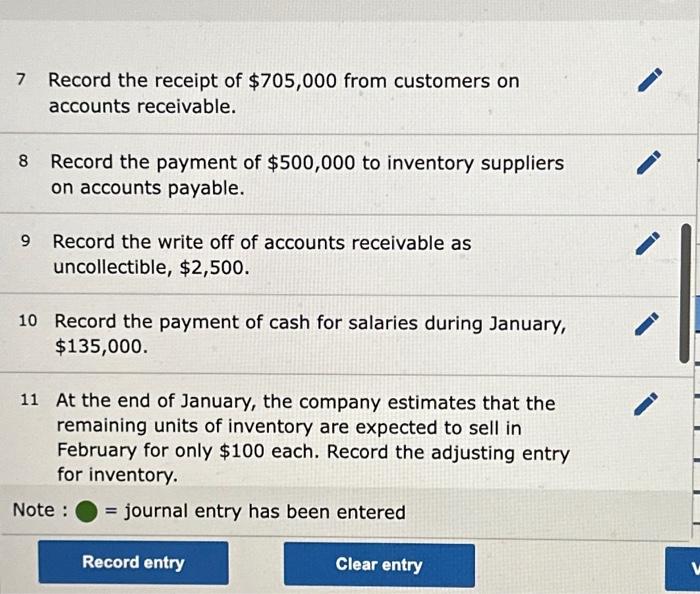

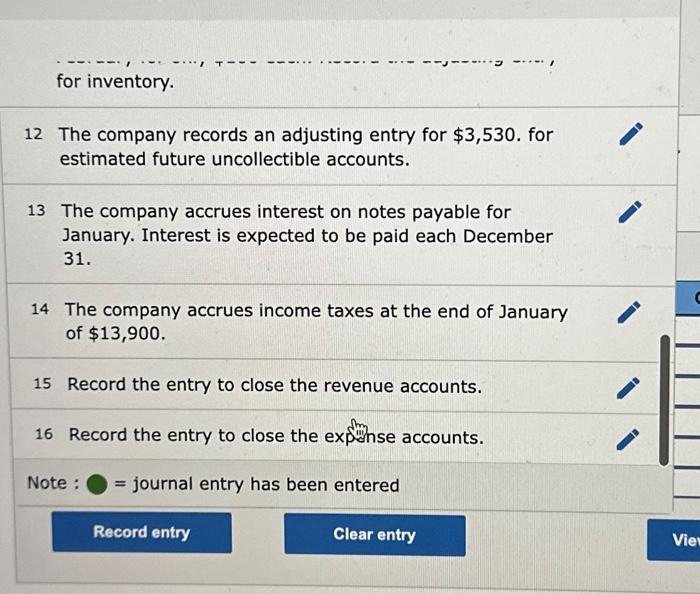

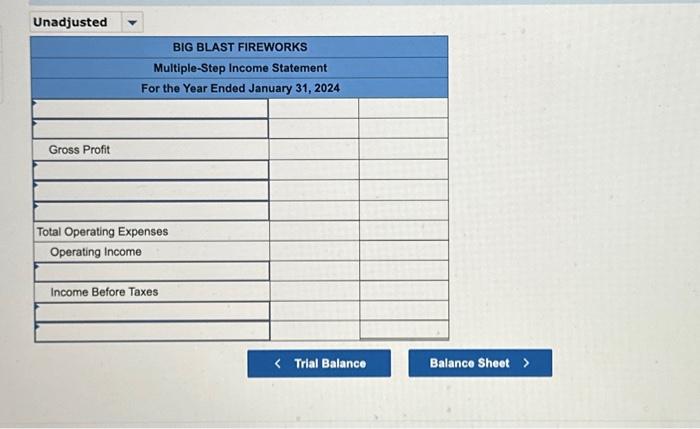

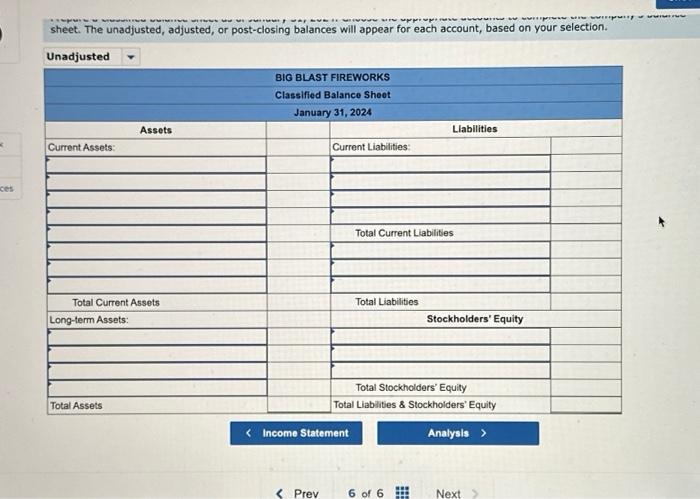

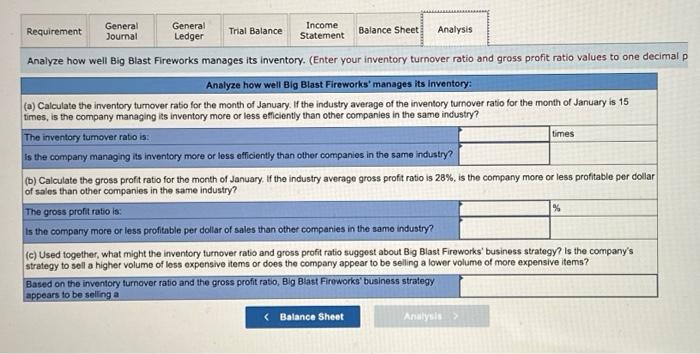

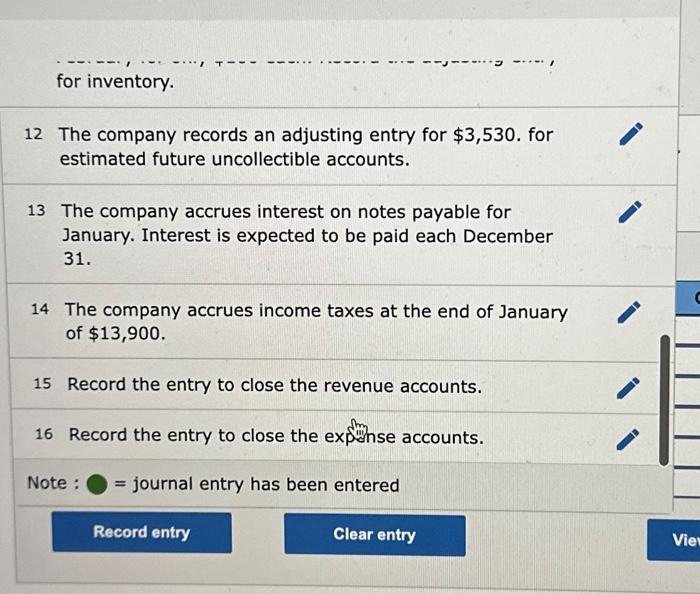

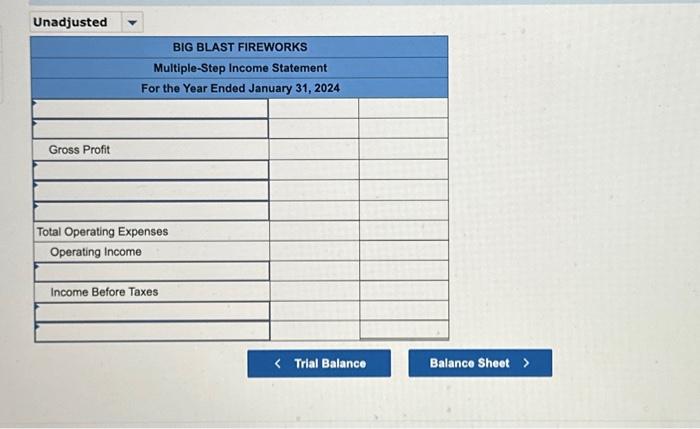

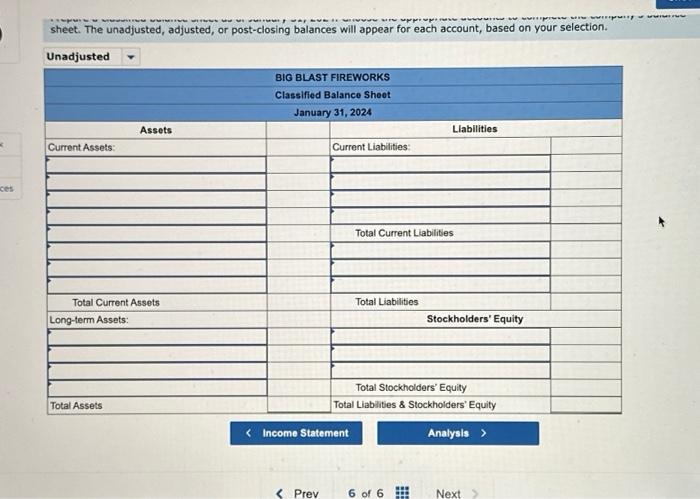

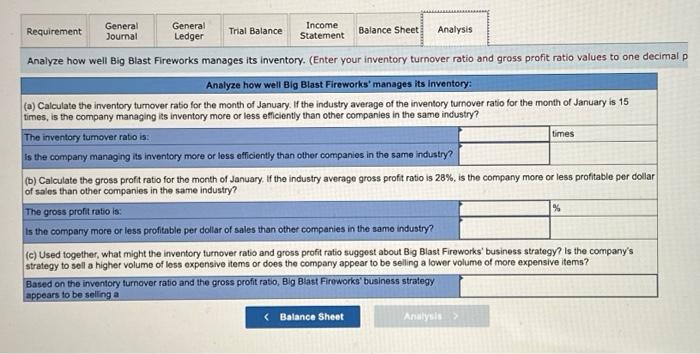

for inventory. 12 The company records an adjusting entry for $3,530. for estimated future uncollectible accounts. 13 The company accrues interest on notes payable for January. Interest is expected to be paid each December 31. 14 The company accrues income taxes at the end of January of $13,900. 15 Record the entry to close the revenue accounts. 16 Record the entry to close the exponse accounts. Note : = journal entry has been entered Unadjusted \begin{tabular}{|l|l|l|} \hline \multicolumn{2}{|c|}{ BIG BLAST FIREWORKS } \\ \hline \multicolumn{2}{|c|}{ Multiple-Step Income Statement } \\ \hline For the Year Ended January 31, 2024 \\ \hline Gross Profit & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline Total Operating Expenses & & \\ \hline Operating Income & & \\ \hline & & \\ \hline Income Before Taxes & & \\ \hline & & \\ \hline \end{tabular} Trial Balance Balance Sheet 1 Record purchase of 1,450 units for $158,050 on account (\$109 each). 2 Record purchase of 1,550 units for $176,700 on account (\$114 each). 3 Record purchase of 1,650 units for $196,350 on account (\$119 each). 4 Record the return of 180 of the units purchased on January 12 because of defects. 5 Record the sale of 4,800 units on account for $720,000. 6 Record the cost of the units sold, which is determined using a FIFO perpetual inventory system. sheet. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. On January 1, 2024, the general ledger of Big Blast Fireworks includes the following account balances: The $46,000 beginning balance of inventory consists of 460 units, each costing $100. During January 2024, Big Biast Fireworks had the following inventory transactions: January 3 Purchase 1,450 units for $158,050 on account ( $109 each). January \& Purchase 1,550 units for $176,700 on account ( $114 each). January 12 Purchase 1,650 units for $196,350 os account (\$119 each). January 15 Return 180 of the units purchased on January 12 because of defects. January 19 sel1 4,800 units on accoust for $720,000 The cost of the units sold is deternined using a rrmo perpetual inventory system. January 22 Receive $705,000 from customers on accounts receivable. January 22 Receive $705,000 fron custoders on accounts receivable. January 27 Write off accounts receivable as uncollectible, $2,500. January 31 Pay cash for salaries during Jasuary, $135,000. The following information is available on January 31, 2024. a. At the end of January, the company estimates that the remaining units of inventory purchased on January 12 are expected to sell in February for only $100 each. [Hint: Determine the number of units remaining from January 12 after subtracting the units returned on January 15 and the units assumed sold (FIFO) on January 19.] b. The company records an adjusting entry for $3,530. for estimated future uncollectible accounts c. The company accrues interest on notes payable for January. Interest is expected to be paid each December 31. c. The company accrues income taxes at the end of January of $13,900. 7 Record the receipt of $705,000 from customers on accounts receivable. 8 Record the payment of $500,000 to inventory suppliers on accounts payable. 9 Record the write off of accounts receivable as uncollectible, $2,500. 10 Record the payment of cash for salaries during January, $135,000. 11 At the end of January, the company estimates that the remaining units of inventory are expected to sell in February for only $100 each. Record the adjusting entry for inventory. (a) Calculate the inventory tumover rabio for the month of January. It the industry average of the inventory turnover ratio for the month of January is 15 times, is the company managing its inventory more or less etficiently than other companies in the same industry? The inventory tumover ratio is: is the comparty managing its inventory more or less efficiently than other companies in the same industry? (b) Calculate the gross profit ratio for the month of January. If the industry average gross profit ratio is 28%, is the company more or less profitable per dollar of sales than other companies in the same industry? The gross profit ratio is: Is the company more or less profitable per dollar of sales than other companies in the same industry? (c) Used together, what might the inventory furnover ratio and gross profit ratio suggest about Big Blast Fireworks' business strategy? is the company's strategy to sell a higher volume of loss expensive items or does the company appear to be selling a lower volume of more expensive items