Question

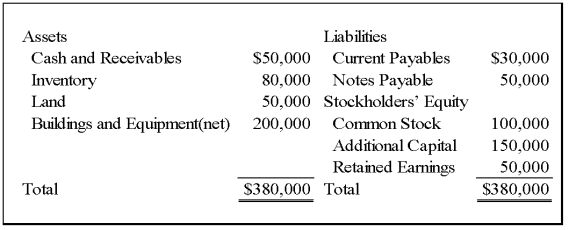

On January 1, 20X9, Wilton Company acquired all of Sirius Company's common shares, for $365,000 cash. On that date, Sirius's balance sheet appeared as follows:

On January 1, 20X9, Wilton Company acquired all of Sirius Company's common shares, for $365,000 cash. On that date, Sirius's balance sheet appeared as follows:

The fair values of all of Sirius's assets and liabilities were equal to their book values except for inventory that had a fair value of $85,000, land that had a fair value of $60,000, and buildings and equipment that had a fair value of $250,000. Buildings and equipment have a remaining useful life of 10 years with zero salvage value. Wilton Company decided to employ push-down accounting for the acquisition. Subsequent to the combination, Sirius continued to operate as a separate company.

57. Based on the preceding information, what amount will be present in the revaluation capital account, when consolidating entries are prepared? 58. Based on the preceding information, what amount of differential will arise in the consolidation process?

The answers are $65,000 and 0, respectively. Can you please explain how to get them? Thank you.

Assets Liabilities Cash and Receivables $50,000 Current Payables $30,000 50,000 80,000 Notes Payable Inventory Land 50,000 Stockholders' Equity Buildings and Equipment net) 200,000 Common Stock 100,000 Additional Capital 150,000 50,000 Retained Earnings Total $380,000 Total $380,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started