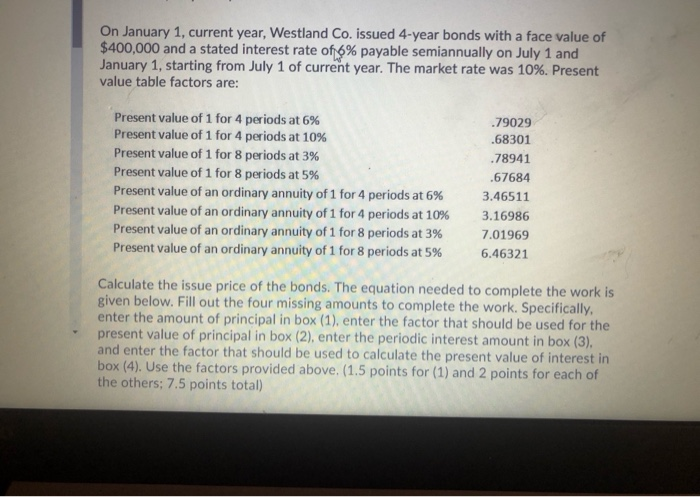

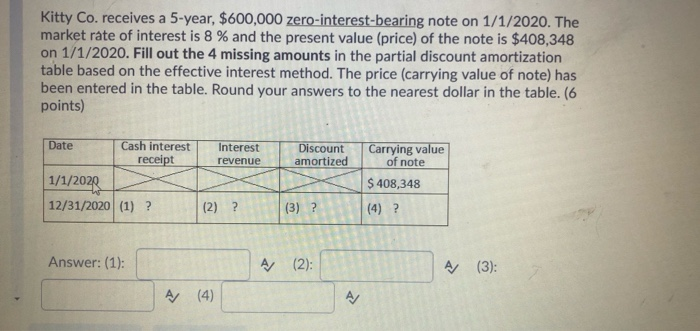

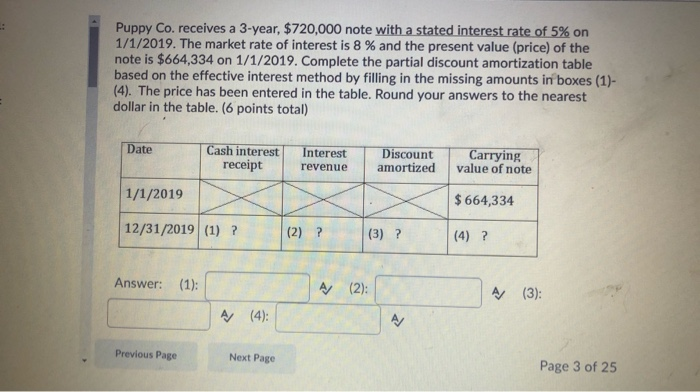

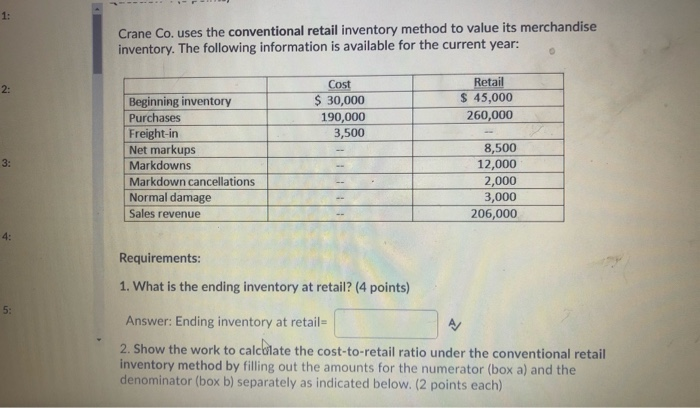

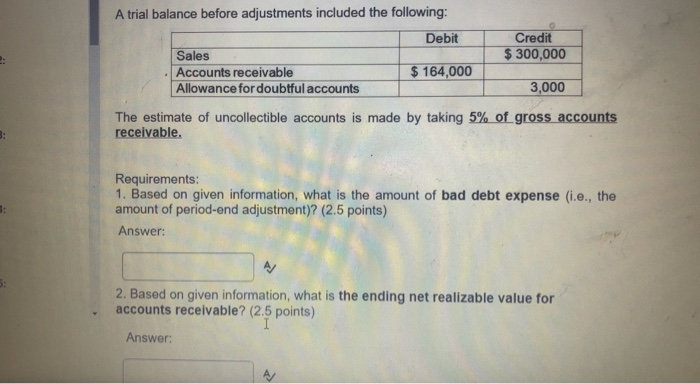

On January 1, current year, Westland Co. issued 4-year bonds with a face value of $400,000 and a stated interest rate of 6% payable semiannually on July 1 and January 1, starting from July 1 of current year. The market rate was 10%. Present value table factors are: .78941 Present value of 1 for 4 periods at 6% .79029 Present value of 1 for 4 periods at 10% .68301 Present value of 1 for 8 periods at 3% Present value of 1 for 8 periods at 5% .67684 Present value of an ordinary annuity of 1 for 4 periods at 6% 3.46511 Present value of an ordinary annuity of 1 for 4 periods at 10% 3.16986 Present value of an ordinary annuity of 1 for 8 periods at 3% 7.01969 Present value of an ordinary annuity of 1 for 8 periods at 5% 6.46321 Calculate the issue price of the bonds. The equation needed to complete the work is given below. Fill out the four missing amounts to complete the work. Specifically, enter the amount of principal in box (1), enter the factor that should be used for the present value of principal in box (2), enter the periodic interest amount in box (3), and enter the factor that should be used to calculate the present value of interest in box (4). Use the factors provided above. (1.5 points for (1) and 2 points for each of the others; 7.5 points total) Kitty Co. receives a 5-year, $600,000 zero-interest-bearing note on 1/1/2020. The market rate of interest is 8 % and the present value (price) of the note is $408,348 on 1/1/2020. Fill out the 4 missing amounts in the partial discount amortization table based on the effective interest method. The price (carrying value of note) has been entered in the table. Round your answers to the nearest dollar in the table. (6 points) Interest revenue Discount amortized Date Cash interest receipt 1/1/2022 12/31/2020 (1) ? Carrying value of note $ 408,348 (4) ? (2) ? (3) ? Answer: (1): A (2): A (3): A (4) A/ Puppy Co. receives a 3-year, $720,000 note with a stated interest rate of 5% on 1/1/2019. The market rate of interest is 8 % and the present value (price) of the note is $664,334 on 1/1/2019. Complete the partial discount amortization table based on the effective interest method by filling in the missing amounts in boxes (1)- (4). The price has been entered in the table. Round your answers to the nearest dollar in the table. (6 points total) Date Cash interest receipt Interest revenue Discount amortized Carrying value of note 1/1/2019 $ 664,334 12/31/2019 (1) ? (2) ? (3) ? (4) ? Answer: (1): A (2): A) (3): A (4): A/ Previous Page Next Page Page 3 of 25 1: Crane Co. uses the conventional retail inventory method to value its merchandise inventory. The following information is available for the current year: 2: Cost $ 30,000 190,000 3,500 Retail $ 45,000 260,000 Beginning inventory Purchases Freight-in Net markups Markdowns Markdown cancellations Normal damage Sales revenue 3: 8,500 12,000 2,000 3,000 206,000 4: Requirements: 1. What is the ending inventory at retail? (4 points) 5: Answer: Ending inventory at retail A/ 2. Show the work to calculate the cost-to-retail ratio under the conventional retail inventory method by filling out the amounts for the numerator (box a) and the denominator (box b) separately as indicated below. (2 points each) A trial balance before adjustments included the following: Debit Credit Sales $ 300,000 Accounts receivable $164,000 Allowance for doubtful accounts 3,000 The estimate of uncollectible accounts is made by taking 5% of gross accounts receivable. Requirements: 1. Based on given information, what is the amount of bad debt expense (i.e., the amount of period-end adjustment)? (2.5 points) Answer: 3: A/ 2. Based on given information, what is the ending net realizable value for accounts receivable? (2.5 points)