Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, Merry Walker and other stockholders established a catering service. Listed below are accounts to use for transactions (a) through (f), each identified

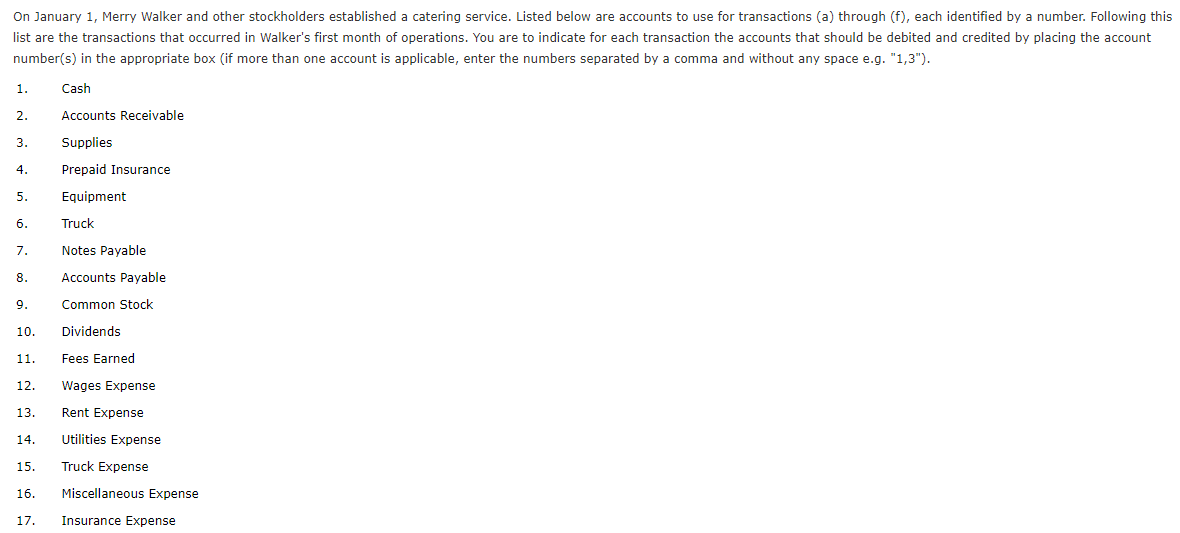

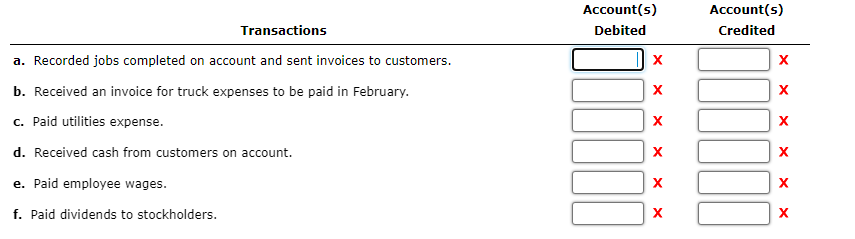

On January 1, Merry Walker and other stockholders established a catering service. Listed below are accounts to use for transactions (a) through (f), each identified by a number. Following this list are the transactions that occurred in Walker's first month of operations. You are to indicate for each transaction the accounts that should be debited and credited by placing the account number(s) in the appropriate box (if more than one account is applicable, enter the numbers separated by a comma and without any space e.g. "1,3").

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started