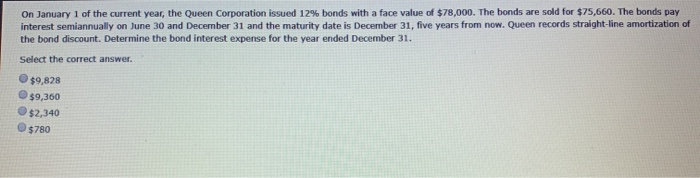

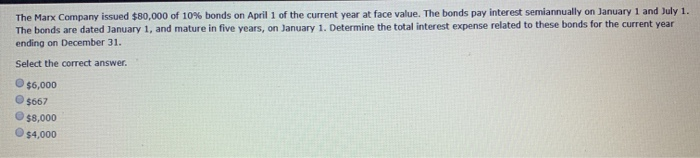

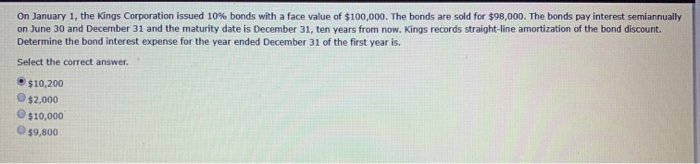

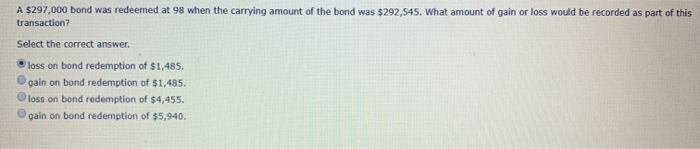

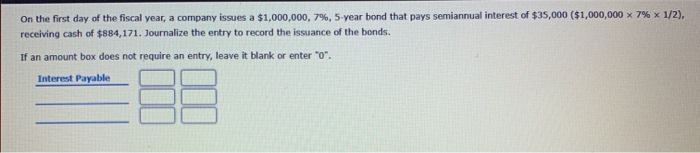

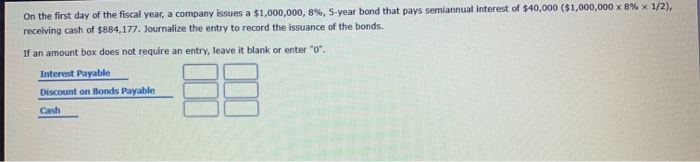

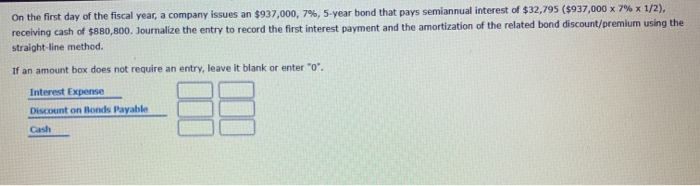

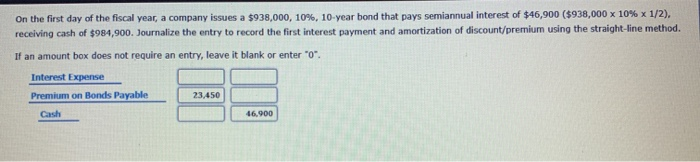

On January 1 of the current year, the Queen Corporation issued 12% bonds with a face value of $78,000. The bonds are sold for $75,660. The bonds pay interest semiannually on June 30 and December 31 and the maturity date is December 31, five years from now. Queen records straight-line amortization of the bond discount. Determine the bond interest expense for the year ended December 31. Select the correct answer. $9,828 $9,360 $2,340 $780 The Marx Company issued $80,000 of 10% bonds on April 1 of the current year at face value. The bonds pay interest semiannually on January 1 and July 1. The bonds are dated January 1, and mature in five years, on January 1. Determine the total interest expense related to these bonds for the current year ending on December 31. Select the correct answer. $6,000 $667 $8,000 $4,000 On January 1, the Kings Corporation issued 10% bonds with a face value of $100,000. The bonds are sold for $98,000. The bonds pay interest semiannually on June 30 and December 31 and the maturity date is December 31, ten years from now. Kings records straight-line amortization of the bond discount. Determine the bond interest expense for the year ended December 31 of the first year is. Select the correct answer. $10,200 $2,000 $10,000 39,800 A $297,000 bond was redeemed at 98 when the carrying amount of the bond was $292.545. What amount of gain or loss would be recorded as part of this transaction? Select the correct answer. loss on bond redemption of $1,485. gain on bond redemption of $1,485. loss on bond redemption of $4,455. gain on bond redemption of $5,940. On the first day of the fiscal year, a company issues a $1,000,000,7%, 5-year bond that pays semiannual interest of $35,000 ($1,000,000 x 7% x 1/2). receiving cash of $884,171. Journalize the entry to record the issuance of the bonds. If an amount box does not require an entry, leave it blank or enter "o". Interest Payable On the first day of the fiscal year, a company issues a $1,000,000, 8%, 5-year bond that pays semiannual interest of $40,000 ($1,000,000 x 8% x 1/2), receiving cash of $884,177. Journalize the entry to record the issuance of the bonds. If an amount box does not require an entry, leave it blank or enter "o". Interest Payable Discount on Bonds Payable Cash On the first day of the fiscal year, a company issues a $938,000, 10%, 10-year bond that pays semiannual interest of $46,900 (5938,000 x 10% x 1/2). receiving cash of $984,900. Journalize the entry to record the first interest payment and amortization of discount/premium using the straight-line method. If an amount box does not require an entry, leave it blank or enter "0". Interest Expense Premium on Bonds Payable 23.450 46.900 Cash