Question

On January 1 of this year, Olive Corporation issued bonds. Interest is payable once a year on December 31. The bonds mature at the end

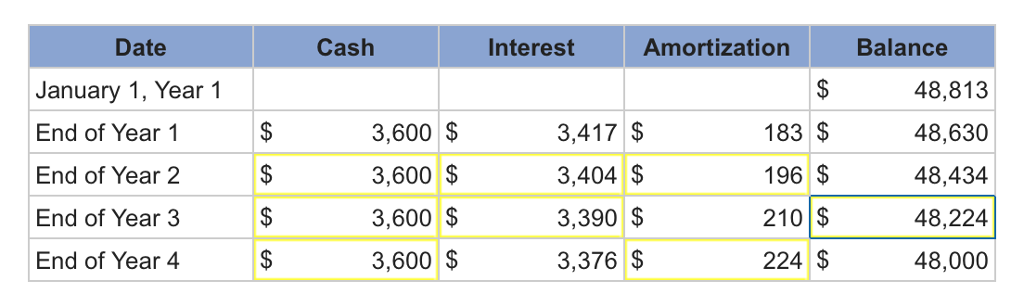

On January 1 of this year, Olive Corporation issued bonds. Interest is payable once a year on December 31. The bonds mature at the end of four years. Olive uses the effective-interest amortization method. The amortization schedule below pertains to the bonds:

a. How much cash will be disbursed for interest each period and in total over the life of the bonds?

b. What is the coupon rate? (Enter your answer as a percentage rounded to 1 decimal place (i.e. 0.123 should be entered as 12.3).)

c. What was the annual market rate of interest on the date the bonds were issued? (Enter your answer as a percentage rounded to the nearest whole percent (i.e. 0.123 should be entered as 12).)

d. What amount of interest expense will be reported on the income statement for Year 2 and Year 3?(Round your final answers to nearest whole dollar amount.)

e. What amount will be reported on the balance sheet at the end of Year 2 and Year 3?

Date January 1, Year 1 End of Year 1 End of Year 2 End of Year 3 End of Year 4 Cash 3,600 3,600 3,600 3,600 Interest Amortization Balance 48,813 183 48,630 3,417 196 3,404 48,434 210 3,390 48,224 224 3,376 48,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started