Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1 of Year 1 Merick Inc. purchased a building for $6 million. The building is expected to have a 45 - year life

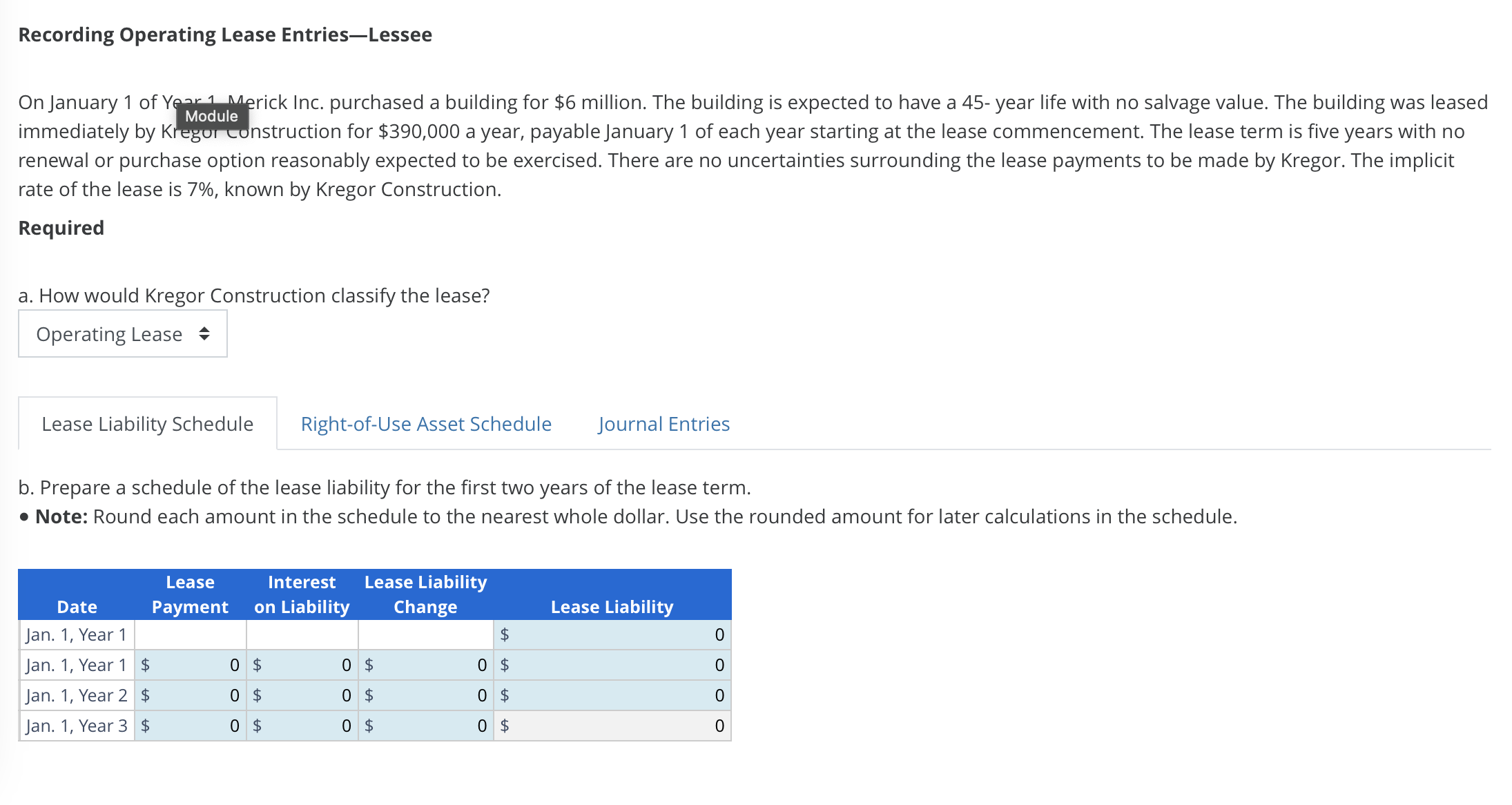

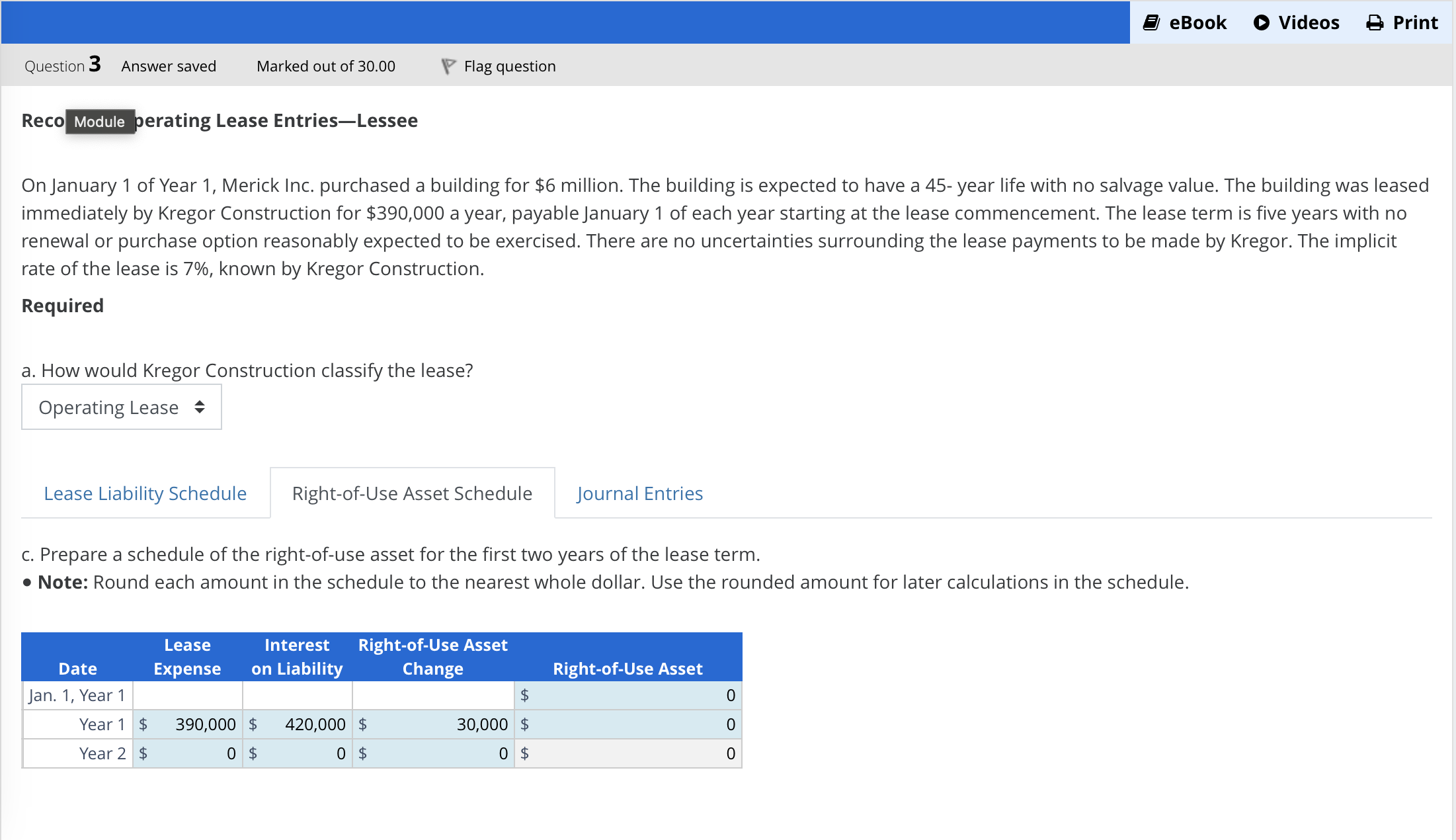

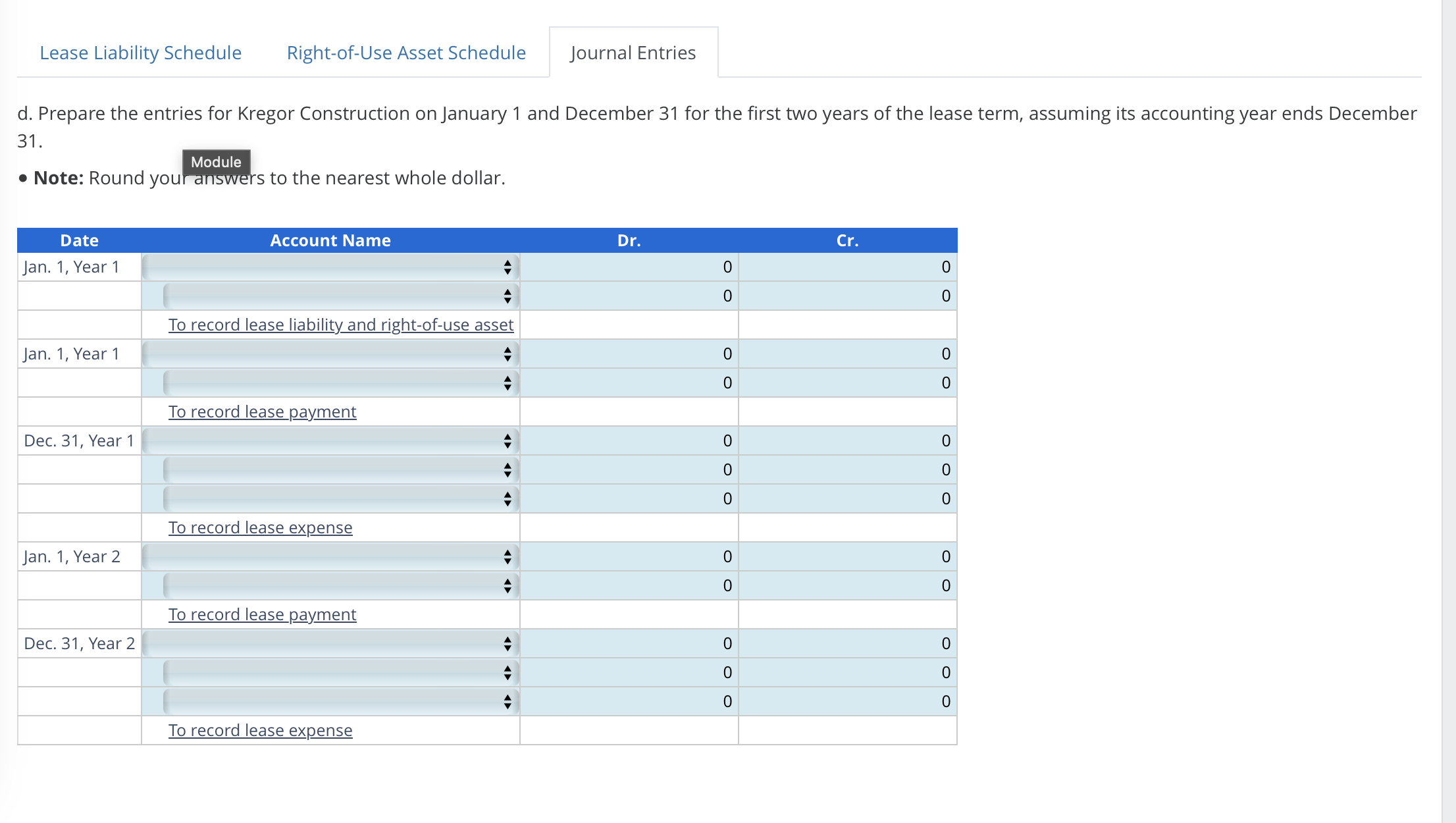

On January 1 of Year 1 Merick Inc. purchased a building for $6 million. The building is expected to have a 45 - year life with no salvage value. The building was leased immediately by Kregor construction for $390,000 a year, payable January 1 of each year starting at the lease commencement. The lease term is five years with no renewal or purchase option reasonably expected to be exercised. There are no uncertainties surrounding the lease payments to be made by Kregor. The implicit rate of the lease is 7\%, known by Kregor Construction. Required On January 1 of Year 1 Merick Inc. purchased a building for $6 million. The building is expected to have a 45 - year life with no salvage value. The building was leased immediately by Kregor construction for $390,000 a year, payable January 1 of each year starting at the lease commencement. The lease term is five years with no renewal or purchase option reasonably expected to be exercised. There are no uncertainties surrounding the lease payments to be made by Kregor. The implicit rate of the lease is 7\%, known by Kregor Construction. Required a. How would Kregor Construction classify the lease? b. Prepare a schedule of the lease liability for the first two years of the lease term. - Note: Round each amount in the schedule to the nearest whole dollar. Use the rounded amount for later calculations in the schedule. On January 1 of Year 1, Merick Inc. purchased a building for $6 million. The building is expected to have a 45 - year life with no salvage value. The building was leased immediately by Kregor Construction for $390,000 a year, payable January 1 of each year starting at the lease commencement. The lease term is five years with no renewal or purchase option reasonably expected to be exercised. There are no uncertainties surrounding the lease payments to be made by Kregor. The implicit rate of the lease is 7\%, known by Kregor Construction. Required a. How would Kregor Construction classify the lease? c. Prepare a schedule of the right-of-use asset for the first two years of the lease term. - Note: Round each amount in the schedule to the nearest whole dollar. Use the rounded amount for later calculations in the schedule. d. Prepare the entries for Kregor Construction on January 1 and December 31 for the first two years of the lease term, assuming its accounting year ends December 31. Module - Note: Round youranswers to the nearest whole dollar

On January 1 of Year 1 Merick Inc. purchased a building for $6 million. The building is expected to have a 45 - year life with no salvage value. The building was leased immediately by Kregor construction for $390,000 a year, payable January 1 of each year starting at the lease commencement. The lease term is five years with no renewal or purchase option reasonably expected to be exercised. There are no uncertainties surrounding the lease payments to be made by Kregor. The implicit rate of the lease is 7\%, known by Kregor Construction. Required On January 1 of Year 1 Merick Inc. purchased a building for $6 million. The building is expected to have a 45 - year life with no salvage value. The building was leased immediately by Kregor construction for $390,000 a year, payable January 1 of each year starting at the lease commencement. The lease term is five years with no renewal or purchase option reasonably expected to be exercised. There are no uncertainties surrounding the lease payments to be made by Kregor. The implicit rate of the lease is 7\%, known by Kregor Construction. Required a. How would Kregor Construction classify the lease? b. Prepare a schedule of the lease liability for the first two years of the lease term. - Note: Round each amount in the schedule to the nearest whole dollar. Use the rounded amount for later calculations in the schedule. On January 1 of Year 1, Merick Inc. purchased a building for $6 million. The building is expected to have a 45 - year life with no salvage value. The building was leased immediately by Kregor Construction for $390,000 a year, payable January 1 of each year starting at the lease commencement. The lease term is five years with no renewal or purchase option reasonably expected to be exercised. There are no uncertainties surrounding the lease payments to be made by Kregor. The implicit rate of the lease is 7\%, known by Kregor Construction. Required a. How would Kregor Construction classify the lease? c. Prepare a schedule of the right-of-use asset for the first two years of the lease term. - Note: Round each amount in the schedule to the nearest whole dollar. Use the rounded amount for later calculations in the schedule. d. Prepare the entries for Kregor Construction on January 1 and December 31 for the first two years of the lease term, assuming its accounting year ends December 31. Module - Note: Round youranswers to the nearest whole dollar Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started