Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, Year 1, Super Ltd purchased 25% of the common shares of Spider Ltd for $2,500. On that date the net assets of

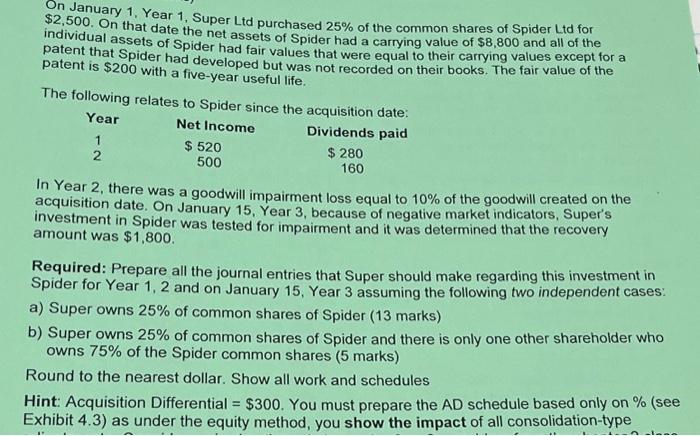

On January 1, Year 1, Super Ltd purchased 25% of the common shares of Spider Ltd for $2,500. On that date the net assets of Spider had a carrying value of $8,800 and all of the individual assets of Spider had fair values that were equal to their carrying values except for a patent that Spider had developed but was not recorded on their books. The fair value of the patent is $200 with a five-year useful life. The following relates to Spider since the acquisition date: Year Net Income Dividends paid 1 2 $ 520 500 $ 280 160 In Year 2, there was a goodwill impairment loss equal to 10% of the goodwill created on the acquisition date. On January 15, Year 3, because of negative market indicators, Super's investment in Spider was tested for impairment and it was determined that the recovery amount was $1,800. Required: Prepare all the journal entries that Super should make regarding this investment in Spider for Year 1, 2 and on January 15, Year 3 assuming the following two independent cases: a) Super owns 25% of common shares of Spider (13 marks) b) Super owns 25% of common shares of Spider and there is only one other shareholder who owns 75% of the Spider common shares (5 marks) Round to the nearest dollar. Show all work and schedules Hint: Acquisition Differential = $300. You must prepare the AD schedule based only on % (see Exhibit 4.3) as under the equity method, you show the impact of all consolidation-type

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started