please help me out on the questions! a little lost

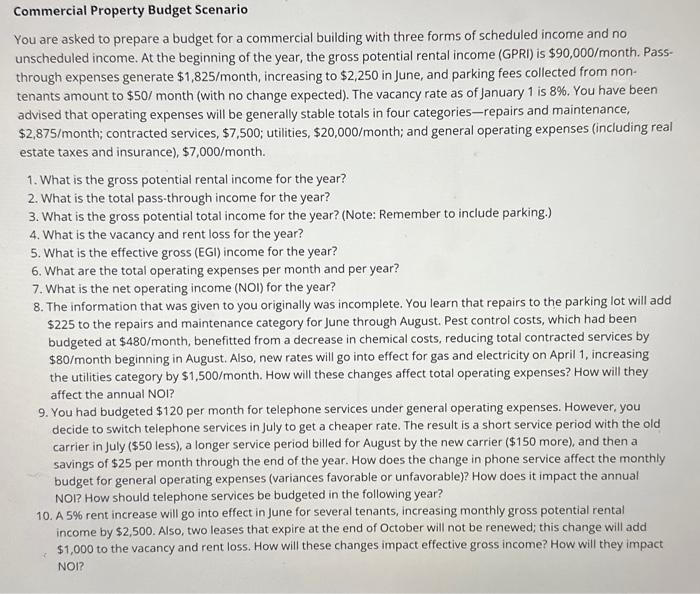

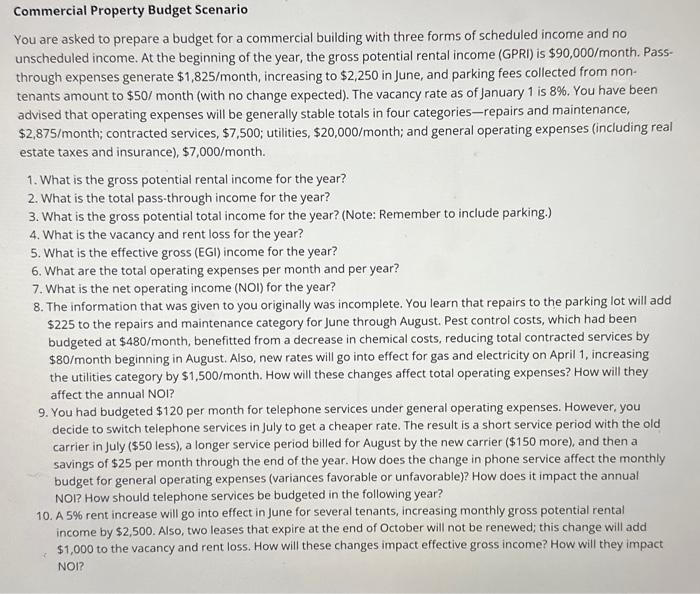

Commercial Property Budget Scenario You are asked to prepare a budget for a commercial building with three forms of scheduled income and no unscheduled income. At the beginning of the year, the gross potential rental income (GPRI) is $90,000/ month. Passthrough expenses generate $1,825/ month, increasing to $2,250 in June, and parking fees collected from nontenants amount to $50/ month (with no change expected). The vacancy rate as of January 1 is 8%. You have been advised that operating expenses will be generally stable totals in four categories-repairs and maintenance, $2,875/ month; contracted services, $7,500; utilities, $20,000/ month; and general operating expenses (including real estate taxes and insurance), $7,000/ month. 1. What is the gross potential rental income for the year? 2. What is the total pass-through income for the year? 3. What is the gross potential total income for the year? (Note: Remember to include parking.) 4. What is the vacancy and rent loss for the year? 5. What is the effective gross (EGI) income for the year? 6. What are the total operating expenses per month and per year? 7. What is the net operating income (NOI) for the year? 8. The information that was given to you originally was incomplete. You learn that repairs to the parking lot will add $225 to the repairs and maintenance category for June through August. Pest control costs, which had been budgeted at $480/ month, benefitted from a decrease in chemical costs, reducing total contracted services by $80/ month beginning in August. Also, new rates will go into effect for gas and electricity on April 1, increasing the utilities category by $1,500/ month. How will these changes affect total operating expenses? How will they affect the annual NOI? 9. You had budgeted $120 per month for telephone services under general operating expenses. However, you decide to switch telephone services in July to get a cheaper rate. The result is a short service period with the old carrier in July ( $50 less), a longer service period billed for August by the new carrier ( $150 more), and then a savings of $25 per month through the end of the year. How does the change in phone service affect the monthly budget for general operating expenses (variances favorable or unfavorable)? How does it impact the annual NOI? How should telephone services be budgeted in the following year? 10. A 5% rent increase will go into effect in June for several tenants, increasing monthly gross potential rental income by $2,500. Also, two leases that expire at the end of October will not be renewed; this change will add $1,000 to the vacancy and rent loss. How will these changes impact effective gross income? How will they impact NOI