Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1 , Year 3 , Baxter University purchased a 5 0 - year old building adjacent to its campus. The university was able

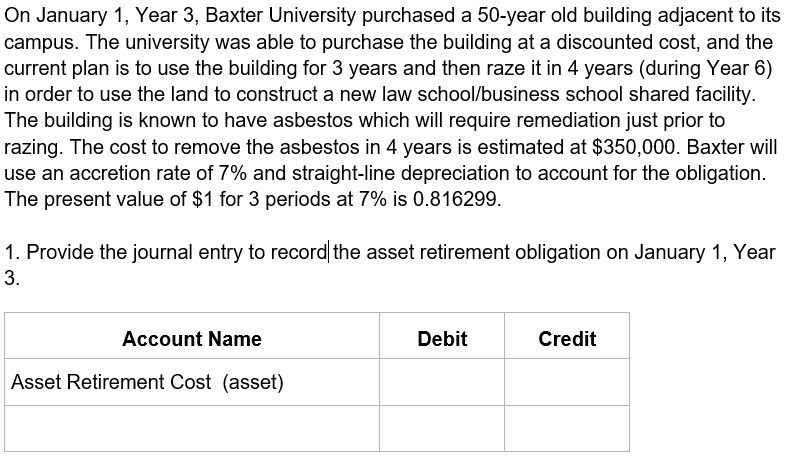

On January Year Baxter University purchased a year old building adjacent to its campus. The university was able to purchase the building at a discounted cost, and the current plan is to use the building for years and then raze it in years during Year in order to use the land to construct a new law schoolbusiness school shared facility. The building is known to have asbestos which will require remediation just prior to razing. The cost to remove the asbestos in years is estimated at $ Baxter will use an accretion rate of and straightline depreciation to account for the obligation. The present value of $ for periods at is

Provide the journal entry to record the asset retirement obligation on January Year Populate the table below to show the accretion expense associated with the liability. Enter if the amount is zero. Provide the journal entry to record accretion and depreciation expense on December

Year

Assuming the cost to remove the asbestos in Year is $ provide the journal entry to record the cost.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started