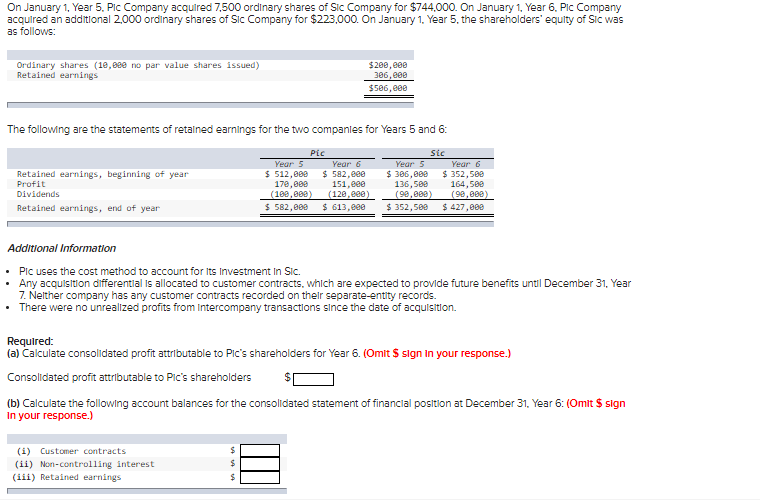

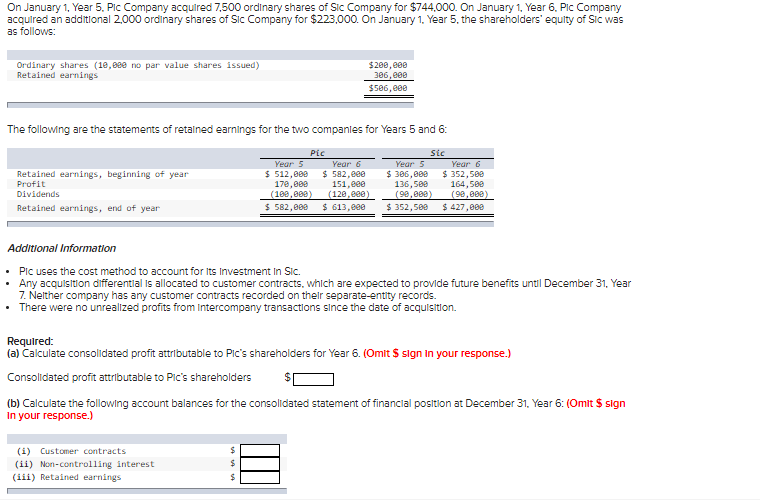

On January 1, Year 5, Plc Company acquired 7,500 ordinary shares of Sic Company for $744,000. On January 1, Year 6, Plc Company acquired an additional 2,000 ordinary shares of Sic Company for $223,000. On January 1, Year 5 , the shareholders' equity of Sic was as follows: The following are the statements of retained earnings for the two companles for Years 5 and 6 : Additional Information - PIc uses the cost method to account for its investment in Sic. - Any acquisition dlfferentlal is allocated to customer contracts, which are expected to provide future benefits untl December 31 , Year 7. Nelther company has any customer contracts recorded on thelr separate-entity records. - There were no unrealized profits from intercompany transactions since the date of acquisition. Required: (a) Calculate consolidated profit attrlbutable to Pic's shareholders for Year 6. (Omit $ sign in your response.) Consolidated profit attrlbutable to Plc's shareholders $ (b) Calculate the following account balances for the consolidated statement of financlal position at December 31, Year 6 : (Omit \$ sign in your response.) On January 1, Year 5, Plc Company acquired 7,500 ordinary shares of Sic Company for $744,000. On January 1, Year 6, Plc Company acquired an additional 2,000 ordinary shares of Sic Company for $223,000. On January 1, Year 5 , the shareholders' equity of Sic was as follows: The following are the statements of retained earnings for the two companles for Years 5 and 6 : Additional Information - PIc uses the cost method to account for its investment in Sic. - Any acquisition dlfferentlal is allocated to customer contracts, which are expected to provide future benefits untl December 31 , Year 7. Nelther company has any customer contracts recorded on thelr separate-entity records. - There were no unrealized profits from intercompany transactions since the date of acquisition. Required: (a) Calculate consolidated profit attrlbutable to Pic's shareholders for Year 6. (Omit $ sign in your response.) Consolidated profit attrlbutable to Plc's shareholders $ (b) Calculate the following account balances for the consolidated statement of financlal position at December 31, Year 6 : (Omit \$ sign in your response.)