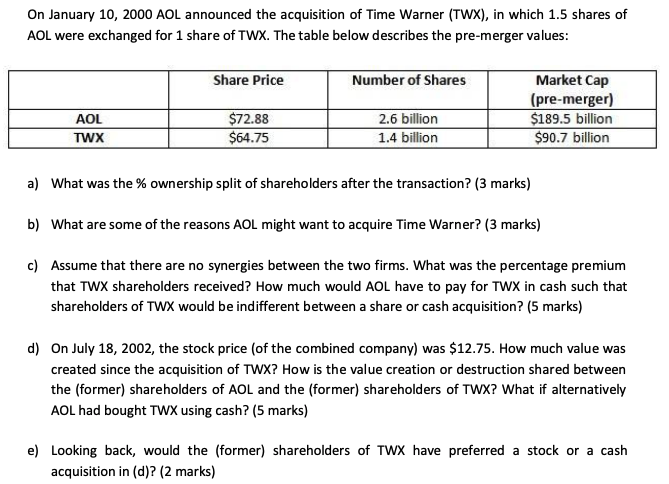

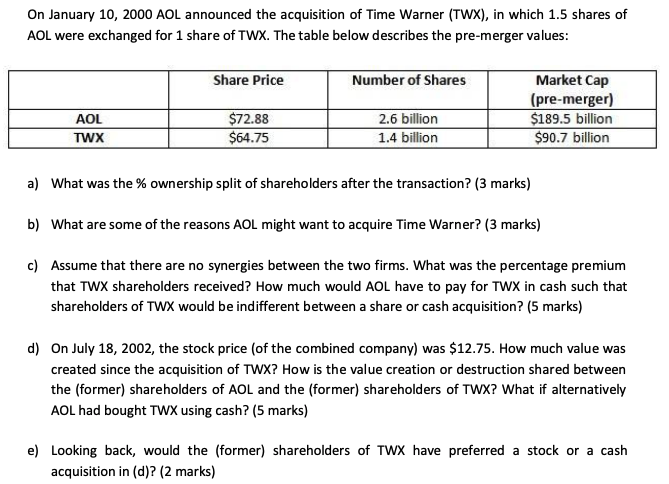

On January 10, 2000 AOL announced the acquisition of Time Warner (TWX), in which 1.5 shares of AOL were exchanged for 1 share of TWX. The table below describes the pre-merger values: Share Price Number of Shares Market Cap (pre-merger) $189.5 billion $90.7 billion AOL TWX $72.88 $64.75 2.6 billion 1.4 billion a) What was the % ownership split of shareholders after the transaction? (3 marks) b) What are some of the reasons AOL might want to acquire Time Warner? (3 marks) c) Assume that there are no synergies between the two firms. What was the percentage premium that TWX shareholders received? How much would AOL have to pay for TWX in cash such that shareholders of TWX would be indifferent between a share or cash acquisition? (5 marks) d) On July 18, 2002, the stock price (of the combined company) was $12.75. How much value was created since the acquisition of TWX? How is the value creation or destruction shared between the (former) shareholders of AOL and the (former) shareholders of TWX? What if alternatively AOL had bought TWX using cash? (5 marks) e) Looking back, would the (former) shareholders of TWX have preferred a stock or a cash acquisition in (d)? (2 marks) On January 10, 2000 AOL announced the acquisition of Time Warner (TWX), in which 1.5 shares of AOL were exchanged for 1 share of TWX. The table below describes the pre-merger values: Share Price Number of Shares Market Cap (pre-merger) $189.5 billion $90.7 billion AOL TWX $72.88 $64.75 2.6 billion 1.4 billion a) What was the % ownership split of shareholders after the transaction? (3 marks) b) What are some of the reasons AOL might want to acquire Time Warner? (3 marks) c) Assume that there are no synergies between the two firms. What was the percentage premium that TWX shareholders received? How much would AOL have to pay for TWX in cash such that shareholders of TWX would be indifferent between a share or cash acquisition? (5 marks) d) On July 18, 2002, the stock price (of the combined company) was $12.75. How much value was created since the acquisition of TWX? How is the value creation or destruction shared between the (former) shareholders of AOL and the (former) shareholders of TWX? What if alternatively AOL had bought TWX using cash? (5 marks) e) Looking back, would the (former) shareholders of TWX have preferred a stock or a cash acquisition in (d)? (2 marks)