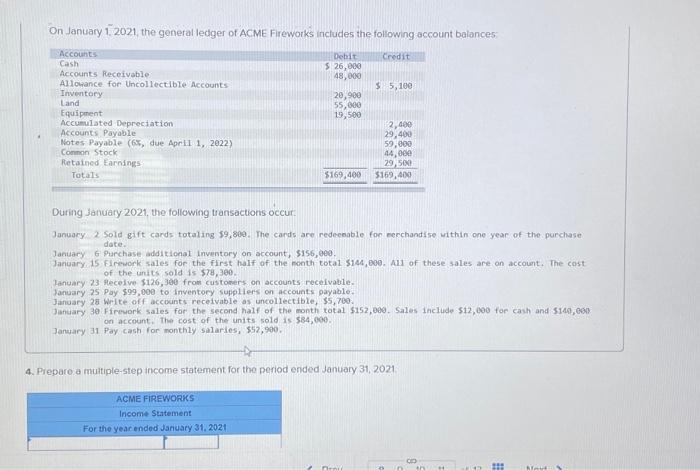

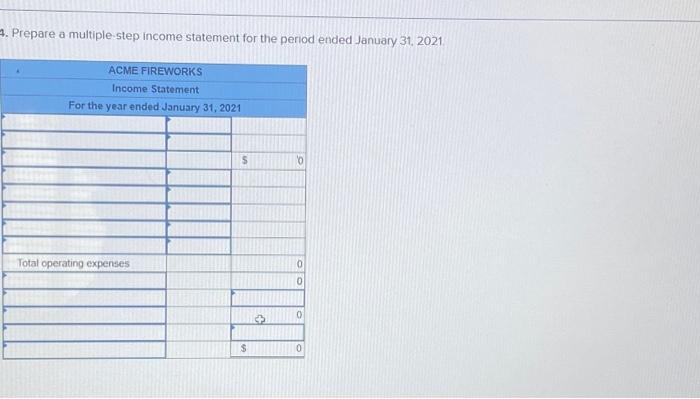

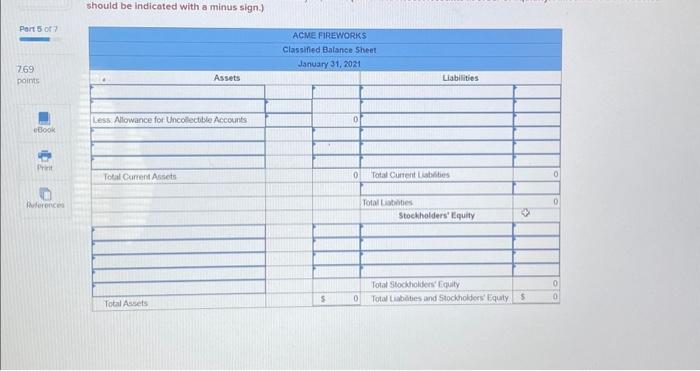

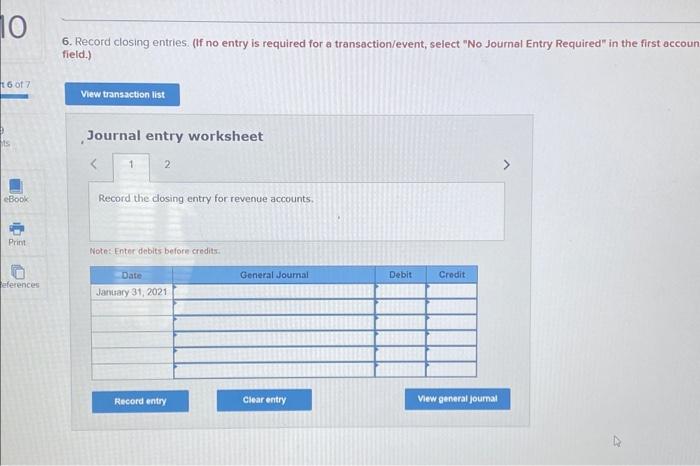

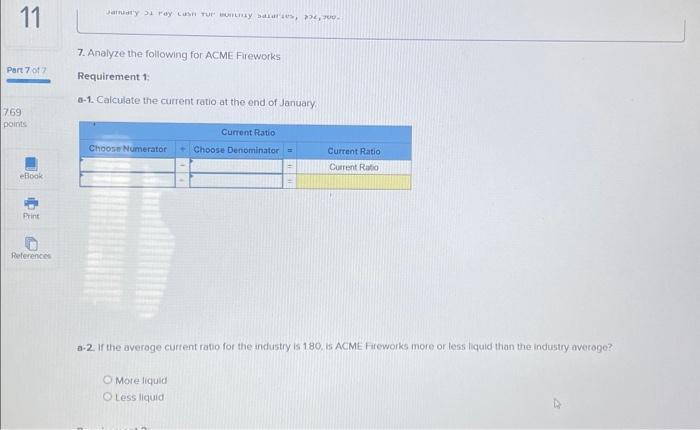

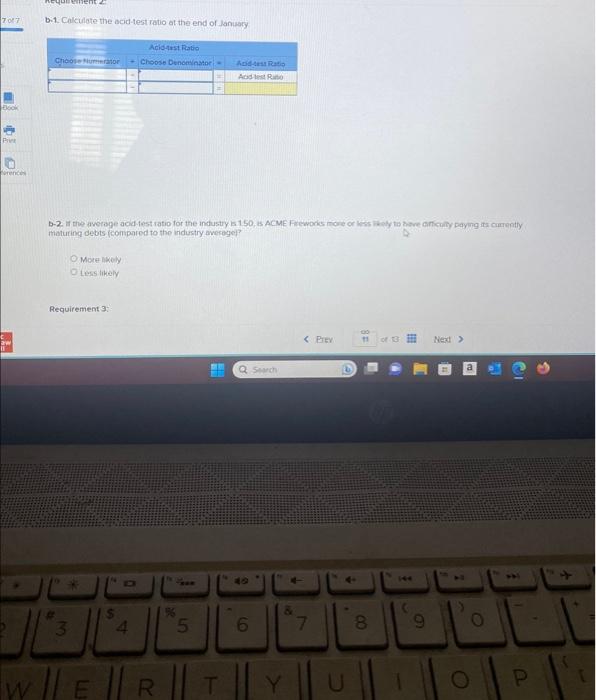

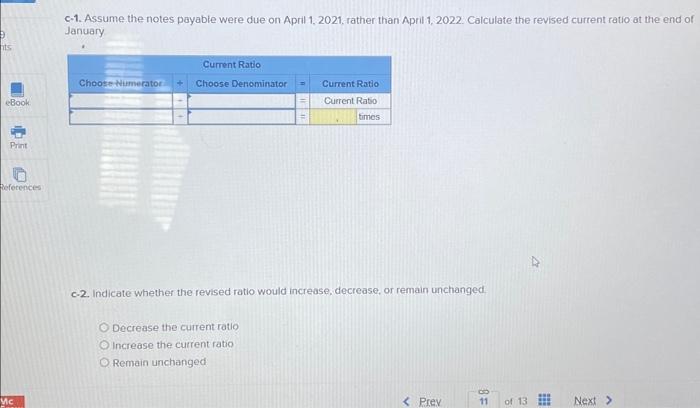

On January 1.2021, the general ledger of ACME Fireworks includes the following account balances: During January 2021, the following transactions occur: January 2 Sold gift cards totaling 59,809 . The cands are redecnable for eerchandise within one year of the purchase date. January 6 Purchase additionat inventory on account, $3156,000. January is firework sales for the first haif of the month total sis4, 000 . All of these sales are on account. The cost of the units sold is 578,300 . Panuary 23 receive $126,300 from customers on accounts receivatie. January 25 Pay $99,000 to inventocy suppliers on Accounts payable. January 28 write off accounts receivable os uncollectible, $5,700. January 30 Firevork sales for the second half of the month total $152,009. Sales include $12,000 for cash and $140,060 on account. The cost of the units sold is $84,000. January, 31 Pay cash for monthly salaries, 552,900. 4. Preparo a muitiple-step income statement for the period ended January 31,2021 Prepare a multiple-step income statement for the period ended January 31.2021 should be indicated with a minus sign.) 6. Record closing entries. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first accour field.) Journal entry worksheet Record the dosing entry for revenue accounts. Note: Enter debits before credits. 7. Analyze the following for ACME Fireworks Requirement 1: a-1. Calculate the current ratio at the end of January. a-2. If the averoge curtent ratio for the industry is 180 , is ACME Fiteworks more or less hiquid than the industry averoge? More fiquid Less liquid b.1. Calculate the acid-test ratio at the end of Janisicy maturing debts fcompared to the industry awerage? More axoly tess likely c-1. Assume the notes payable were due on April 1,2021, rather than April 1,2022. Calculate the revised current ratio at the end of January c-2. Indicate whether the revised ratio would increase, decrease, or remain unchanged, Decrease the current ratio Increase the current ratio Remain unchanged On January 1.2021, the general ledger of ACME Fireworks includes the following account balances: During January 2021, the following transactions occur: January 2 Sold gift cards totaling 59,809 . The cands are redecnable for eerchandise within one year of the purchase date. January 6 Purchase additionat inventory on account, $3156,000. January is firework sales for the first haif of the month total sis4, 000 . All of these sales are on account. The cost of the units sold is 578,300 . Panuary 23 receive $126,300 from customers on accounts receivatie. January 25 Pay $99,000 to inventocy suppliers on Accounts payable. January 28 write off accounts receivable os uncollectible, $5,700. January 30 Firevork sales for the second half of the month total $152,009. Sales include $12,000 for cash and $140,060 on account. The cost of the units sold is $84,000. January, 31 Pay cash for monthly salaries, 552,900. 4. Preparo a muitiple-step income statement for the period ended January 31,2021 Prepare a multiple-step income statement for the period ended January 31.2021 should be indicated with a minus sign.) 6. Record closing entries. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first accour field.) Journal entry worksheet Record the dosing entry for revenue accounts. Note: Enter debits before credits. 7. Analyze the following for ACME Fireworks Requirement 1: a-1. Calculate the current ratio at the end of January. a-2. If the averoge curtent ratio for the industry is 180 , is ACME Fiteworks more or less hiquid than the industry averoge? More fiquid Less liquid b.1. Calculate the acid-test ratio at the end of Janisicy maturing debts fcompared to the industry awerage? More axoly tess likely c-1. Assume the notes payable were due on April 1,2021, rather than April 1,2022. Calculate the revised current ratio at the end of January c-2. Indicate whether the revised ratio would increase, decrease, or remain unchanged, Decrease the current ratio Increase the current ratio Remain unchanged