Answered step by step

Verified Expert Solution

Question

1 Approved Answer

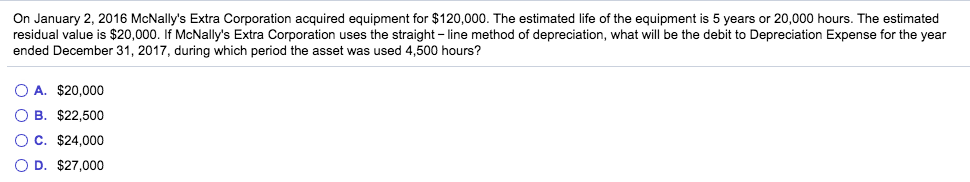

On January 2, 2016 McNally's Extra Corporation acquired equipment for $120,000. The estimated life of the equipment is 5 years or 20,000 hours. The estimated

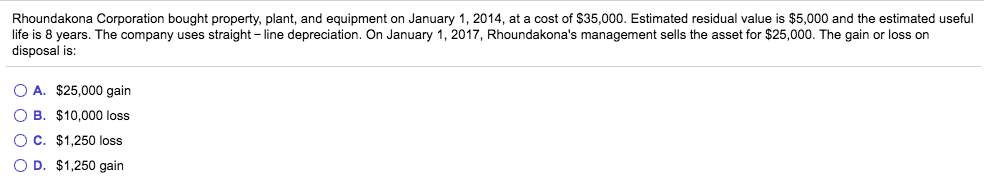

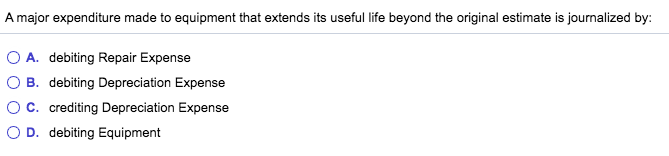

On January 2, 2016 McNally's Extra Corporation acquired equipment for $120,000. The estimated life of the equipment is 5 years or 20,000 hours. The estimated residual value is $20,000. If McNally's Extra Corporation uses the straight-line method of depreciation, what will be the debit to Depreciation Expense for the year ended December 31, 2017, during which period the asset was used 4,500 hours? O A. $20,000 OB. $22,500 O C. $24,000 OD. $27,000 Rhoundakona Corporation bought property, plant, and equipment on January 1, 2014, at a cost of $35,000. Estimated residual value is $5,000 and the estimated useful life is 8 years. The company uses straight-line depreciation. On January 1, 2017, Rhoundakona's management sells the asset for $25,000. The gain or loss on disposal is: O A. $25,000 gain O B. $10,000 loss OC. $1,250 loss OD. $1,250 gain A major expenditure made to equipment that extends its useful life beyond the original estimate is journalized by: O A. debiting Repair Expense O B. debiting Depreciation Expense OC. crediting Depreciation Expense OD. debiting Equipment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started