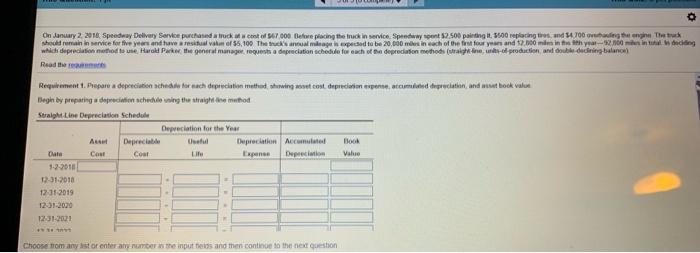

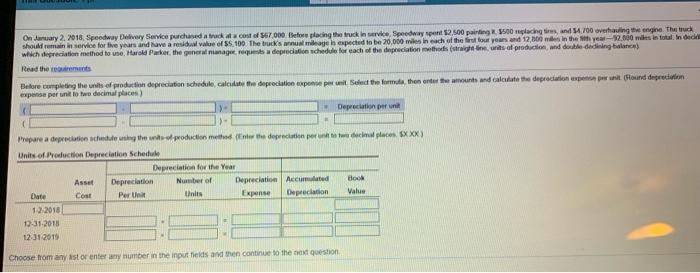

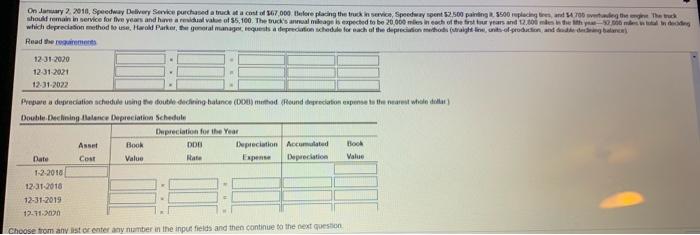

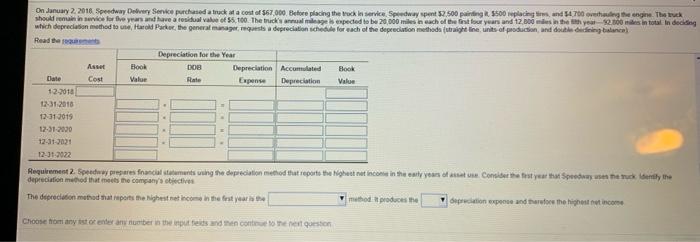

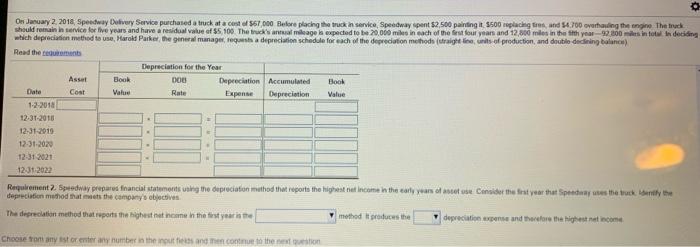

On January 2, 2016 Speedway Delivery Service purchased a truck conto 67.000 Before placing the truck in service. Sprawy pont 32.500 painting it. 5500 replacing trend 1.700 Thestru should remain in Mrvice for five years and have a valm of 55,190 There's annual milager is expected to be 20.000 miles in each of the first four years and 900 minithya-5200 in Weing which depreciation method to use Harold Paw the general manager request a dnescilation schedule for each of a depreciation methods (Uraight to production, and double dining balance Read the Requirement 1. Prepare a depreciation schede torach depreciation methund, shuning out tout depreciation expertcomid deprecation, and at book value Begin by preparing depreciation schedule ning the straight muthod Straight Line Depreciation Schedule Depreciation for the Year Depreciable tul Depreciation Accumulate BOOM Data Cost Life Vale 12-01-2018 12:31 2019 1201-2020 1231-2021 Choose trom any or enterary number the inputs and then continue to the next question On January 2, 2018, Speedway Delivery Service purchased a fuck at a cost of 67.000 tetore placing the truck in service Speedway spent 12,500 painting reglacing and 1.100 overhauling the engine. The truch should remain in service for five years and have a resid value of 55 100 The bucks may be expected to be 20,000 miles in each of the first four years and 12,000 in the with you -2.000 miles in total, India which depreciation method to me. Harold Parker the gener ninage depreciation schedules to each of the depreciation med straights of production, and double dedining balanca Read the Before completing the shef production depreciation schedule calculate depreciation experi per cent Select the forma, then enter the mounts and calculate the depreciation expert per ut ourd depreciation expone per unit to two decimal places) Depreciation per Prepare a deprecated in the production method for the depreciation per decimal places XXX) Units of Production Depreciation Schedule Depreciation for the Year Asset Depreciation Number of Depreciation Accumulated Late Cost Per Unit Units Expense Depreciation Value 12. 2018 12-31-2018 12.31 2015 Chocse from any astor enter any number in the input fields and then continue to the question On January 2 2018 Speedway Delivery Service purchased a truck a co 67.000 Before placing the truck in service, Spedway spent $2.500 painting. 5500 replacing trees and weather The should remain in service for five years and have a revival of 55,100. The truck's mal mage is expected to be 20.000 mencach of the first four years and 12.000 mes is the thing which depreciation method to use, wok Parker, the general managers a depresion schedule for each of the depreciation methods (traight lines of production and degree Road to 1231-2020 12-31 2021 12-31-2022 Prepare a depreciation schedule using the double dedining balance (Du) mehed Round depreciation expense to the nearest wilde Double Declining Illence Lepreciation Schedule Depreciation for the Year Book DO Iepreciation Accumulated Boch Date Cost Value Kate Depreciation Value 1-2-2010 12.01.2018 12-31-2019 12.11.20 Choose from any stor enter any number in the input fields and then continue to the next question Block On January 2, 2016 Speedway Delivery Sekce purchased a truck at a cost of $67,000. Before placing the rock in service Speedway spent $2.500 pag. 5500 placing and 54700 righe engine. The should remain for five years and have a residual value of 55,100. The truck's age is expected to be 20.000 miles in each of the best four years and 12.000 miles in the year 2000 in total in doing which depreciation method to Harold Packer, the general managements a depreciation schedule for each of the depreciation methods (traight line units of production, and doing ba Read the Depreciation for the Year DOB Depreciation Accumulated Date Cost Value Rate Expense Depreciation Value 12-2010 12.31.2010 12:312019 12-31-2000 12-31-3021 12-31-2022 Requirement 2 Speedww prepares fnancial statements in the depreciation method that reports the Night not income in the early years of Consider the test year that Speedomety the depreciation method that meets the company's objectives The depreciation method that reports the highest income in the first year med produces the option expand therefore the highest income Choose from any isto enter any number in the put fields and men contenuto e resin On January 2, 2018 Speedway Delivery Service purchased a truck at a cost of 567.000 Before placing the truck in service Speedway spent $2.500 painting it 5500 replacing tires and 54.700 overhanding the engine the truck should remain in wervice for five years and have a residual value of $5 100 The rock al mileage is expected to be 20.000 miles in each of the first four years and 12,000 miles in the Sith year 2000 in totul In deciding which depreciation method to use, Harold Parker the general manager, es a depreciation schedule for each of the depreciation methods (traight line units of production, and double doining balance) Read the Depreciation for the Year Asset Book DOB Depreciation Accumulated Book Date Cost Value Rate Expense Depreciation Value 1-2-2018 12-31-2018 12.31-2010 12-31-2020 12-31 2021 12:31 2022 . Requirement Speedway prepared financial statements in the depreciation method that reports the highest het income in the early years o Consider the first year that Speedway we the track only the depreciation method that meet the company's objectives The degrelation method that reports the highest come in the first year is the method troduces the depreciation expense and therefore the highest rat income Choose from any storender any number in the outs and continue to the rest