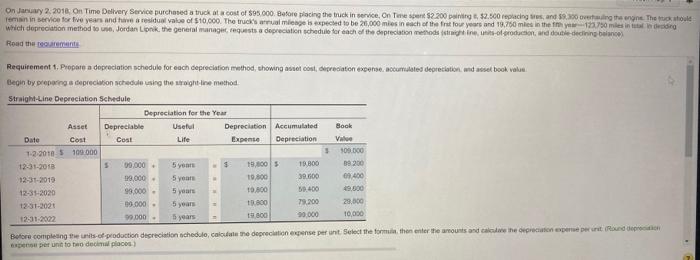

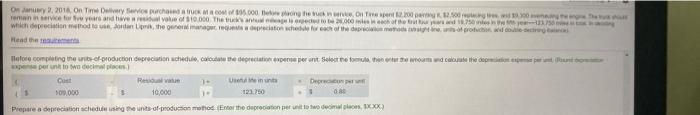

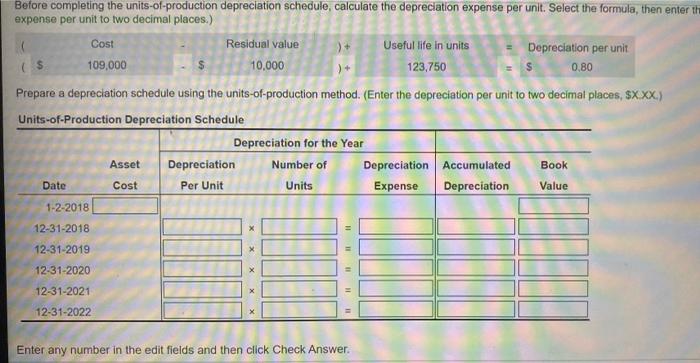

On January 2, 2018 On Time Delivery Service purchased a truck at a cost of $95.000. Before placing the truck in service, On Tuespent $2.200 pr. 32.500 replacing tres, and in the engine. The whole reman in service for five years and have a residual value of $10,000. The truck's realmenge is expected to be 25,000 mies in each of the first four years and 19.750 mies in the foy123.7 miles in indoor which depreciation method to use, Jordan Lion, the general manager requests a depreciation schedule for each of the depreciation methods in soroduction, and double-dedining balance Road the Requirement 1. Prepare a depreciation schedule for each depreciation method, showing a cost depreciation expense oumated depreciation and set book value Begin by preparing a depreciation schedule using the straight line method Straight-Line Depreciation Schedule Depreciation for the Year Asset Depreciable Useful Depreciation Accumulated Book Date Cost Life Expense Depreciation Valve 1.2.2010 5 100 000 3 109.000 12-31-2018 5 00 000 5 years 19.00 19,800 39 200 12-31-2018 199,000 - 5 year 39.600 0400 12-31 2020 99,000 5 years 0.800 19.000 1231-2020 39.000 5 years 1.800 79.200 12-31-2002 50.000 - 11 800 30 000 10,000 Cost 10.800 50.400 5 years Before completing the units of production depreciation schedule, calculate the depreciation expense perunt Select the form the enter the amounts and the precisione per perut Radeon pense per un to two decima pocos On y 2.2016 On Time Delay Mong the worst ... em service of years and have a 10.000 The Modern which depreciation mode is the generation where the most protector Head the llo completing the production depreciation schedule, care preciente peront Select the date outcome wd cate the department peperunto two decades Red Useinna De 100.000 10,000 123.750 08 Prepare a depreciation scheduling rent of production to Enter the direction to decimo. XXX) Before completing the units-of-production depreciation schedule, calculate the depreciation expense per unit. Select the formula, then enter the expense per unit to two decimal places.) Cost Residual value + Useful life in units = Depreciation per unit 109,000 10,000 ) + 123,750 $ 0.80 Prepare a depreciation schedule using the units-of-production method. (Enter the depreciation per unit to two decimal places, $XXX.) Units-of-Production Depreciation Schedule Depreciation for the Year Asset Depreciation Number of Depreciation Accumulated Book Date Cost Per Unit Units Expense Depreciation Value 1-2-2018 12-31-2018 111 12-31-2019 12-31-2020 11 12-31-2021 12-31-2022 Enter any number in the edit fields and then click Check