Question

On January 2, 2019, Anne Inc. sold equipment which has a carrying amount of $400,000 in exchange for a $600,000 4-year non-interest-bearing note that will

On January 2, 2019, Anne Inc. sold equipment which has a carrying amount of $400,000 in exchange for a $600,000 4-year non-interest-bearing note that will be due on January 2, 2023. There was no established exchange price for the equipment. The prevailing rate of interest for a note of this type on January 2, 2019 was 10%. What should be recorded as the carrying value of the note receivable as of December 31, 2021 balance sheet?

2. Noemy Co. owns 15,000 of the 100,000 ordinary shares of Republic Corporation. The investment is accounted as Financial Assets at Fair Value Through Profit or Loss (FA-FV-P/L) with a carrying value of $3,300,000. Republic Corporation declared a 10% stock dividend but gave the investors the option to receive $210 per whole stock of dividend. What amount of cash will Noemy Co. receive? What is the journal entry to record the dividends if Noemy Co. opted to receive cash?

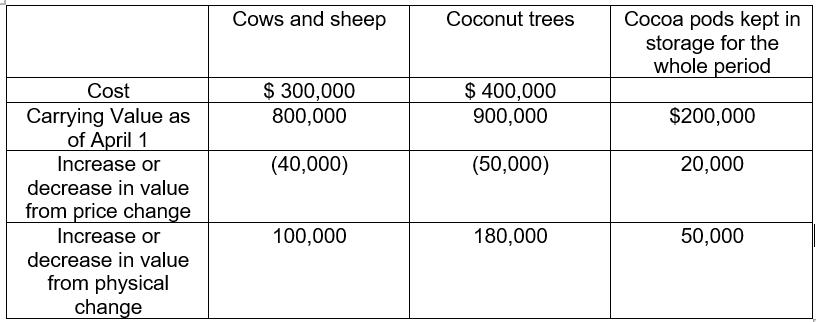

3. Jessa Company has several assets for classification as biological assets. After assessing the information shown below, how much should Jessa Company report as net gain from change in fair value of biological assets for the quarter?

4. Tulips Company owned 50,000 shares of another Pam Company. These 50,000 shares have an original price of $100 per share. The investee distributed 50,000 rights to Tulips Company. Tulips Company was entitled to buy one new share for $140 and five of these rights. Each share had a market value of $150 and each right had market value of $10 on the date of issuance. Tulips Company exercised all rights. The share rights are accounted for separately and measured initially at fair value. How much should be recorded for the new shares that are acquired by exercising the rights?

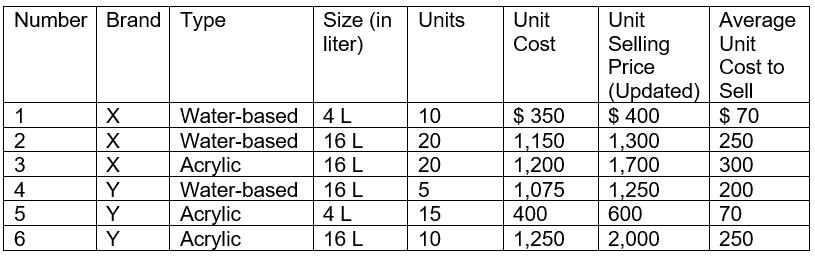

5. Vanity Corporation sells different types of paint. Due to the low demand, it would be testing its inventory for impairment. It acquired the following data:

What amount should be reported by Vanity Corporation as loss from inventory write-down?

What amount should be reported by Vanity Corporation as loss from inventory write-down?

Cost Carrying Value as of April 1 Increase or decrease in value from price change Increase or decrease in value from physical change Cows and sheep $ 300,000 800,000 (40,000) 100,000 Coconut trees $ 400,000 900,000 (50,000) 180,000 Cocoa pods kept in storage for the whole period $200,000 20,000 50,000

Step by Step Solution

3.30 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

We have multiple questions to address here so lets tackle them one by one Question 1 We have a 4year noninterestbearing note for 600000 that was given in exchange for equipment Because the note is non...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started