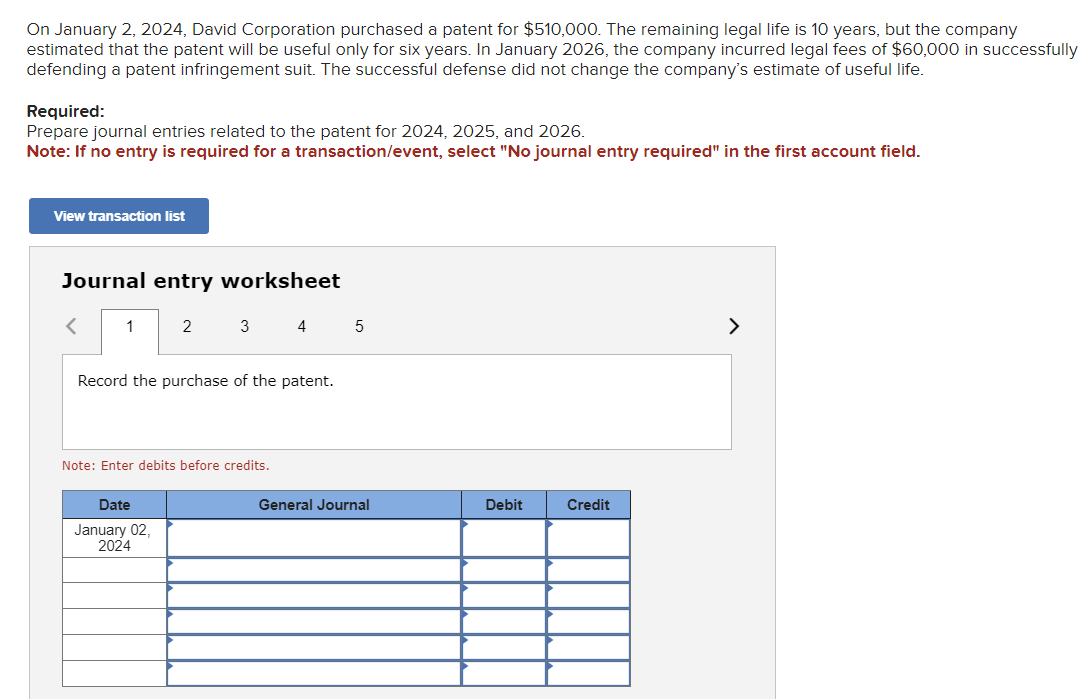

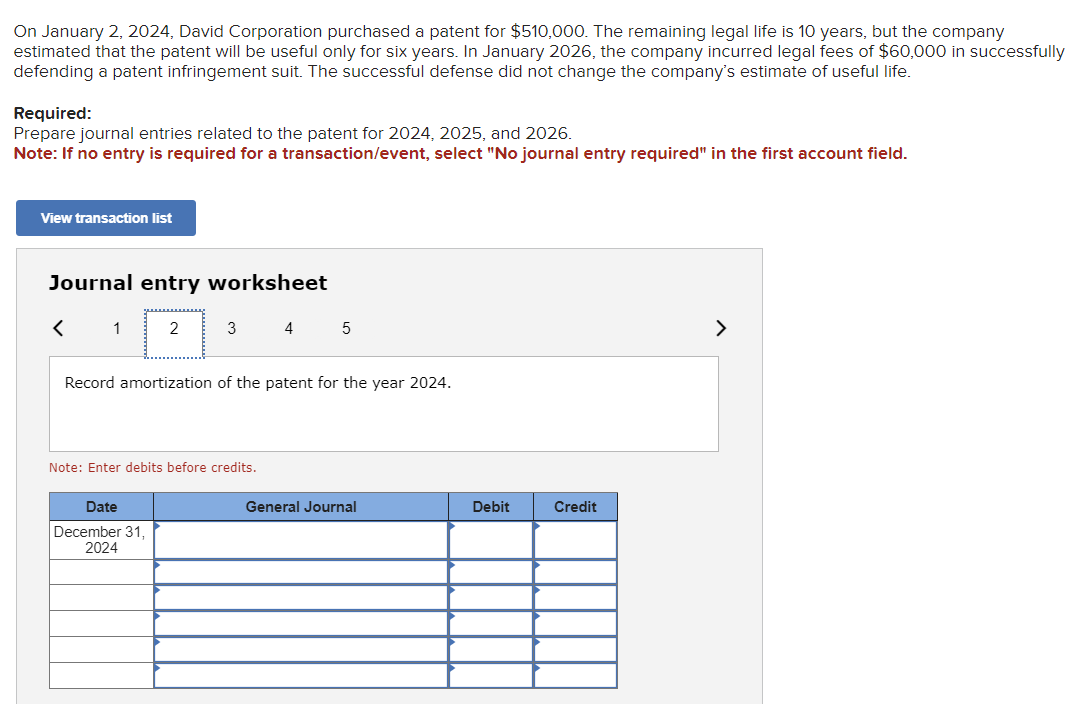

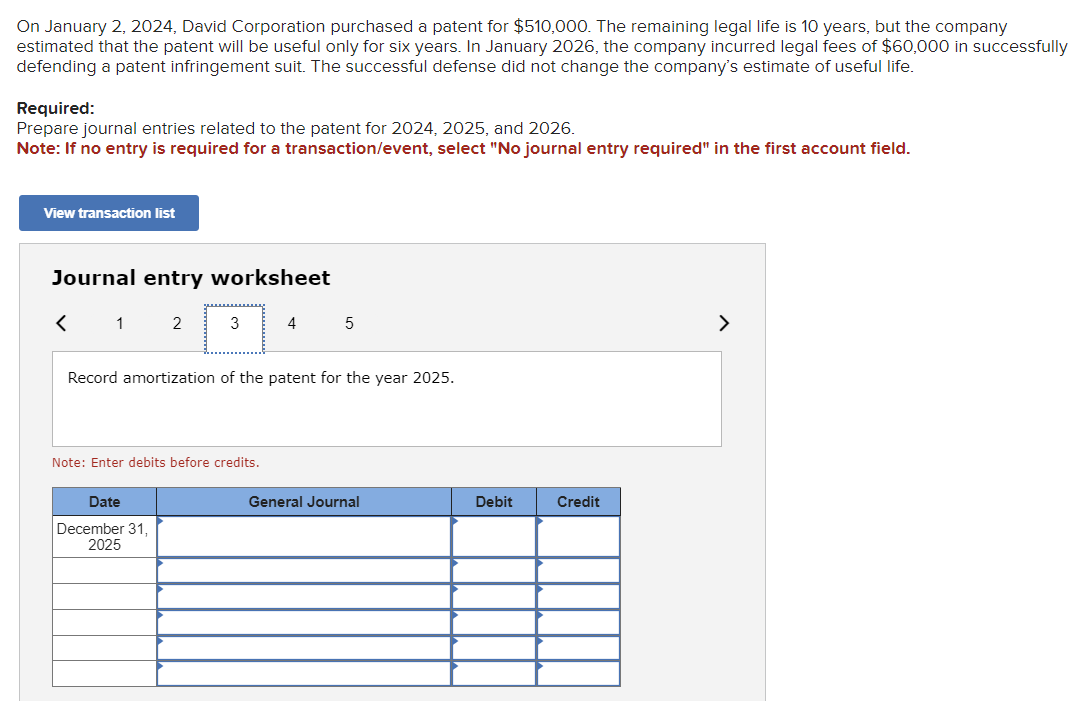

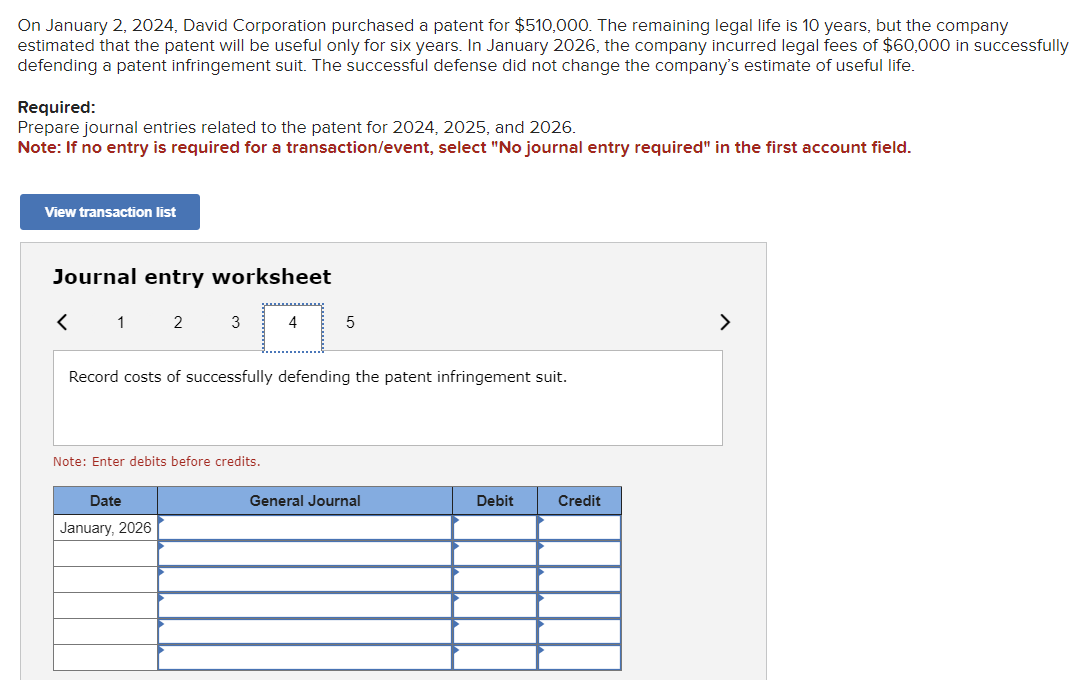

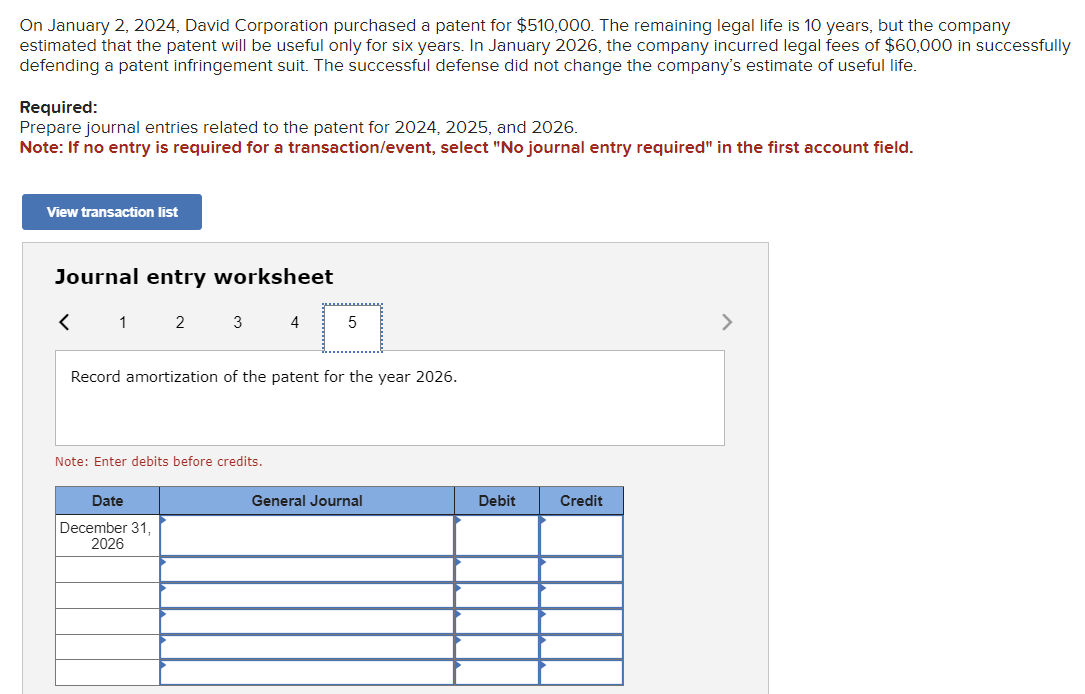

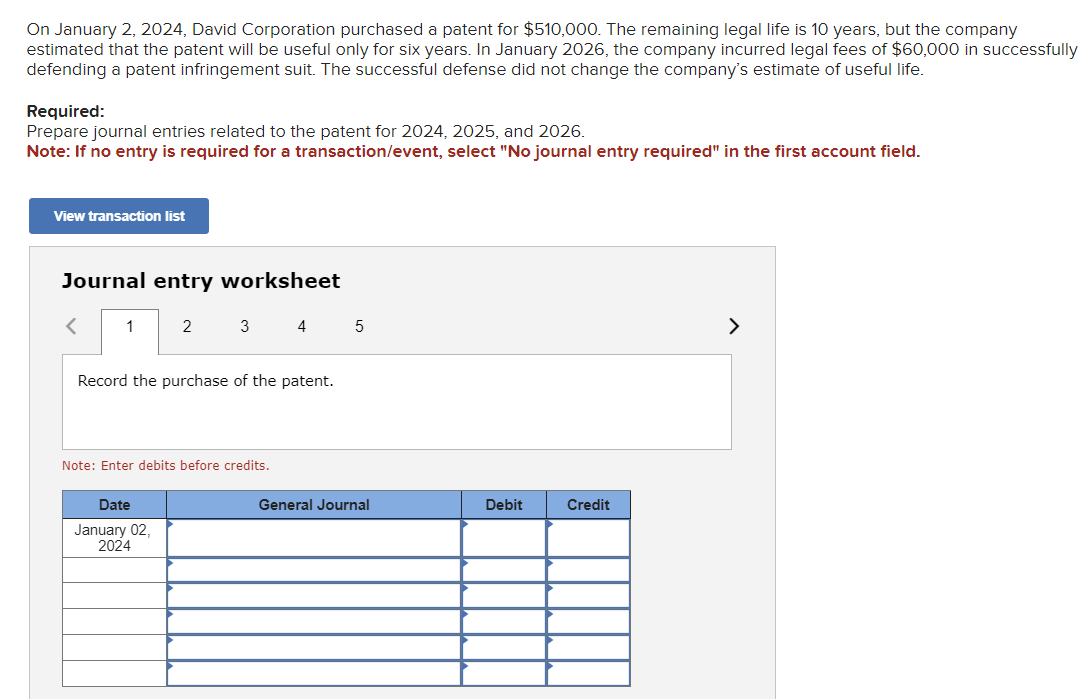

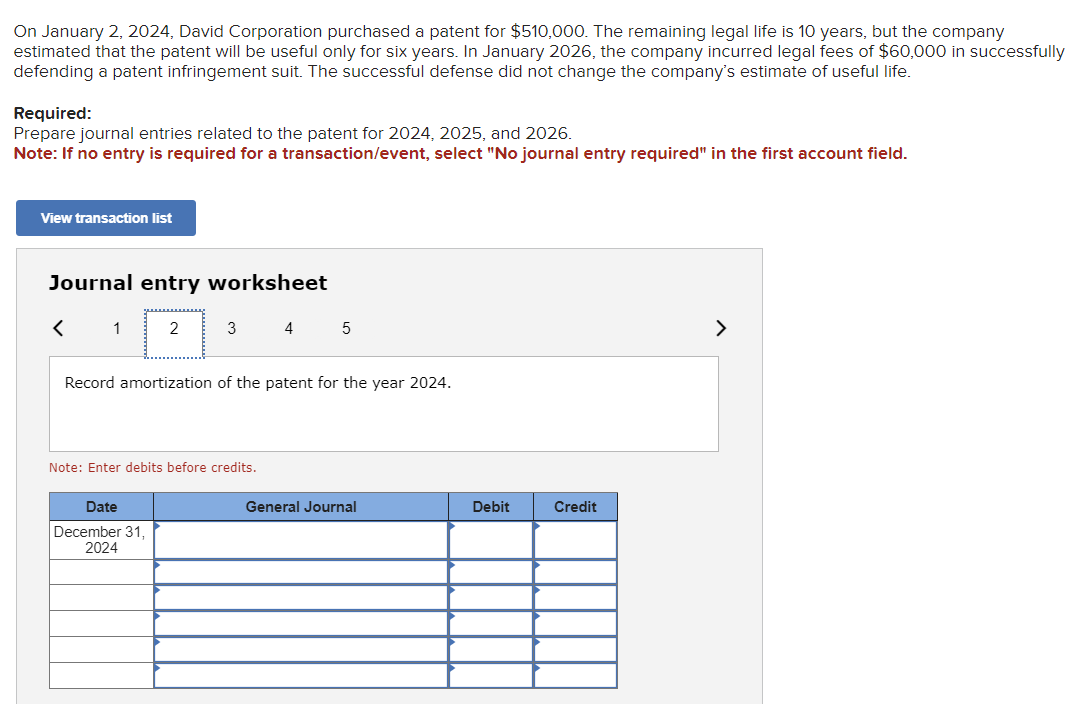

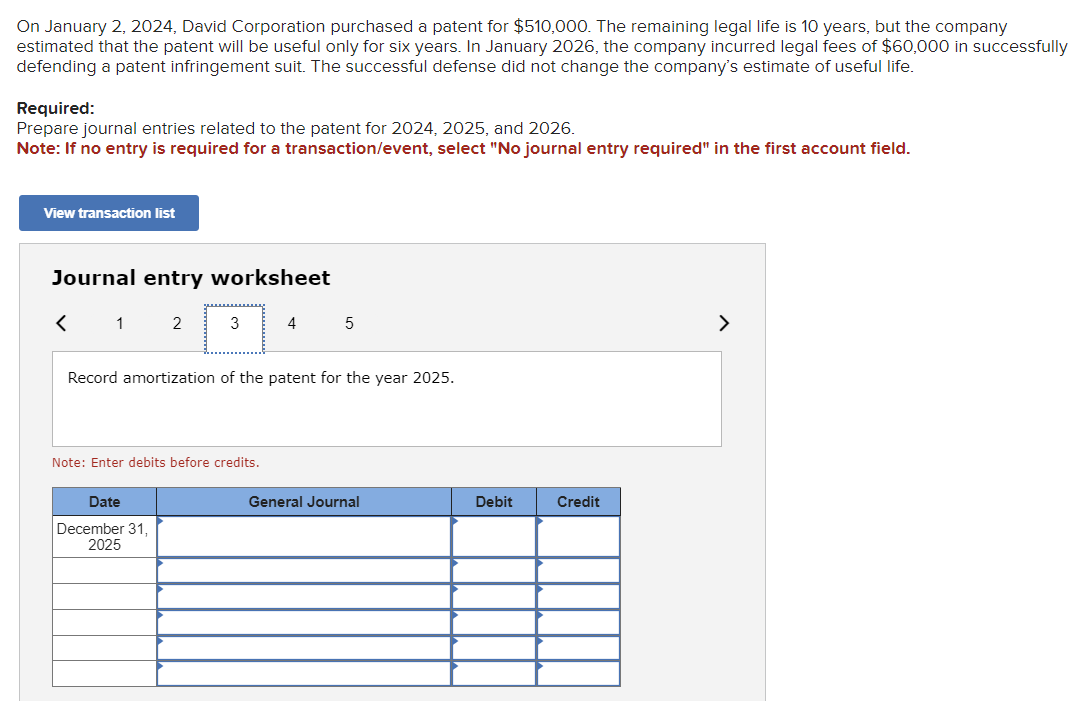

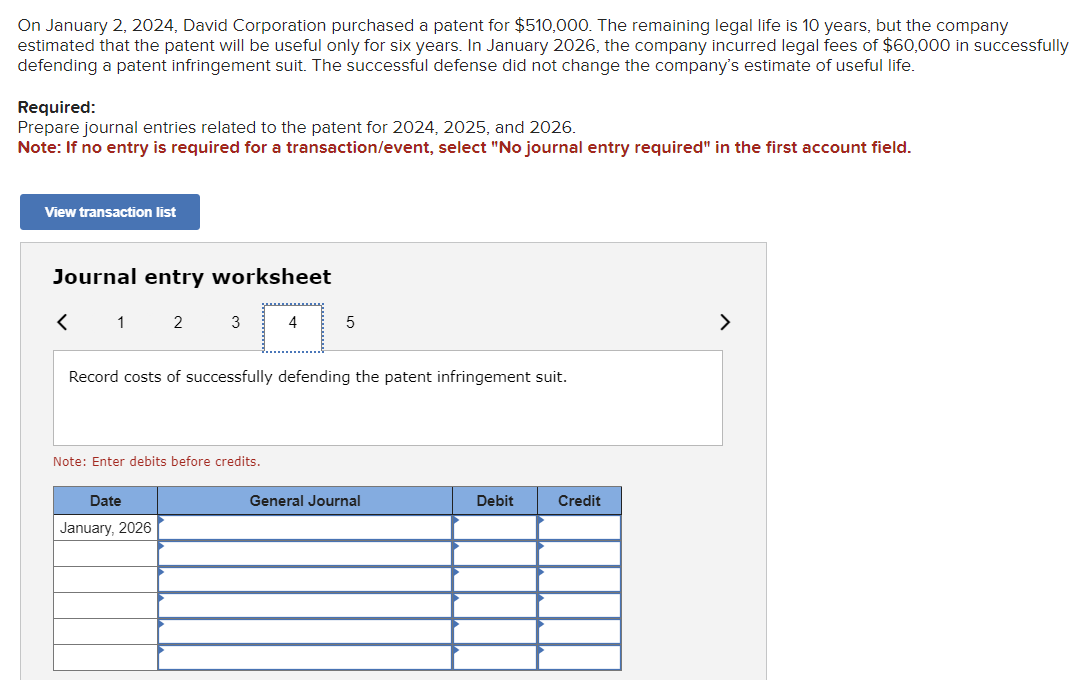

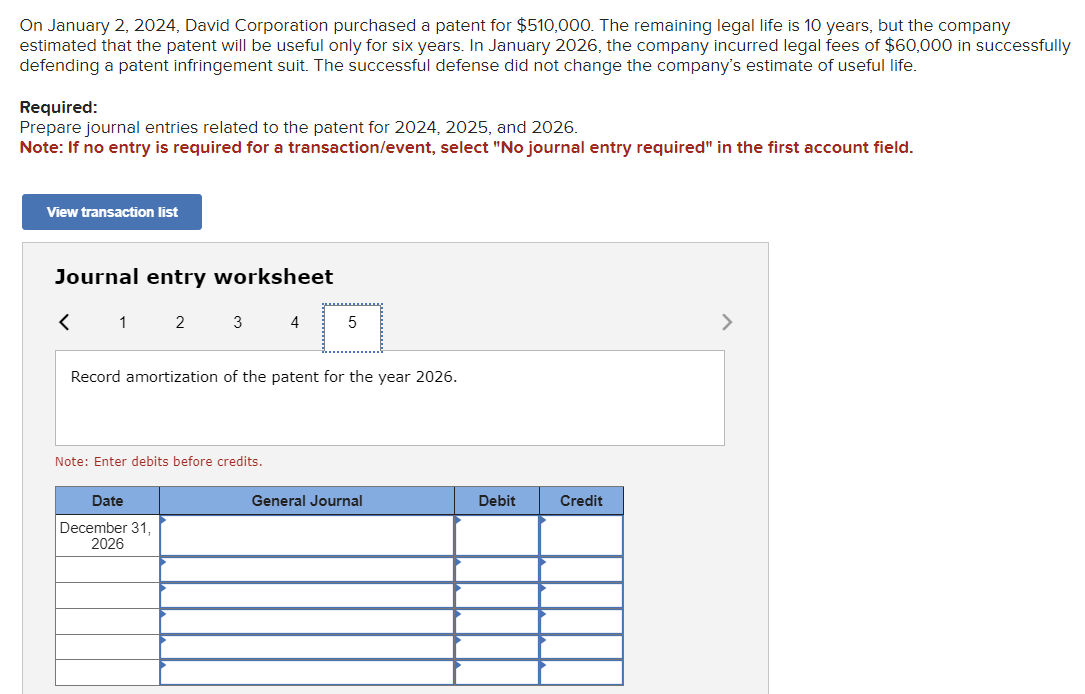

On January 2, 2024, David Corporation purchased a patent for $510,000. The remaining legal life is 10 years, but the company estimated that the patent will be useful only for six years. In January 2026 , the company incurred legal fees of $60,000 in successfully defending a patent infringement suit. The successful defense did not change the company's estimate of useful life. Required: Prepare journal entries related to the patent for 2024, 2025, and 2026. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 2345> Note: tnter debits betore credits. On January 2, 2024, David Corporation purchased a patent for $510,000. The remaining legal life is 10 years, but the company estimated that the patent will be useful only for six years. In January 2026 , the company incurred legal fees of $60,000 in successfully defending a patent infringement suit. The successful defense did not change the company's estimate of useful life. Required: Prepare journal entries related to the patent for 2024, 2025, and 2026. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 5 Record amortization of the patent for the year 2024. Note: Enter debits before credits. On January 2, 2024, David Corporation purchased a patent for $510,000. The remaining legal life is 10 years, but the company estimated that the patent will be useful only for six years. In January 2026 , the company incurred legal fees of $60,000 in successfully defending a patent infringement suit. The successful defense did not change the company's estimate of useful life. Required: Prepare journal entries related to the patent for 2024, 2025, and 2026. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record amortization of the patent for the year 2025. Note: Enter debits before credits. On January 2, 2024, David Corporation purchased a patent for $510,000. The remaining legal life is 10 years, but the company estimated that the patent will be useful only for six years. In January 2026 , the company incurred legal fees of $60,000 in successfully defending a patent infringement suit. The successful defense did not change the company's estimate of useful life. Required: Prepare journal entries related to the patent for 2024, 2025, and 2026. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet