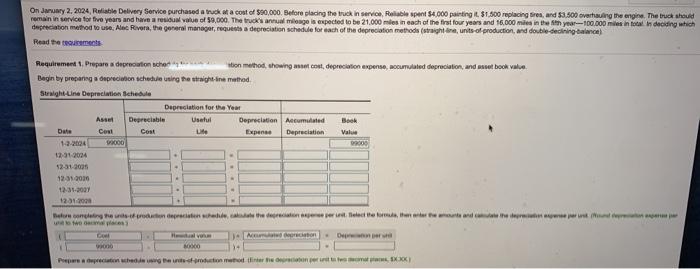

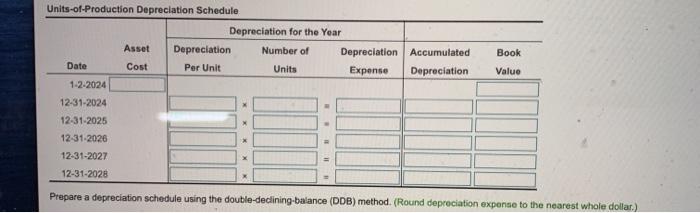

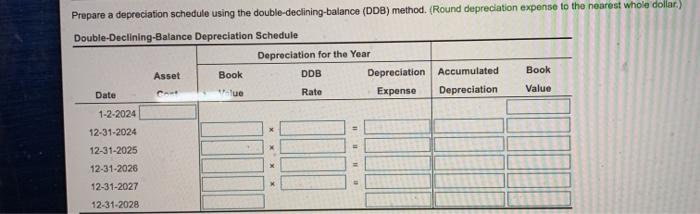

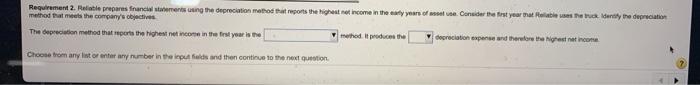

On January 2, 2024, Riable Delivery Service purchased a ruck a cost of $90,000. Before placing the truck in service, Reliable spent $4.000 painting it $1.500 replacing tres, and $3.500 overting the engine. The truck should remain in service for five years and have a res value of 9,000. The truck's annual longo is expected to be 21.000 miles in each of the first four years and 16.000 miles in the son year--100,000 miles in total in deciding which depreciation method tous les Rivera, the general manager, request a depreciation schedule for each of the depreciation methods (straight-an, units of production, and double-decining balance) Read the teements Value Requirement Prepare a deprecaton cho on method, showing on depreciation expense, Doulated depreciation, and asset book value Begin by preparing a precion schedule using the right in method Steight-Line Depreciation Schedule Depreciation for the Year Asset Depreciable Useful Depreciation Accumulated Date Cost Cost Ute Expense Depreciation 13-2004 000 99000 12.1.2004 12-01-2005 - 12:31 2030 12-31-2007 12012 Betrecere deren, where were out and cheer . - Non MX Book Value Units-of-Production Depreciation Schedule Depreciation for the Year Asset Depreciation Number of Depreciation Accumulated Date Cost Per Unit Units Expense Depreciation 1-2-2024 12-31-2024 12-31-2025 12-31-2026 12-31-2027 12-31-2028 Prepare a depreciation schedule using the double-dedining-balance (DDB) method. (Round depreciation exponse to the nearest whole dollar) Prepare a depreciation schedule using the double-declining-balance (DDB) method. (Round depreciation expense to the nearest whole dollar) Double-Declining-Balance Depreciation Schedule Depreciation for the Year Asset Book DDB Depreciation Accumulated Book Date Rate Expense Depreciation Value 1-2-2024 12-31-2024 12-31-2025 12-31-2026 12-31-2027 12-31-2028 Requirement 2. Reliable prepares financial statements in the depreciation method that reports the great income in the early years of st. Consider the test year at labi sestretly the depreciation method that meets the company's objectives The depreciation method that reports the highest net in the first year is the method it produces the depreciation expens therefore the rest net income Choose from any intor enter any number in the puts and then continue to the next