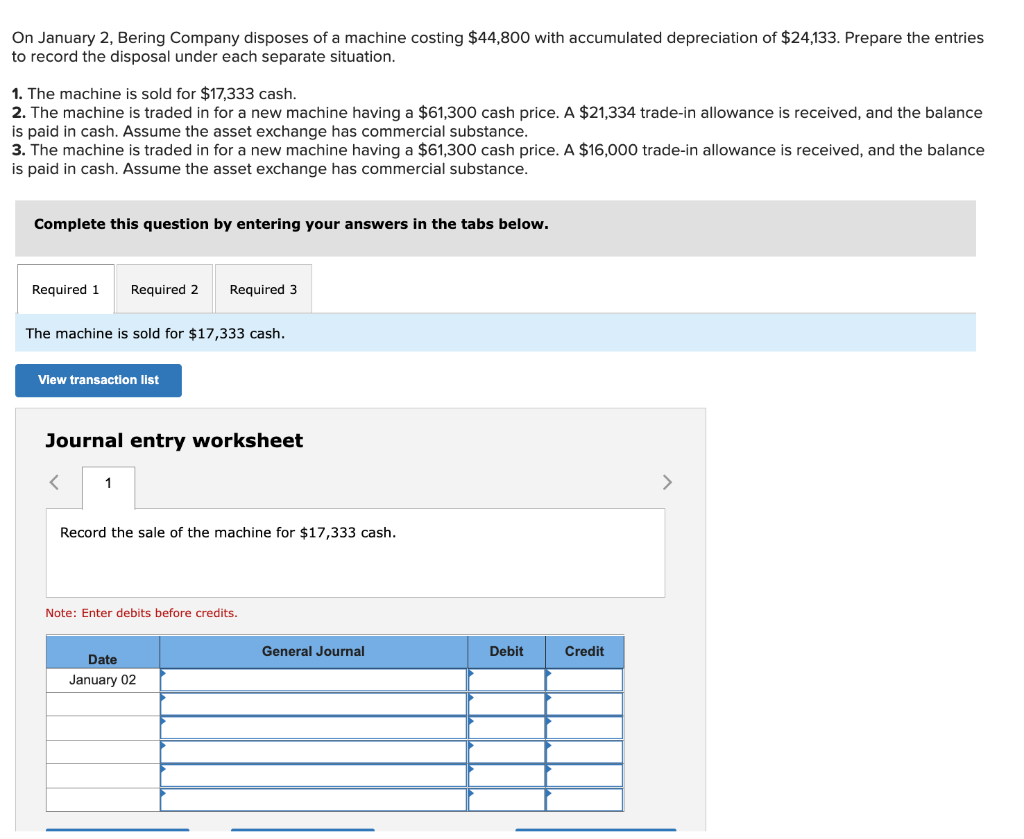

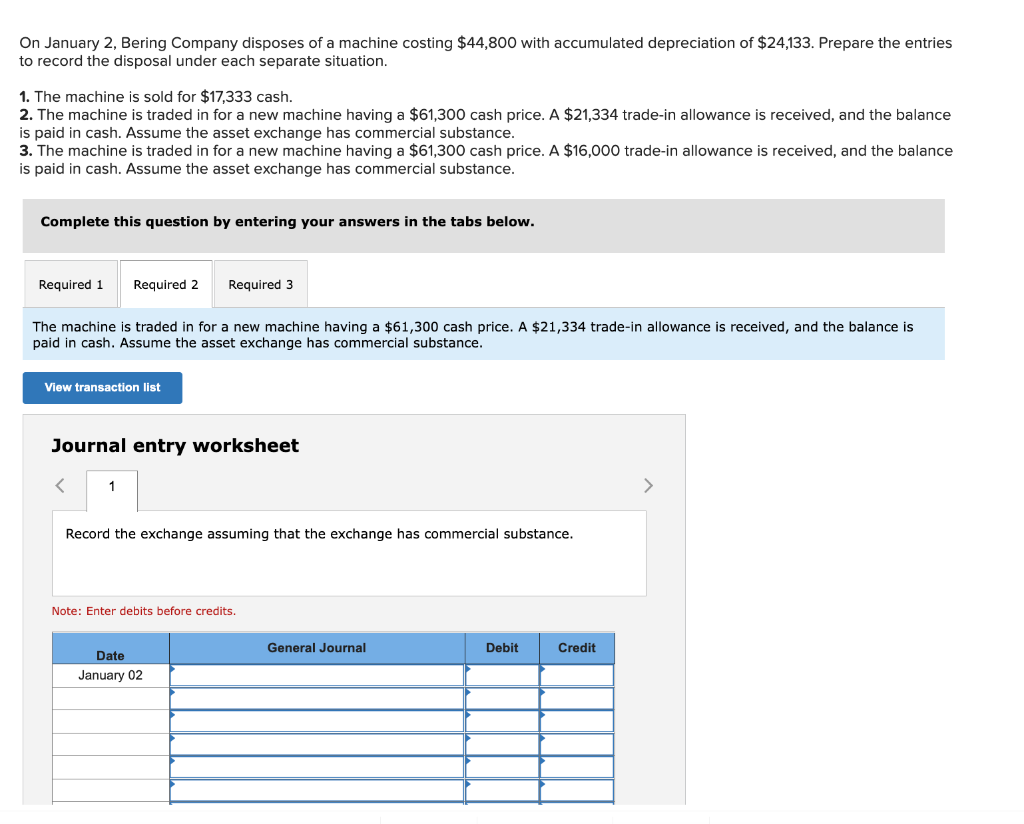

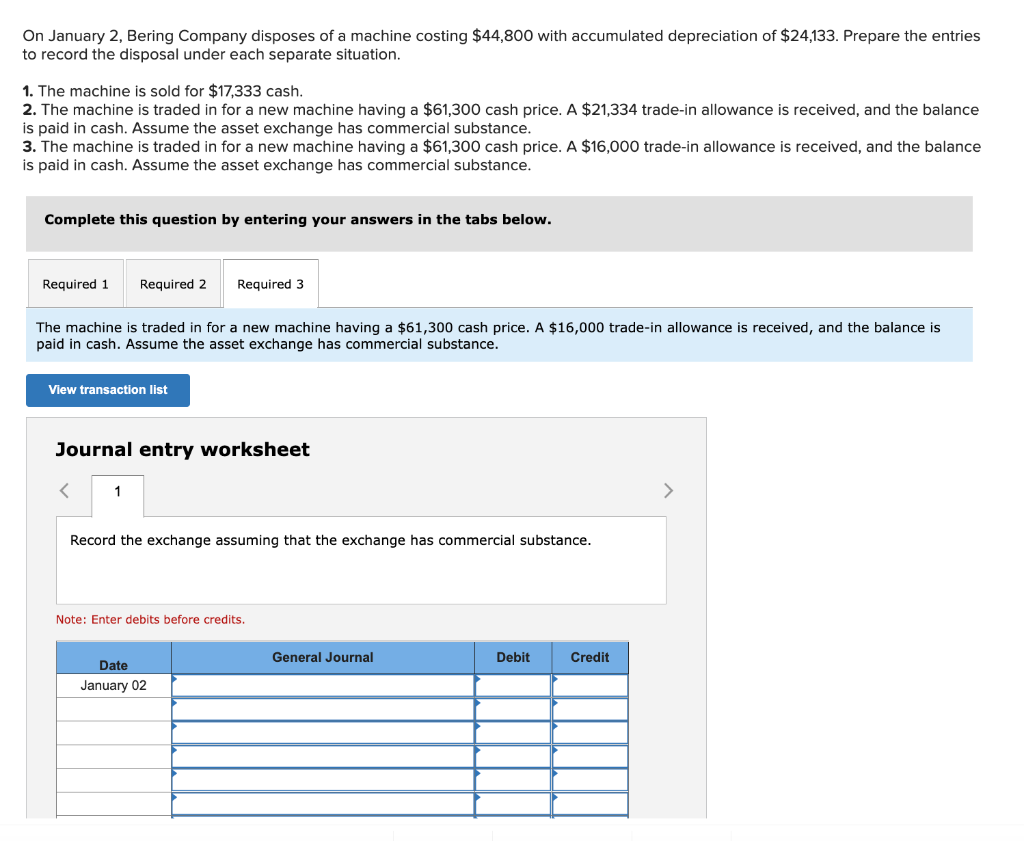

On January 2, Bering Company disposes of a machine costing $44,800 with accumulated depreciation of $24,133. Prepare the entries to record the disposal under each separate situation. 1. The machine is sold for $17,333 cash. 2. The machine is traded in for a new machine having a $61,300 cash price. A$21,334 trade-in allowance is received, and the balance is paid in cash. Assume the asset exchange has commercial substance. 3. The machine is traded in for a new machine having a $61,300 cash price. A$16,000 trade-in allowance is received, and the balance is paid in cash. Assume the asset exchange has commercial substance. Complete this question by entering your answers in the tabs below. The machine is sold for $17,333 cash. Journal entry worksheet Record the sale of the machine for $17,333 cash. Note: Enter debits before credits. On January 2, Bering Company disposes of a machine costing $44,800 with accumulated depreciation of $24,133. Prepare the entries to record the disposal under each separate situation. 1. The machine is sold for $17,333 cash. 2. The machine is traded in for a new machine having a $61,300 cash price. A$21,334 trade-in allowance is received, and the balance is paid in cash. Assume the asset exchange has commercial substance. 3. The machine is traded in for a new machine having a $61,300 cash price. A$16,000 trade-in allowance is received, and the balance is paid in cash. Assume the asset exchange has commercial substance. Complete this question by entering your answers in the tabs below. The machine is traded in for a new machine having a $61,300 cash price. A $21,334 trade-in allowance is received, and the balance is paid in cash. Assume the asset exchange has commercial substance. Journal entry worksheet Record the exchange assuming that the exchange has commercial substance. Note: Enter debits before credits. On January 2, Bering Company disposes of a machine costing $44,800 with accumulated depreciation of $24,133. Prepare the entries to record the disposal under each separate situation. 1. The machine is sold for $17,333 cash. 2. The machine is traded in for a new machine having a $61,300 cash price. A$21,334 trade-in allowance is received, and the balance is paid in cash. Assume the asset exchange has commercial substance. 3. The machine is traded in for a new machine having a $61,300 cash price. A$16,000 trade-in allowance is received, and the balance is paid in cash. Assume the asset exchange has commercial substance. Complete this question by entering your answers in the tabs below. The machine is traded in for a new machine having a $61,300 cash price. A$16,000 trade-in allowance is received, and the balance is paid in cash. Assume the asset exchange has commercial substance. Journal entry worksheet Record the exchange assuming that the exchange has commercial substance. Note: Enter debits before credits