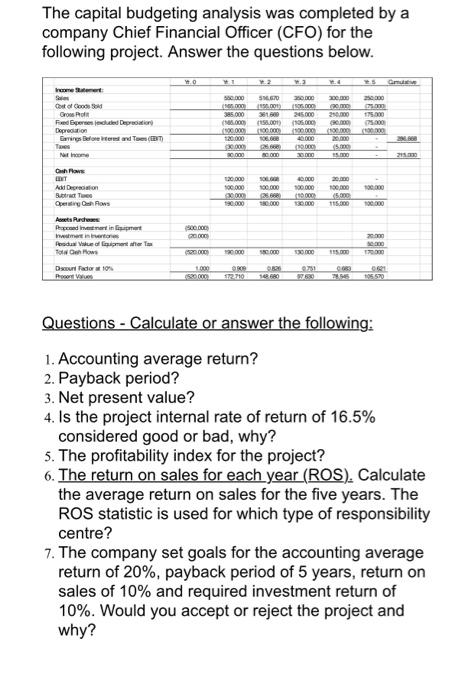

The capital budgeting analysis was completed by a company Chief Financial Officer (CFO) for the following project. Answer the questions below. mu 50.000 000 385.000 (8.000 Cost of Code Groot Fred perses feduled Degretor Depreciation Savings Before read SHO 250.000 20.00 245.000 (150.000 00.000 100000 200.000 20 2 17.00 75.000 120.000 2. 5. 20.000 0.000 50.000 2015 Can SOE 190.000 120.000 100.000 2000 190.000 0.000 500.000 0 000 130 000 100.000 5.000 115.000 550.000 190.000 Add Denon Supra Tee Opening Can Ross Ata Perde Pescanding into Produse Voeder Town How Durador 10 900.000 20.000 120.000 000 SOOD DO 170000 1000 1270 ON 260 102 105570 Questions - Calculate or answer the following: 1. Accounting average return? 2. Payback period? 3. Net present value? 4. Is the project internal rate of return of 16.5% considered good or bad, why? 5. The profitability index for the project? 6. The return on sales for each year (ROS). Calculate the average return on sales for the five years. The ROS statistic is used for which type of responsibility centre? 7. The company set goals for the accounting average return of 20%, payback period of 5 years, return on sales of 10% and required investment return of 10%. Would you accept or reject the project and why? The capital budgeting analysis was completed by a company Chief Financial Officer (CFO) for the following project. Answer the questions below. mu 50.000 000 385.000 (8.000 Cost of Code Groot Fred perses feduled Degretor Depreciation Savings Before read SHO 250.000 20.00 245.000 (150.000 00.000 100000 200.000 20 2 17.00 75.000 120.000 2. 5. 20.000 0.000 50.000 2015 Can SOE 190.000 120.000 100.000 2000 190.000 0.000 500.000 0 000 130 000 100.000 5.000 115.000 550.000 190.000 Add Denon Supra Tee Opening Can Ross Ata Perde Pescanding into Produse Voeder Town How Durador 10 900.000 20.000 120.000 000 SOOD DO 170000 1000 1270 ON 260 102 105570 Questions - Calculate or answer the following: 1. Accounting average return? 2. Payback period? 3. Net present value? 4. Is the project internal rate of return of 16.5% considered good or bad, why? 5. The profitability index for the project? 6. The return on sales for each year (ROS). Calculate the average return on sales for the five years. The ROS statistic is used for which type of responsibility centre? 7. The company set goals for the accounting average return of 20%, payback period of 5 years, return on sales of 10% and required investment return of 10%. Would you accept or reject the project and why