Answered step by step

Verified Expert Solution

Question

1 Approved Answer

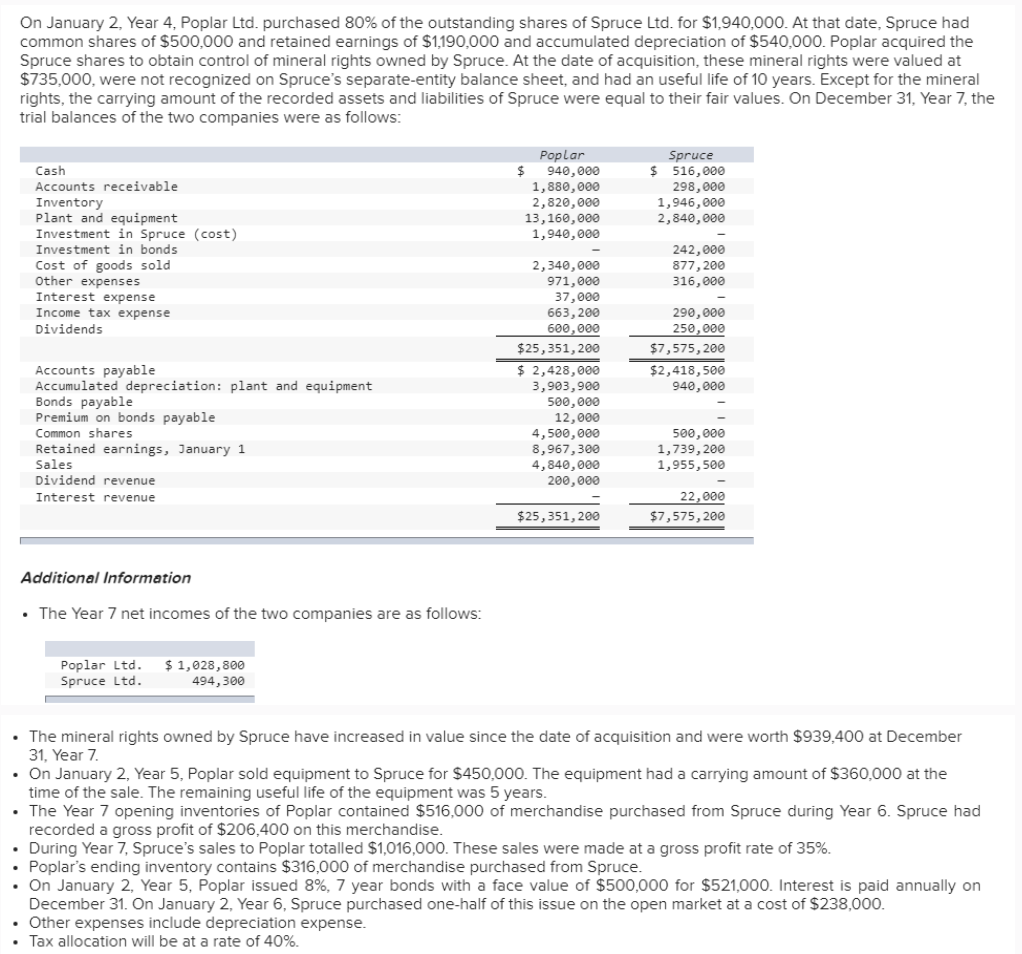

On January 2 , Year 4 , Poplar Ltd . purchased 8 0 % of the outstanding shares of Spruce Ltd . for $ 1

On January Year Poplar Ltd purchased of the outstanding shares of Spruce Ltd for $ At that date, Spruce had common shares of $ and retained earnings of $ and accumulated depreciation of $ Poplar acquired the Spruce shares to obtain control of mineral rights owned by Spruce. At the date of acquisition, these mineral rights were valued at $ were not recognized on Spruce's separateentity balance sheet, and had an useful life of years. Except for the mineral rights, the carrying amount of the recorded assets and liabilities of Spruce were equal to their fair values. On December Year the trial balances of the two companies were as follows:

tablePoplar,SpruceCash$$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started