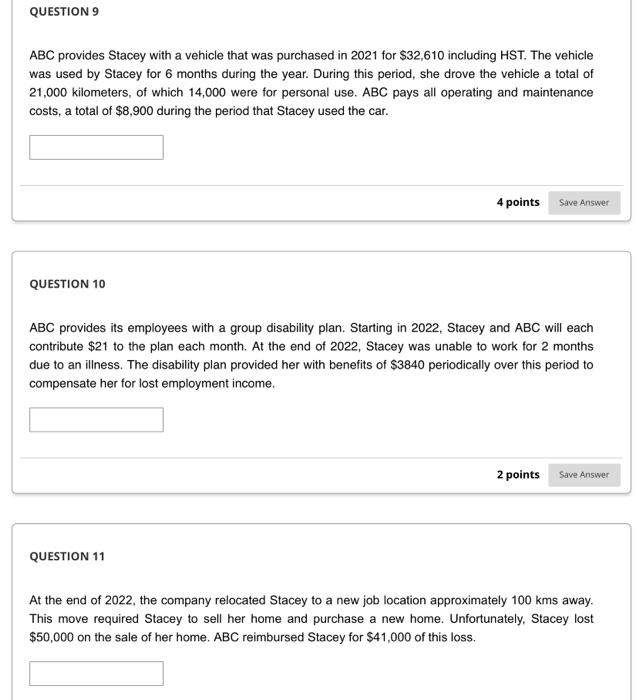

On January 2,2022, Ms. Stacey Koutakos moves from London, Ontario, to Thunder Bay, Ontario, in order to begin employment with ABC Ltd. (ABC). The following items pertain to Stacey's employment information for the 2022 taxation year. For each "question", provide the effect on Stacey's net employment income. - An inclusion in employment income should be entered in the box as a positive number. - If the item would have no effect on the calculation of employment income, enter the number 0 (zero) in the box. - Round all answers to the nearest dollar where applicable. ABC contributed $4,000 into an RPP (Registered Pension Plan) on Stacey's behalf. Because of her strong professional reputation, ABC paid Stacey a signing bonus of $20,000. The signing bonus was paid on March 1, 2022. QUESTION 4 ABC provides group medical coverage to all of its employees. The private health plan premiums paid by ABC on Stacey's behalf cost $666 for the year. 1 points QUESTION 5 On December 12,2022 , a bonus of $12,800 was accrued for Stacey. She received $8,300 of this bonus on December 27, 2022. The remainder is to be paid on January 13, 2023. During the year, Stacey received two non-cash gifts, a birthday gift worth $260 and a Christmas gift worth $458. QUESTION 7 Because of the need to invest some of her additional income, ABC provided Stacey with financial counseling services. The value of these services was $1633. QUESTION 8 Stacey participates in ABC's stock option plan. ABC is a public company. Options were issued on Stacey's first day in 2022. The exercise price of the options is equal to $10.48 per share. The fair market value (FMV) of ABC 's shares at the time of issue was $10.48 per share. Stacey acquired 6,000 of the company's shares on September 1,2022 . On that date, ABC shares had a FMV of $12.81 per share. Stacey is still holding the shares at the end of 2022. ABC provides Stacey with a vehicle that was purchased in 2021 for $32,610 including HST. The vehicle was used by Stacey for 6 months during the year. During this period, she drove the vehicle a total of 21,000 kilometers, of which 14,000 were for personal use. ABC pays all operating and maintenance costs, a total of $8,900 during the period that Stacey used the car. QUESTION 10 ABC provides its employees with a group disability plan. Starting in 2022, Stacey and ABC will each contribute $21 to the plan each month. At the end of 2022, Stacey was unable to work for 2 months due to an illness. The disability plan provided her with benefits of $3840 periodically over this period to compensate her for lost employment income. 2 points QUESTION 11 At the end of 2022, the company relocated Stacey to a new job location approximately 100kms away. This move required Stacey to sell her home and purchase a new home. Unfortunately. Stacey lost $50,000 on the sale of her home. ABC reimbursed Stacey for $41,000 of this loss. Stacey's employer provided her with a loan of $140,000 at interest rate of 2.3%. The funds were provided on July 1, 2022. Stacey pays interest monthly and paid all of the interest required in 2022. Assume the prescribed rate set by the CRA is 3% for all four quarters of 2022