Answered step by step

Verified Expert Solution

Question

1 Approved Answer

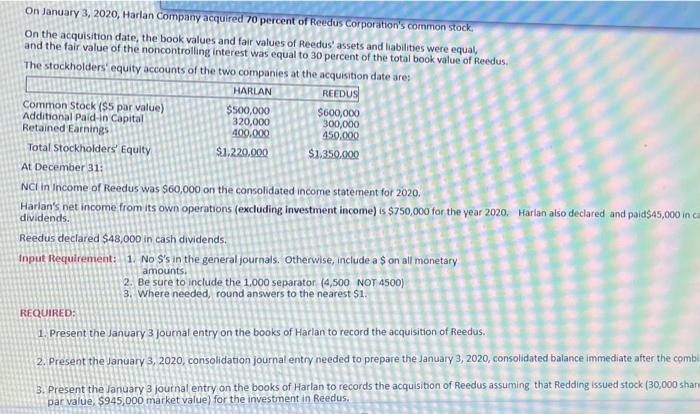

On January 3, 2020, Harlan Company acquired 70 percent of Reedus Corporation's common stock On the acquisition date, the book values and fair values

On January 3, 2020, Harlan Company acquired 70 percent of Reedus Corporation's common stock On the acquisition date, the book values and fair values of Reedus' assets and liabilities were equal, and the fair value of the noncontrolling interest was equal to 30 percent of the total book value of Reedus, The stockholders' equity accounts of the two companies at the acquisition date are: HARLAN REEDUS $500,000 $600,000 Common Stock ($5 par value) Additional Paid-in Capital Retained Earnings 320,000 300,000 400,000 450,000 Total Stockholders' Equity $1,220.000 $1.350.000 At December 31: NCI in Income of Reedus was $60,000 on the consolidated income statement for 2020. Harlan's net income from its own operations (excluding investment income) is $750,000 for the year 2020. Harlan also declared and paid $45,000 in ca dividends. Reedus declared $48,000 in cash dividends. Input Requirement: 1. No S's in the general journals. Otherwise, include a $ on all monetary amounts. 2. Be sure to include the 1,000 separator (4,500 NOT 4500) 3. Where needed, round answers to the nearest $1. REQUIRED: 1. Present the January 3 journal entry on the books of Harlan to record the acquisition of Reedus. 2. Present the January 3, 2020, consolidation journal entry needed to prepare the January 3, 2020, consolidated balance immediate after the combi 3. Present the January 3 journal entry on the books of Harlan to records the acquisition of Reedus assuming that Redding issued stock (30,000 share par value, $945,000 market value) for the investment in Reedus.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Cla Paste Home Insert Cut E Copy Format Painter Clipboard C C21 A A B 1 2 Solution 11 3 4 5 6 7 8 9 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started