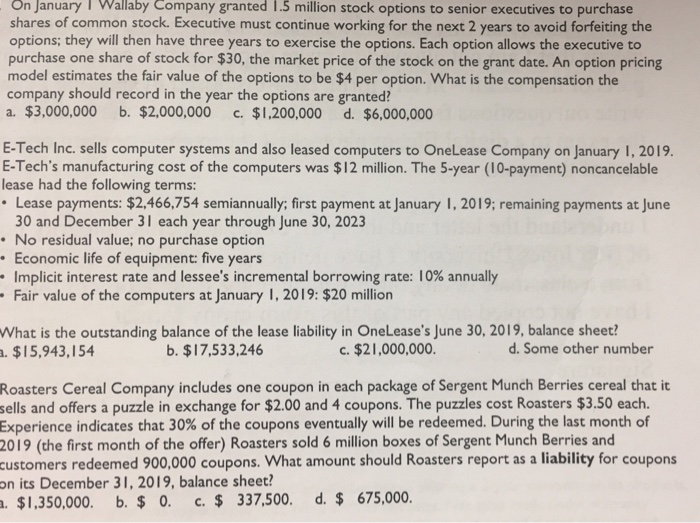

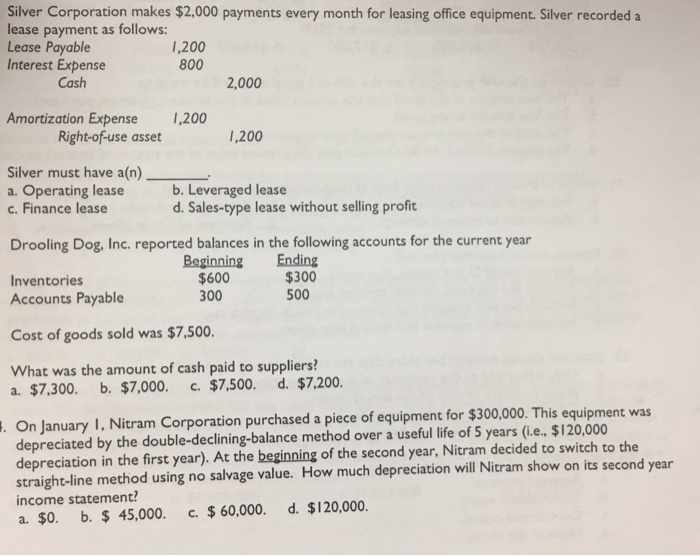

On January Wallaby Company granted 1.5 million stock options to senior executives to purchase shares of common stock. Executive must continue working for the next 2 years to avoid forfeiting the options; they will then have three years to exercise the options. Each option allows the executive to purchase one share of stock for $30, the market price of the stock on the grant date. An option pricing model estimates the fair value of the options to be $4 per option. What is the compensation the company should record in the year the options are granted? a. $3,000,000 b. $2,000,000 c. $1,200,000 d. $6,000,000 E-Tech Inc. sells computer systems and also leased computers to OneLease Company on January 1, 2019 E-Tech's manufacturing cost of the computers was $12 million. The 5-year (10-payment) noncancelable lease had the following terms: Lease payments: $2,466,754 semiannually; first payment at January 1, 2019; remaining payments at June 30 and December 31 each year through June 30, 2023 No residual value; no purchase option Economic life of equipment: five years Implicit interest rate and lessee's incremental borrowing rate: 10% annually Fair value of the computers at January I, 2019: $20 million What is the outstanding balance of the lease liability in OneLease's June 30, 2019, balance sheet? . $15,943,154 d. Some other number b. $17,533,246 c. $21,000,000 Roasters Cereal Company includes one coupon in each package of Sergent Munch Berries cereal that it sells and offers a puzzle in exchange for $2.00 and 4 coupons. The puzzles cost Roasters $3.50 each. Experience indicates that 30% of the coupons eventually will be redeemed. During the last month of 019 (the first month of the offer) Roasters sold 6 million boxes of Sergent Munch Berries and customers redeemed 900,000 coupons. What amount should Roasters report as a liability for coupons on its December 31,2019, balance sheet? $1,350,000. b. 0. c.337,500. d. 675,000 Silver Corporation makes $2,000 payments every month for leasing office equipment. Silver recorded a lease payment as follows: Lease Payable Interest Expense 1,200 800 Cash 2,000 Amortization Expense 1,200 Right-of-use asset 1,200 Silver must have a(n) a. Operating lease c. Finance lease b. Leveraged lease d. Sales-type lease without selling profit Drooling Dog, Inc. reported balances in the following accounts for the current year Beginning Ending Inventories Accounts Payable $600 300 $300 500 Cost of goods sold was $7,500 What was the amount of cash paid to suppliers? a. $7,300. b. $7,000. c. $%7,500. d. $7,200. . On January I, Nitram Corporation purchased a piece of equipment for $300,000. This equipment was depreciated by the double-declining-balance method over a useful life of 5 years (i.e. $120,000 depreciation in the first year). At the beginning of the second year, Nitram decided to switch to the straight-line method using no salvage value. How much depreciation will Nitram show on its second year income statement? a. $0. b. 45,000. c. $60,000. d. $120,000