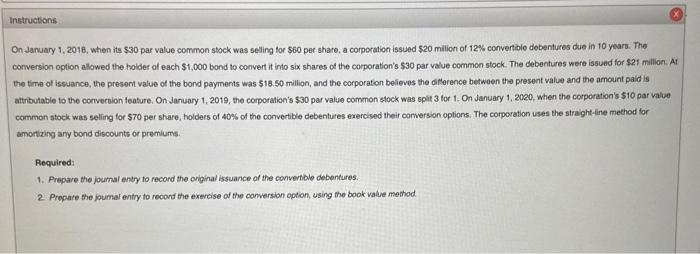

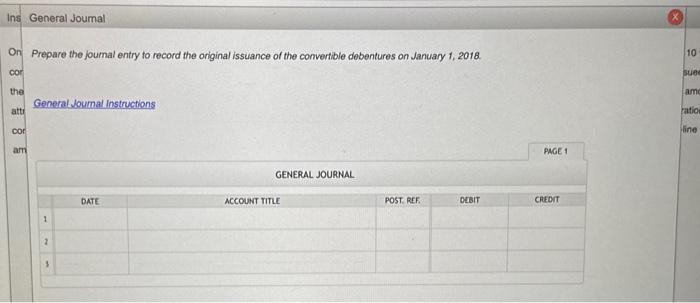

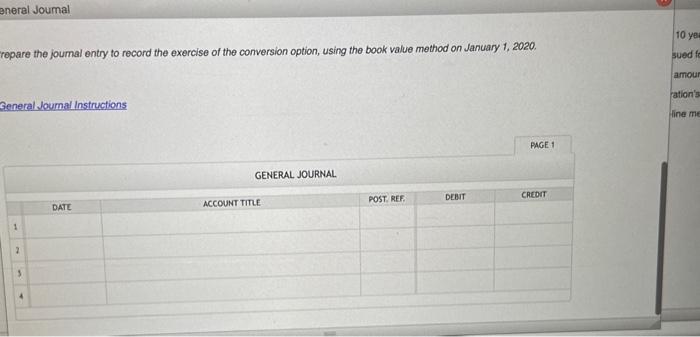

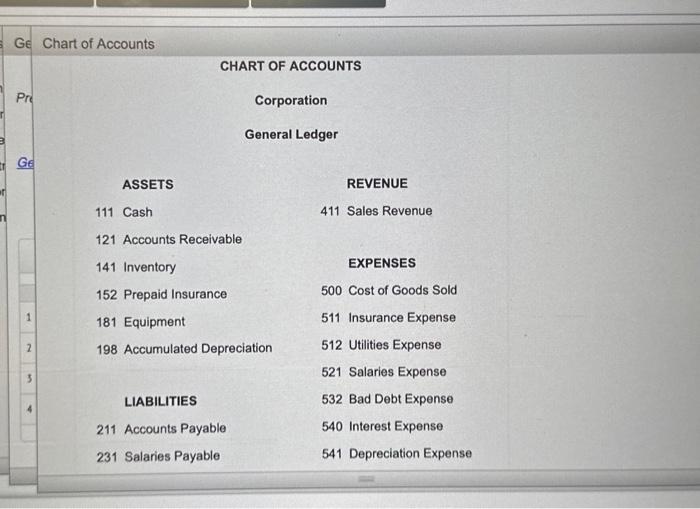

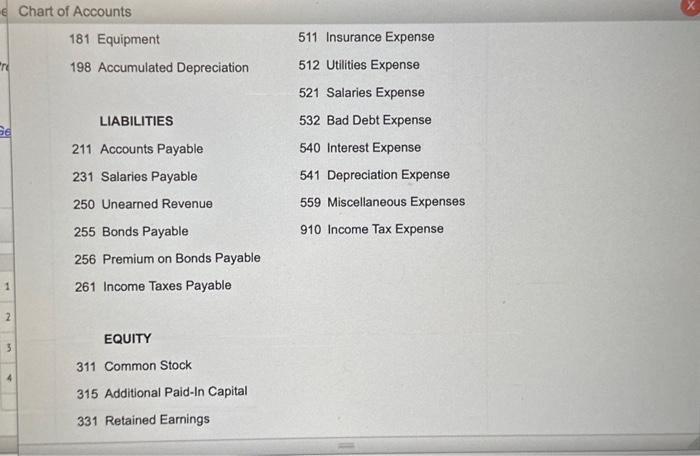

On Jaruary 1, 2018, when its $30 par value common stock was selling for $60 per share, a corporation issued $20 milion of 12% convertible debentures due in 10 years. The comversion option allowed the holder of each $1,000 bond to convert it into six shares of the corporation's $30 par value commen stock. The debentures were issued for $2 : million. At the time of issuance, the present value of the bond payments was $18.50 million, and the corporation believes the ditlerence between the present value and the amount paid is attributable to the conversion feature. On January 1, 2019, the corporation's $30 par value common stock was spit 3 for 1 . On January 1,2020 , when the corporation's $10 par value common stock was seling for $70 per share, holders of 40% of the convertible debentures exercised their comversion options. The corporation uses the straight-line method for amortizing any bond discounts or premlurs. Required 1. Prepare the joumal enty to record the original issuance of the convertible debentures. 2. Prepare the joumat entry to record the exereise of the canversion aption, using the book value method. Prepare the joumal entry to record the original issuance of the convertible debentures on January 1,2018. General boumal Instructions repare the joumal entry to record the exercise of the conversion option, using the book value method on January 1,2020. Reneral Joumal Instructions Ge Chart of Accounts CHART OF ACCOUNTS Pre Corporation General Ledger Ge ASSETS REVENUE 111 Cash 411 Sales Revenue 121 Accounts Receivable 141 Inventory EXPENSES 152 Prepaid Insurance 500 Cost of Goods Sold 1 181 Equipment 511 Insurance Expense 2 198 Accumulated Depreciation 512 Utilities Expense 3 521 Salaries Expense LIABILITIES 532 Bad Debt Expense 211 Accounts Payable 540 Interest Expense 231 Salaries Payable 541 Depreciation Expense Chart of Accounts 181 Equipment 511 Insurance Expense 198 Accumulated Depreciation 512 Utilities Expense 521 Salaries Expense LIABILITIES 532 Bad Debt Expense 211 Accounts Payable 540 Interest Expense 231 Salaries Payable 541 Depreciation Expense 250 Unearned Revenue 559 Miscellaneous Expenses 255 Bonds Payable 910 Income Tax Expense 256 Premium on Bonds Payable 261 Income Taxes Payable EQUITY 311 Common Stock 315 Additional Paid-In Capital 331 Retained Earnings