Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On July 1, 2012, Gilmore Ltd. purchased on account, factory equipment with an invoice price of $85,000. Other costs incurred were freight costs, $1,500; installation,

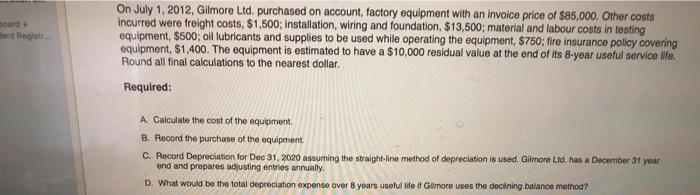

On July 1, 2012, Gilmore Ltd. purchased on account, factory equipment with an invoice price of $85,000. Other costs incurred were freight costs, $1,500; installation, wiring and foundation, $13,500; material and labour costs in testing equipment, $500; oil lubricants and supplies to be used while operating the equipment, $750: fire insurance policy covering equipment, $1,400. The equipment is estimated to have a $10,000 residual value at the end of its 8-year useful service Me. Round all final calculations to the nearest dollar. Required: A. Calculate the cost of the equipment, B. Record the purchase of the equipment. C. Record Depreciation for Dec 31, 2020 assuming the straight line method of depreciation is used. Gilmore Ltd. has a December 31 year end and prepares adjusting entries annually. D. What would be the total depreciation expense over 8 years useful life it Gilmore uses the declining balance method

On July 1, 2012, Gilmore Ltd. purchased on account, factory equipment with an invoice price of $85,000. Other costs incurred were freight costs, $1,500; installation, wiring and foundation, $13,500; material and labour costs in testing equipment, $500; oil lubricants and supplies to be used while operating the equipment, $750: fire insurance policy covering equipment, $1,400. The equipment is estimated to have a $10,000 residual value at the end of its 8-year useful service Me. Round all final calculations to the nearest dollar. Required: A. Calculate the cost of the equipment, B. Record the purchase of the equipment. C. Record Depreciation for Dec 31, 2020 assuming the straight line method of depreciation is used. Gilmore Ltd. has a December 31 year end and prepares adjusting entries annually. D. What would be the total depreciation expense over 8 years useful life it Gilmore uses the declining balance method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started