Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On July 1, 2016, Madeline Company leased a small building and its site to Paris Company on a five-year contract. The lease provides for

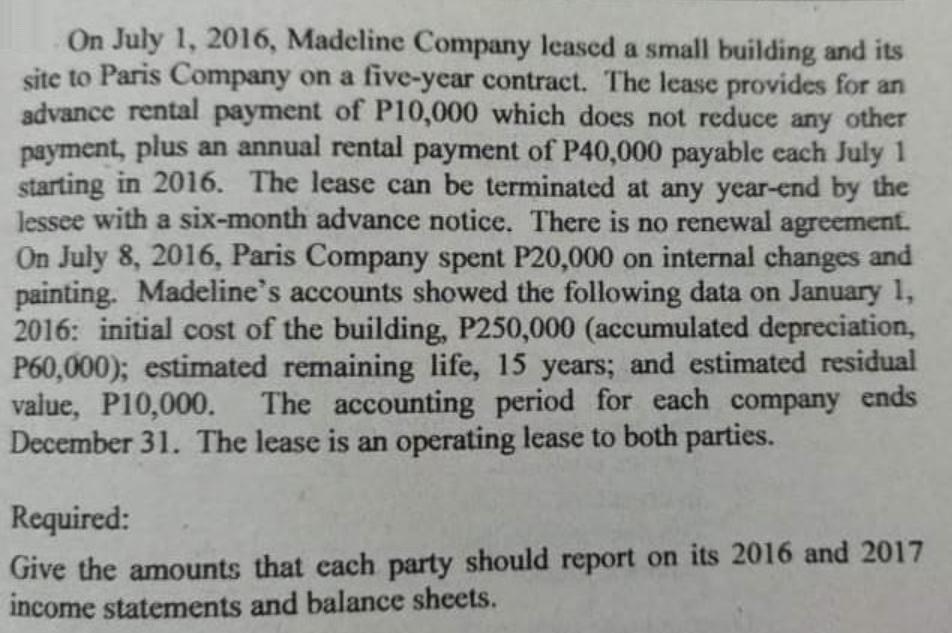

On July 1, 2016, Madeline Company leased a small building and its site to Paris Company on a five-year contract. The lease provides for an advance rental payment of P10,000 which does not reduce any other payment, plus an annual rental payment of P40,000 payable cach July 1 starting in 2016. The lease can be terminated at any year-end by the lessee with a six-month advance notice. There is no renewal agreement. On July 8, 2016, Paris Company spent P20,000 on internal changes and painting. Madeline's accounts showed the following data on January 1, 2016: initial cost of the building, P250,000 (accumulated depreciation, P60,000); estimated remaining life, 15 years; and estimated residual value, P10,000. December 31. The lease is an operating lease to both parties. The accounting period for each company ends Required: Give the amounts that cach party should report on its 2016 and 2017 income statements and balance sheets. On July 1, 2016, Madeline Company leased a small building and its site to Paris Company on a five-year contract. The lease provides for an advance rental payment of P10,000 which does not reduce any other payment, plus an annual rental payment of P40,000 payable cach July 1 starting in 2016. The lease can be terminated at any year-end by the lessee with a six-month advance notice. There is no renewal agreement. On July 8, 2016, Paris Company spent P20,000 on internal changes and painting. Madeline's accounts showed the following data on January 1, 2016: initial cost of the building, P250,000 (accumulated depreciation, P60,000); estimated remaining life, 15 years; and estimated residual value, P10,000. December 31. The lease is an operating lease to both parties. The accounting period for each company ends Required: Give the amounts that cach party should report on its 2016 and 2017 income statements and balance sheets. On July 1, 2016, Madeline Company leased a small building and its site to Paris Company on a five-year contract. The lease provides for an advance rental payment of P10,000 which does not reduce any other payment, plus an annual rental payment of P40,000 payable cach July 1 starting in 2016. The lease can be terminated at any year-end by the lessee with a six-month advance notice. There is no renewal agreement. On July 8, 2016, Paris Company spent P20,000 on internal changes and painting. Madeline's accounts showed the following data on January 1, 2016: initial cost of the building, P250,000 (accumulated depreciation, P60,000); estimated remaining life, 15 years; and estimated residual value, P10,000. December 31. The lease is an operating lease to both parties. The accounting period for each company ends Required: Give the amounts that cach party should report on its 2016 and 2017 income statements and balance sheets. On July 1, 2016, Madeline Company leased a small building and its site to Paris Company on a five-year contract. The lease provides for an advance rental payment of P10,000 which does not reduce any other payment, plus an annual rental payment of P40,000 payable cach July 1 starting in 2016. The lease can be terminated at any year-end by the lessee with a six-month advance notice. There is no renewal agreement. On July 8, 2016, Paris Company spent P20,000 on internal changes and painting. Madeline's accounts showed the following data on January 1, 2016: initial cost of the building, P250,000 (accumulated depreciation, P60,000); estimated remaining life, 15 years; and estimated residual value, P10,000. December 31. The lease is an operating lease to both parties. The accounting period for each company ends Required: Give the amounts that cach party should report on its 2016 and 2017 income statements and balance sheets. On July 1, 2016, Madeline Company leased a small building and its site to Paris Company on a five-year contract. The lease provides for an advance rental payment of P10,000 which does not reduce any other payment, plus an annual rental payment of P40,000 payable cach July 1 starting in 2016. The lease can be terminated at any year-end by the lessee with a six-month advance notice. There is no renewal agreement. On July 8, 2016, Paris Company spent P20,000 on internal changes and painting. Madeline's accounts showed the following data on January 1, 2016: initial cost of the building, P250,000 (accumulated depreciation, P60,000); estimated remaining life, 15 years; and estimated residual value, P10,000. December 31. The lease is an operating lease to both parties. The accounting period for each company ends Required: Give the amounts that cach party should report on its 2016 and 2017 income statements and balance sheets.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a BMlance sheer in the boolks of madeine o EXtract pauticulaes Equity u ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started