Answered step by step

Verified Expert Solution

Question

1 Approved Answer

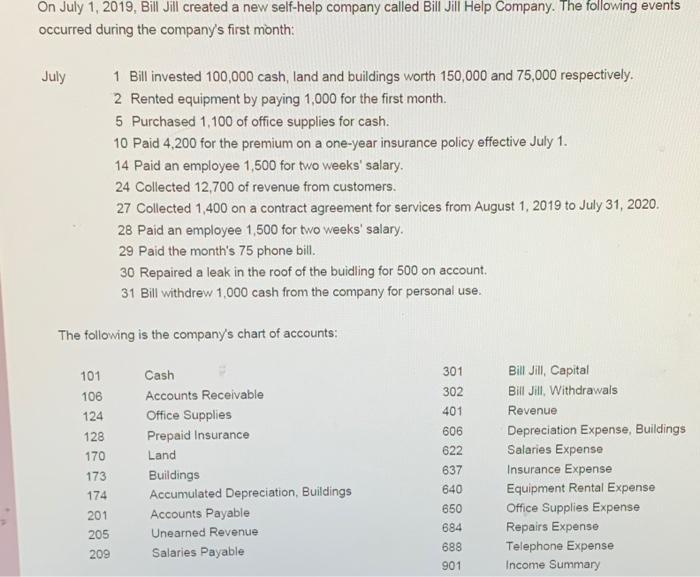

On July 1, 2019, Bill Jill created a new self-help company called Bill Jill Help Company. The following events occurred during the company's first

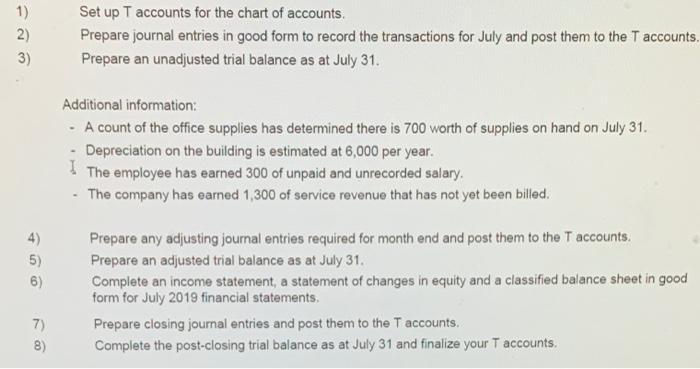

On July 1, 2019, Bill Jill created a new self-help company called Bill Jill Help Company. The following events occurred during the company's first month: July 1 Bill invested 100,000 cash, land and buildings worth 150,000 and 75,000 respectively. 2 Rented equipment by paying 1,000 for the first month. 5 Purchased 1,100 of office supplies for cash. 10 Paid 4,200 for the premium on a one-year insurance policy effective July 1. 14 Paid an employee 1,500 for two weeks' salary. 24 Collected 12,700 of revenue from customers. 27 Collected 1,400 on a contract agreement for services from August 1, 2019 to July 31, 2020. 28 Paid an employee 1,500 for two weeks' salary. 29 Paid the month's 75 phone bill. 30 Repaired a leak in the roof of the buidling for 500 on account. 31 Bill withdrew 1,000 cash from the company for personal use. The following is the company's chart of accounts: Bill Jill, Capital Bill Jill, Withdrawals 101 Cash 301 106 Accounts Receivable 302 401 Revenue 124 Office Supplies 128 Prepaid Insurance 606 Depreciation Expense, Buildings 622 Salaries Expense 170 Land 637 Insurance Expense 173 Buildings Accumulated Depreciation, Buildings 640 Equipment Rental Expense 174 650 Office Supplies Expense 201 Accounts Payable 684 Repairs Expense 205 Unearned Revenue 209 Salaries Payable 688 Telephone Expense 901 Income Summary 1) Set up T accounts for the chart of accounts. 2) Prepare journal entries in good form to record the transactions for July and post them to the T accounts. 3) Prepare an unadjusted trial balance as at July 31. Additional information: - A count of the office supplies has determined there is 700 worth of supplies on hand on July 31. - Depreciation on the building is estimated at 6,000 per year. I The employee has earned 300 of unpaid and unrecorded salary. The company has earned 1,300 of service revenue that has not yet been billed. 4) Prepare any adjusting journal entries required for month end and post them to the T accounts. 5) Prepare an adjusted trial balance as at July 31. Complete an income statement, a statement of changes in equity and a classified balance sheet in good form for July 2019 financial statements. 6) 7) Prepare closing journal entries and post them to the T accounts. 8) Complete the post-closing trial balance as at July 31 and finalize your T accounts.

Step by Step Solution

★★★★★

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 Journal Entries and Unadjusted Trial Balance 2 Adjusting Journal Entry and Adjusted Tr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started