Question

On July 1, 2019 Star Inc. issued a $756,000, 7%, five-year bond. Interest is to be paid annually. Assume Star Inc. has a year

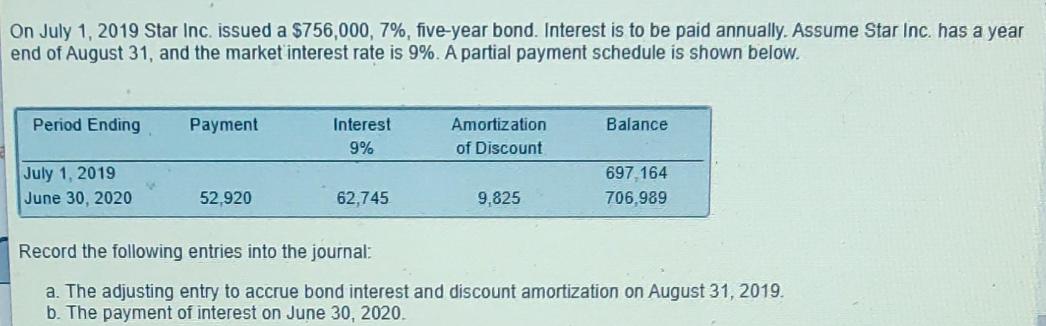

On July 1, 2019 Star Inc. issued a $756,000, 7%, five-year bond. Interest is to be paid annually. Assume Star Inc. has a year end of August 31, and the market interest rate is 9%. A partial payment schedule is shown below. Period Ending July 1, 2019 June 30, 2020 Payment 52,920 Interest 9% 62,745 Amortization of Discount 9,825 Balance 697,164 706,989 Record the following entries into the journal: a. The adjusting entry to accrue bond interest and discount amortization on August 31, 2019. b. The payment of interest on June 30, 2020.

Step by Step Solution

3.34 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

a The adjusting entry to accrue bond interest and discount amortization on August 31 2019 Since were given an annual interest rate of 9 and the face v...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Financial Accounting

Authors: Thomas Beechy, Umashanker Trivedi, Kenneth MacAulay

6th edition

013703038X, 978-0137030385

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App