Answered step by step

Verified Expert Solution

Question

1 Approved Answer

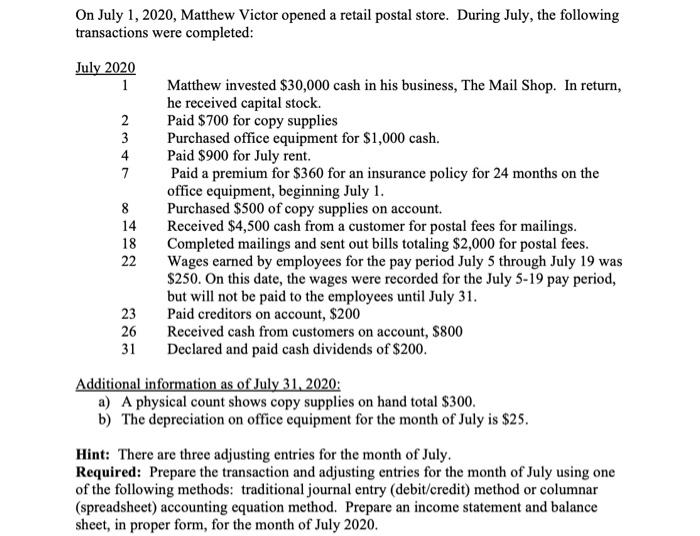

On July 1, 2020, Matthew Victor opened a retail postal store. During July, the following transactions were completed: July 2020 1 2 3 4 7

On July 1, 2020, Matthew Victor opened a retail postal store. During July, the following transactions were completed: July 2020 1 2 3 4 7 84 18 22 14 23 26 31 Matthew invested $30,000 cash in his business, The Mail Shop. In return, he received capital stock. Paid $700 for copy supplies Purchased office equipment for $1,000 cash. Paid $900 for July rent. Paid a premium for $360 for an insurance policy for 24 months on the office equipment, beginning July 1. Purchased $500 of copy supplies on account. Received $4,500 cash from a customer for postal fees for mailings. Completed mailings and sent out bills totaling $2,000 for postal fees. Wages earned by employees for the pay period July 5 through July 19 was $250. On this date, the wages were recorded for the July 5-19 pay period, but will not be paid to the employees until July 31. Paid creditors on account, $200 Received cash from customers on account, $800 Declared and paid cash dividends of $200. Additional information as of July 31, 2020: a) A physical count shows copy supplies on hand total $300. b) The depreciation on office equipment for the month of July is $25. Hint: There are three adjusting entries for the month of July. Required: Prepare the transaction and adjusting entries for the month of July using one of the following methods: traditional journal entry (debit/credit) method or columnar (spreadsheet) accounting equation method. Prepare an income statement and balance sheet, in proper form, for the month of July 2020.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started