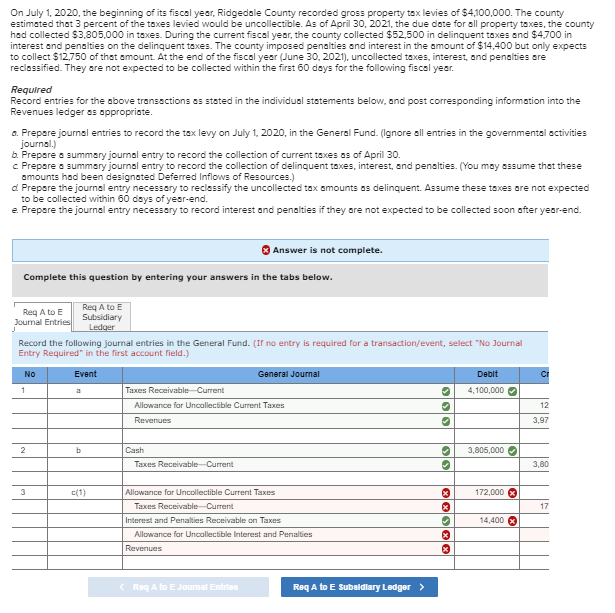

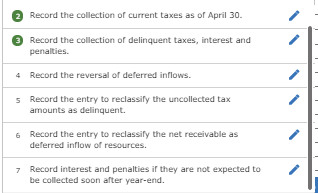

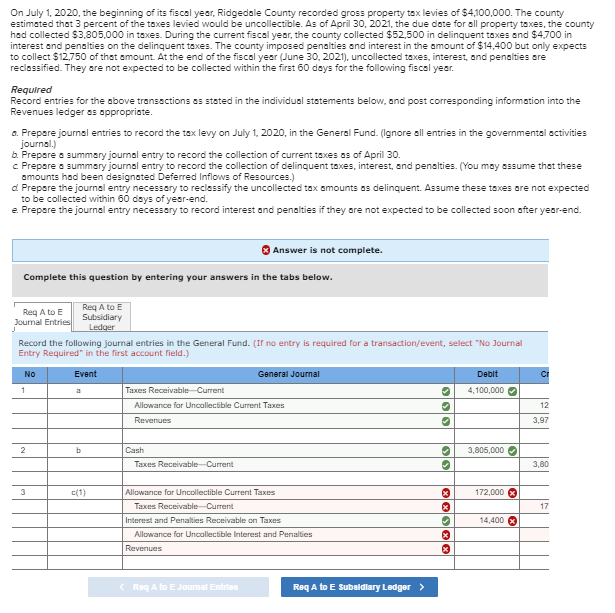

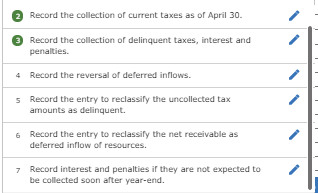

On July 1, 2020, the beginning of its fiscal year, Ridgedale County recorded gross property tax levies of $4,100,000. The county estimated that 3 percent of the taxes levied would be uncollectible. As of April 30, 2021, the due dste for all property taxes, the county had collected S3,805,000 in taxes. During the current fscal yeer, the county collected $52,500 in delinquent taxes and $4,700 in interest and penalties on the delinquent taxes. The county imposed penalties and interest in the amount of $14,400 but only expects to collect $12,750 of that amount. At the end of the fiscal yesr (June 30, 2021), uncollected taxes, interest, and penalties are reclassified. They are not expected to be collected within the first 60 days for the following fiscal year. Required Record entries for the above transsctions as ststed in the individual ststements below, and post corresponding information into the a. Prepare journal entries to record the tax levy on July 1, 2020, in the General Fund. (Ignore all entries in the governmental activities journal.) b. Prepsre a summary journal entry to record the collection of current taxes as of April 30. c Prepare a summsry journal entry to record the collection of delinquent taxes, interest, and penalties. (You may assume that these amounts had been designated Deferred Inflows of Resources.) d Prepare the journal entry necessary to reclassify the uncollected tax amounts as delinquent. Assume these tsxes are not expected to be collected within 60 dsys of yesr-end. e. Prepare the journal entry necessary to record interest and penalties if they are not expected to be collected soon after year-end. Answer is not complete. Complete this question by entering your answers in the tabs below. to Req A to E ournal Subsidiary Record the following journal entries in the General Fund. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) 4,100,000 Alowance for Uncallectble Current Taxes 12 3,97 Cash 3,805,000 Taxes Receivable-Current 3,80 Allowance for Uncollectible Current Taxes 172,000 Taxes ReceivableCurrent Interest and Penalties Receivable on Taxes 14,400 Alowance for Uncallectble Interest and Penalties Revenues Req A to E Journal Entries Req A to E Subsidlary Ledger >