Answered step by step

Verified Expert Solution

Question

1 Approved Answer

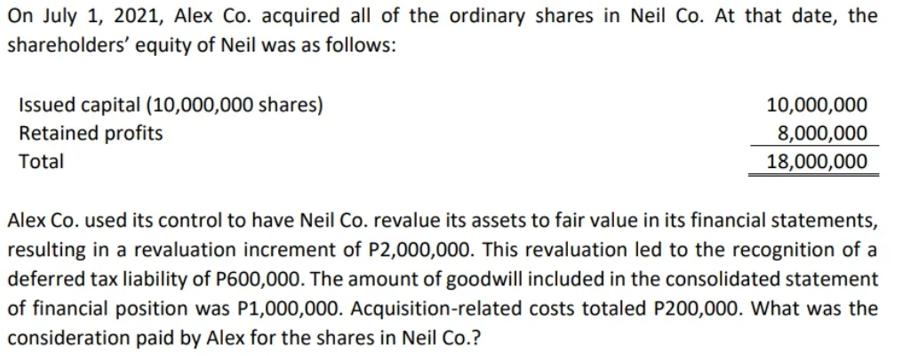

On July 1, 2021, Alex Co. acquired all of the ordinary shares in Neil Co. At that date, the shareholders' equity of Neil was

On July 1, 2021, Alex Co. acquired all of the ordinary shares in Neil Co. At that date, the shareholders' equity of Neil was as follows: Issued capital (10,000,000 shares) Retained profits Total 10,000,000 8,000,000 18,000,000 Alex Co. used its control to have Neil Co. revalue its assets to fair value in its financial statements, resulting in a revaluation increment of P2,000,000. This revaluation led to the recognition of a deferred tax liability of P600,000. The amount of goodwill included in the consolidated statement of financial position was P1,000,000. Acquisition-related costs totaled P200,000. What was the consideration paid by Alex for the shares in Neil Co.?

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

We can calculate the consideration paid by Alex Co for the shares in Neil Co by adding up the fair v...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started