Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On July 1, 2026, Fontaine Company purchased for cash 40% of the outstanding common stock of Knoblett Company. Both Fontaine Company and Knoblett Company have

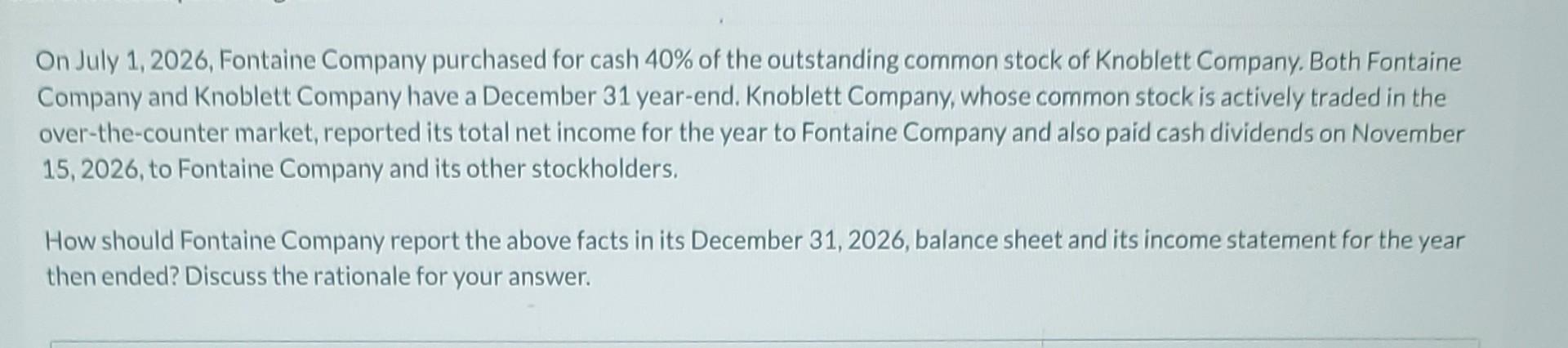

On July 1, 2026, Fontaine Company purchased for cash 40% of the outstanding common stock of Knoblett Company. Both Fontaine Company and Knoblett Company have a December 31 year-end. Knoblett Company, whose common stock is actively traded in the over-the-counter market, reported its total net income for the year to Fontaine Company and also paid cash dividends on November 15,2026 , to Fontaine Company and its other stockholders. How should Fontaine Company report the above facts in its December 31, 2026, balance sheet and its income statement for the year then ended? Discuss the rationale for your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started