Question

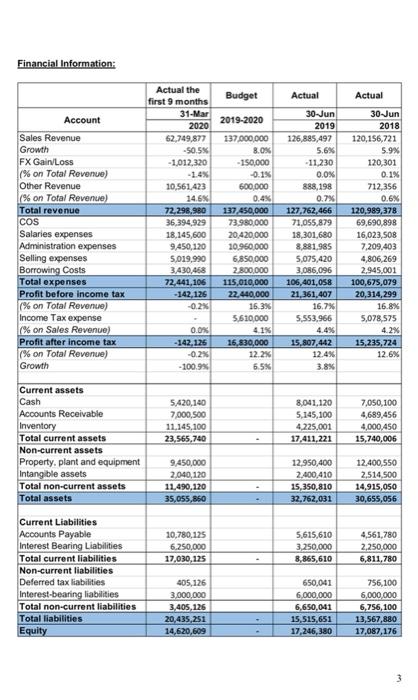

Part B - Report Background CurtainsMaster is a large proprietary company established in North Queensland in the 1990s, selling a wide range of high-quality fabric

Part B - Report

Background

CurtainsMaster is a large proprietary company established in North Queensland in the

1990s, selling a wide range of high-quality fabric curtains for household decoration. The

company purchases products from manufactures in Vietnam, Bangladesh, and China, and

then sells its products to wholesales customers in Australia, Germany, and the United

States. The company also places its products on consignment in various small retail stores

in Queensland. Sales mainly peak from the second half of the financial year, generating an

average of 60% of revenue for the whole year. In past years the company has performed

well, with its profit rate at around 12% and an average increase in annual revenues of 5%.

In the last two years, the company has extended its marketing from Germany to other

countries in Europe. As a result of this, in the budget for the year 2019-2020, the company

while aiming to maintain its profit rate, plans to increase its revenues by 8%. The company

uses USD to pay its suppliers and EUR or USD or AUD in its dealings with customers.

While the business is expanding in Europe, sales in Australia and US are struggling to reach

their targets. These markets are quite competitive, providing more affordable products with a

large range of designs and choices. Further, in recent years, countries like Vietnam and

China have become more eco-conscious, attempting to reduce their industrial impact on the

environment. As such, textile manufacturing has been discouraged with strict regulations.

Some of CurtainsMaster's suppliers have reduced their production capacity and have

experienced an increase in production costs.

Managing inventory on consignment has been an issue for CurtainsMaster in the past 12

months. On several occasions, the company lost track of their inventory movements and

status at the various retail premises. To support the business expansion and strengthen

internal controls for inventory, in January 2020 the company installed a new inventory

management system on the cloud, which allows inventory movements to be followed up,

from production to end-users. The system will also help to follow up and calculate inventory

ageing from the day the inventory was entered into the system. In the past five years, old

and work-in-progress inventory has piled up due to new designs, orders cancelled by

customers, or specification problems. When the new system was implemented these stock

items, together with others, were entered into the system as the beginning balance for the

inventorv.

Since January 2020, CurtainsMaster has also experienced significant impact due to the

COVID-19 pandemic. Approximately 50% of customer orders due to be delivered in May,

June and July have been cancelled. Payments from customers have been delayed as they

have also been impacted by the situation. Since the middle of February the company's sales

at small retail stores have decreased dramatically, by approximately 70%. From the middle

of March, 60% of staff (both casual and full-time) were made redundant. For the last three

months of the current financial year, the company is expecting to have no sales but still pay

another 10% of the current total expenses. To minimise the impact of a tight cashflow, in

February, when the financial market was peak, the company sold all its financial investments

and generated some extra cash for the business before the market dived in March.

However, things can get worse; there is much uncertainty and no clear indication of when

the pandemic will end.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started