Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On July 10, 2012, you purchase a $10,000 par T-note that matures in five years. The settlement occurs on July 11, 2019. The coupon rate

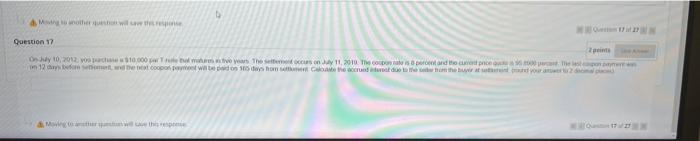

On July 10, 2012, you purchase a $10,000 par T-note that matures in five years. The settlement occurs on July 11, 2019. The coupon rate is 8 percent and the current price quote is 95.8986 percent. The last coupon payment was on 12 days before settlement, and the next coupon payment will be paid on 165 days from settlement. Calculate the accrued interest due to the seller from the buyer at settlement (round your answer to 2 decimal places)

D & Moing to another question will save the response Question 17 2 points On Jay 10, 2012 you parchase a $10,000 per Tree that mature tive years. The settement occurs on July 11, 2010. The coupon nate is 0 percent and the current price que 55 000 per The last pon paren on 12 days before seement, and the next coupon payment will be paid on 100 days hom sefument Calouate the accrued aturat duo to the ser from the buyer at sort your answert2 dal pa D & Moing to another question will save the response Question 17 2 points On Jay 10, 2012 you parchase a $10,000 per Tree that mature tive years. The settement occurs on July 11, 2010. The coupon nate is 0 percent and the current price que 55 000 per The last pon paren on 12 days before seement, and the next coupon payment will be paid on 100 days hom sefument Calouate the accrued aturat duo to the ser from the buyer at sort your answert2 dal pa Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started