Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On July 1st of this year, Hodge Co. enters into a contract to provide services to Howard University (HU). The contract is expected to last

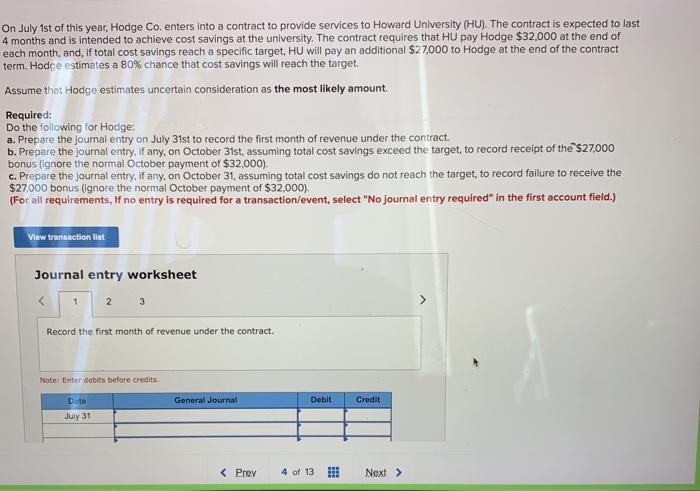

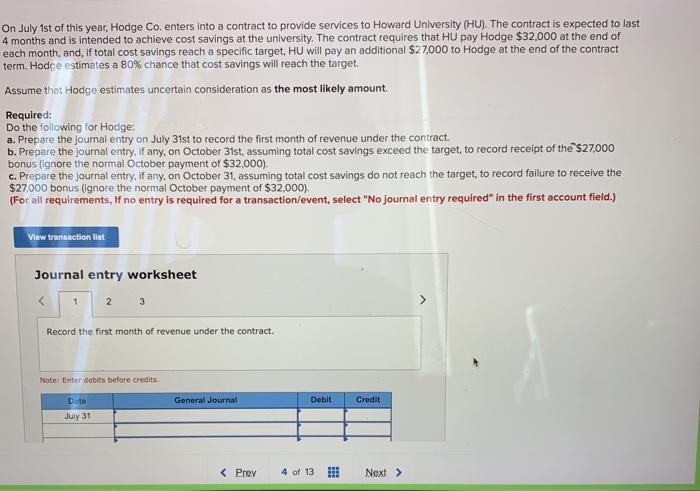

On July 1st of this year, Hodge Co. enters into a contract to provide services to Howard University (HU). The contract is expected to last 4 months and is intended to achieve cost savings at the university. The contract requires that HU pay Hodge $32,000 at the end of each month, and, if total cost savings reach a specific target, HU will pay an additional $27,000 to Hodge at the end of the contract term. Hodge estimates a 80% chance that cost savings will reach the target. Assume that Hodge estimates uncertain consideration as the most likely amount Required: Do the following for Hodge: a. Prepare the journal entry on July 31st to record the first month of revenue under the contract. b. Prepare the journal entry, if any, on October 31st, assuming total cost savings exceed the target, to record receipt of the $27,000 bonus [ignore the normal October payment of $32,000). c. Prepare the journal entry, if any, on October 31, assuming total cost savings do not reach the target to record fallure to receive the $27,000 bonus (ignore the normal October payment of $32,000). (For all requirements, If no entry is required for a transaction/event, select "No journal entry required" In the first account field.) View transaction list Journal entry worksheet

On July 1st of this year, Hodge Co. enters into a contract to provide services to Howard University (HU). The contract is expected to last 4 months and is intended to achieve cost savings at the university. The contract requires that HU pay Hodge $32,000 at the end of each month, and, if total cost savings reach a specific target, HU will pay an additional $27,000 to Hodge at the end of the contract term. Hodge estimates a 80% chance that cost savings will reach the target. Assume that Hodge estimates uncertain consideration as the most likely amount Required: Do the following for Hodge: a. Prepare the journal entry on July 31st to record the first month of revenue under the contract. b. Prepare the journal entry, if any, on October 31st, assuming total cost savings exceed the target, to record receipt of the $27,000 bonus [ignore the normal October payment of $32,000). c. Prepare the journal entry, if any, on October 31, assuming total cost savings do not reach the target to record fallure to receive the $27,000 bonus (ignore the normal October payment of $32,000). (For all requirements, If no entry is required for a transaction/event, select "No journal entry required" In the first account field.) View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started