Answered step by step

Verified Expert Solution

Question

1 Approved Answer

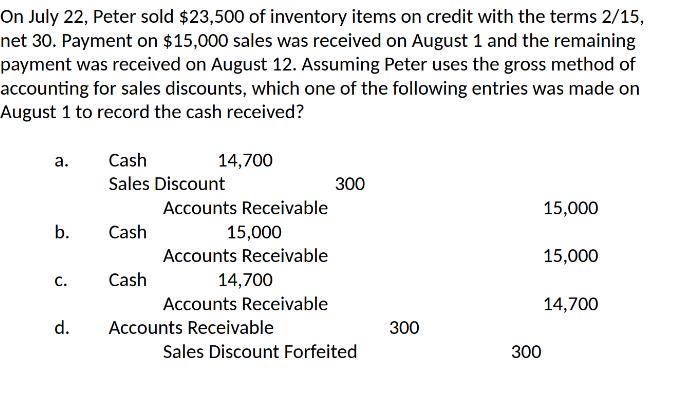

On July 22, Peter sold $23,500 of inventory items on credit with the terms 2/15, net 30. Payment on $15,000 sales was received on

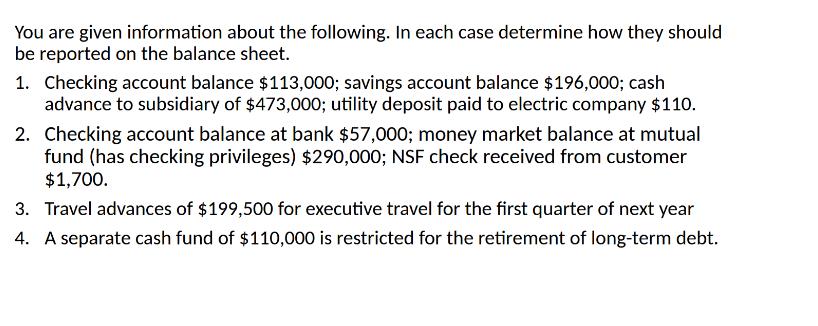

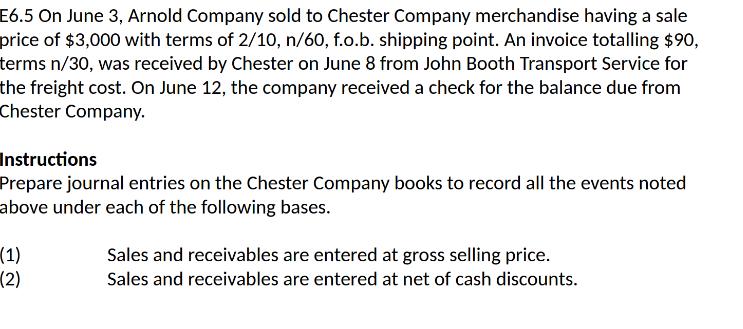

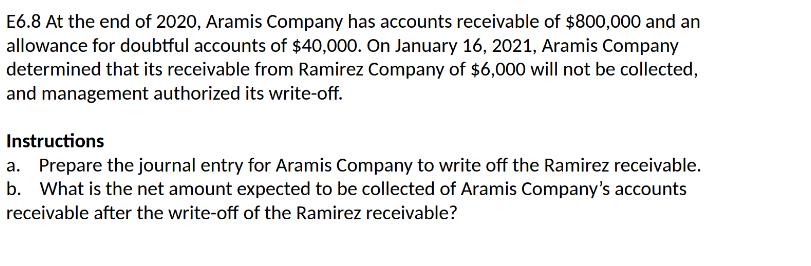

On July 22, Peter sold $23,500 of inventory items on credit with the terms 2/15, net 30. Payment on $15,000 sales was received on August 1 and the remaining payment was received on August 12. Assuming Peter uses the gross method of accounting for sales discounts, which one of the following entries was made on August 1 to record the cash received? a. b. C. d. Cash Sales Discount Cash 14,700 Cash Accounts Receivable 15,000 Accounts Receivable 14,700 Accounts Receivable Accounts Receivable 300 Sales Discount Forfeited 300 300 15,000 15,000 14,700 You are given information about the following. In each case determine how they should be reported on the balance sheet. 1. Checking account balance $113,000; savings account balance $196,000; cash advance to subsidiary of $473,000; utility deposit paid to electric company $110. 2. Checking account balance at bank $57,000; money market balance at mutual fund (has checking privileges) $290,000; NSF check received from customer $1,700. 3. Travel advances of $199,500 for executive travel for the first quarter of next year 4. A separate cash fund of $110,000 is restricted for the retirement of long-term debt. E6.5 On June 3, Arnold Company sold to Chester Company merchandise having a sale price of $3,000 with terms of 2/10, n/60, f.o.b. shipping point. An invoice totalling $90, terms n/30, was received by Chester on June 8 from John Booth Transport Service for the freight cost. On June 12, the company received a check for the balance due from Chester Company. Instructions Prepare journal entries on the Chester Company books to record all the events noted above under each of the following bases. (1) (2) Sales and receivables are entered at gross selling price. Sales and receivables are entered at net of cash discounts. E6.8 At the end of 2020, Aramis Company has accounts receivable of $800,000 and an allowance for doubtful accounts of $40,000. On January 16, 2021, Aramis Company determined that its receivable from Ramirez Company of $6,000 will not be collected, and management authorized its write-off. Instructions a. Prepare the journal entry for Aramis Company to write off the Ramirez receivable. b. What is the net amount expected to be collected of Aramis Company's accounts receivable after the write-off of the Ramirez receivable?

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Lets go through each question and provide the answers Question 1 On July 22 Peter sold 23500 of inventory items on credit with the terms 215 net 30 Pa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started