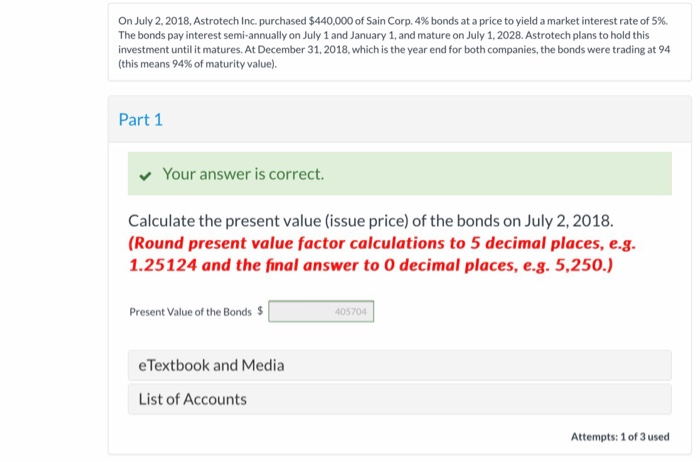

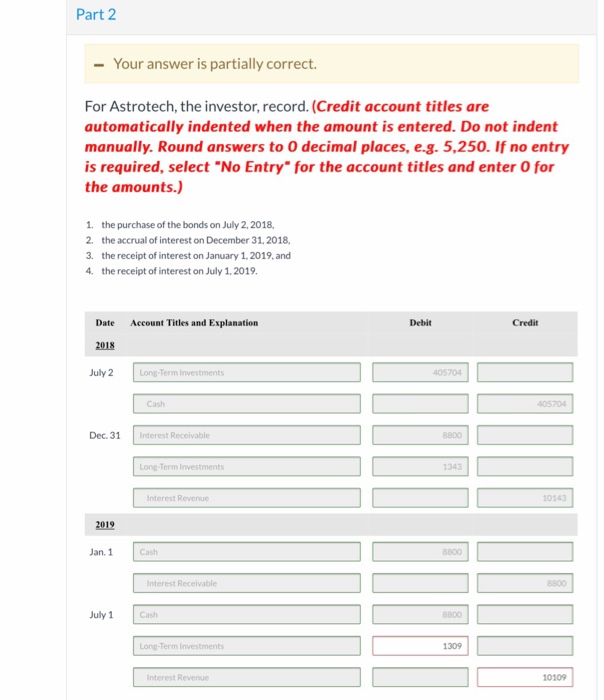

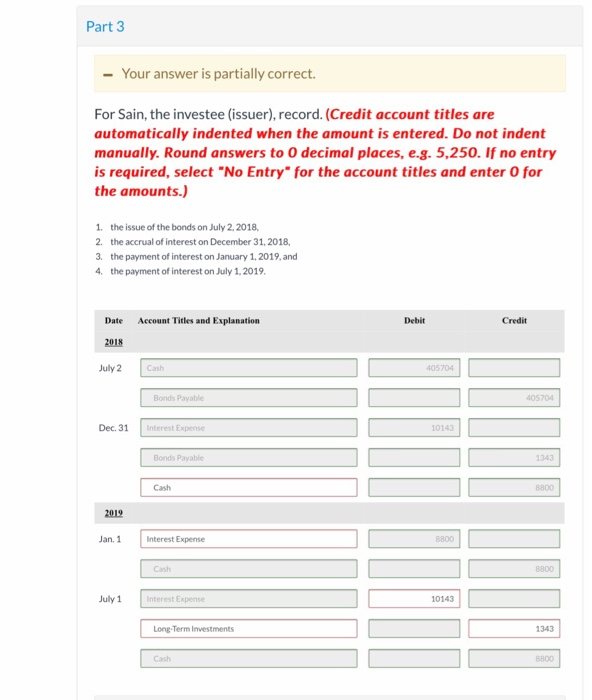

On July 2,2018, Astrotech Inc. purchased $440,000 of Sain Corp. 4 % bonds at a price to yield a market interest rate of 5%. The bonds pay interest semi-annually on July 1 and January 1, and mature on July 1, 2028. Astrotech plans to hold this investment until it matures. At December 31, 2018, which is the year end for both companies, the bonds were trading at 94 (this means 94% of maturity value). Part 1 Your answer is correct. Calculate the present value (issue price) of the bonds on July 2, 2018. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to 0 decimal places, e.g. 5,250.) 405704 Present Value of the Bonds $ e Textbook and Media List of Accounts Attempts: 1 of 3 used Part 2 Your answer is partially correct. For Astrotech, the investor, record. (Credit account titles are automatically inden ted when the amount is entered. Do not indent manually. Round answers to 0 decimal places, e.g. 5,250. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) 1. the purchase of the bonds on July 2, 2018, 2. the accrual of interest on December 31, 2018, 3. the receipt of interest on January 1, 2019, and 4. the receipt of interest on July 1, 2019. Date Account Titles and Explanation Debit Credit 2018 July 2 Long-Term Investments 405704 405704 Cash Dec. 31 Interest Receivable 8800 Long-Term Investments 1343 Interest Revenues 10143 2019 Jan. 1 8800 Cash Interest Receivable July 1 Cash 8800 Long-Term Investments 1309 Interest Revenue 10109 Part 3 - Your answer is partially correct For Sain, the investee (issuer), record. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round answers to 0 decimal places, e.g. 5,250. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) the issue of the bonds on July 2, 2018 1. the accrual of interest on December 31, 2018, 2. 3. the payment of interest on January 1, 2019, and the payment of interest on July 1,2019. 4. Date Account Titles and Explanation Debit Credit 2018 July 2 Cash 405704 Bonds Payable 405704 Dec. 31 Interest Expense 10143 1343 Bonds Payable 8800 Cash 2019 Jan. 1 Interest Expense 8800 Cash 8800 July 1 Interest Expense 10143 1343 Long-Term Imvestments Cash 8800 List of Accounts Accumulated Other Comprehensive Income Accumulated Other Comprehensive Loss Bonds Payable Cash Dividends Receivable Dividend Revenue Held for Trading Investments Income from Associates Interest Expense Interest Payable Interest Receivable Interest Revenue Investment in Associates Long-Term Investments Loss on Bond Redemption No Entry Realized Gain on Held for Trading Investments Realized Gain on Long-Term Investments Realized Loss on Held for Trading Investments Realized Loss on Investment in Associates Realized Gain on Trading Investments Realized Loss on Trading Investments Trading Investments Unrealized Gain on Held for Trading Investments Unrealized Gain on Long-Term Investments Unrealized Loss on Held for Trading Investments Unrealized Loss on Long-Term Investments Unrealized Gain on Trading Investments Unrealized Loss on Trading Investments