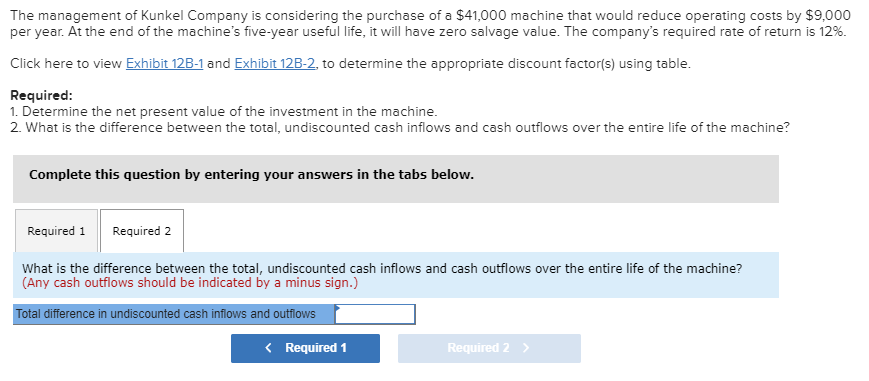

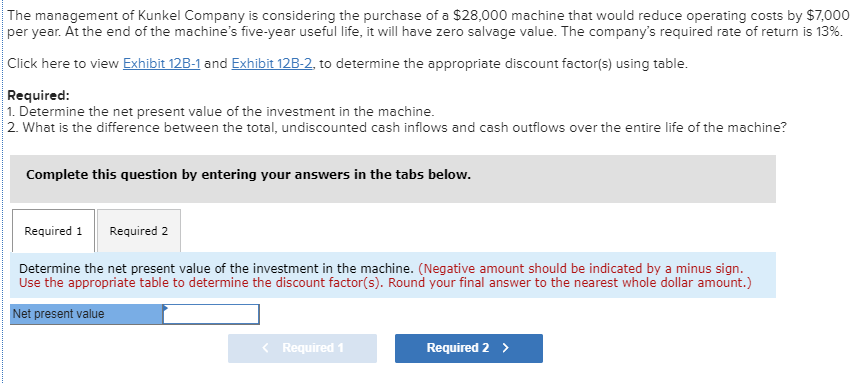

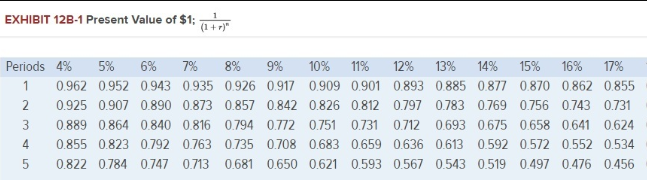

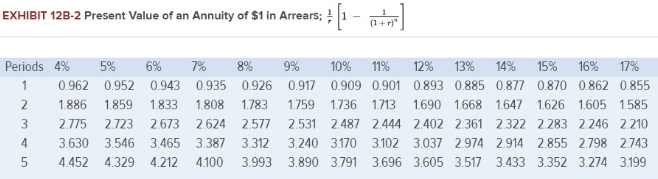

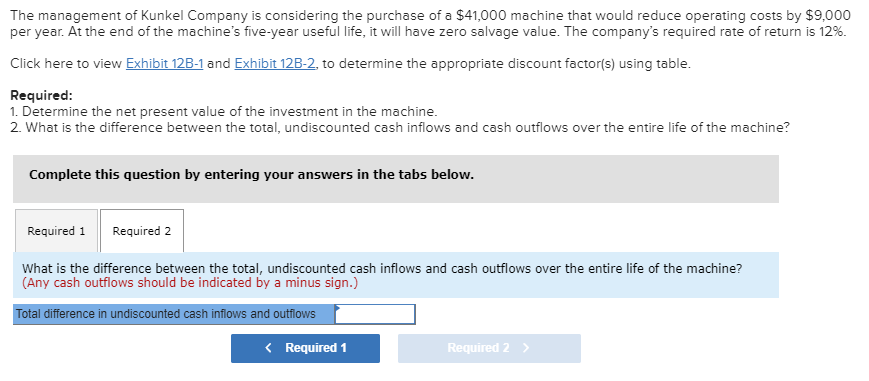

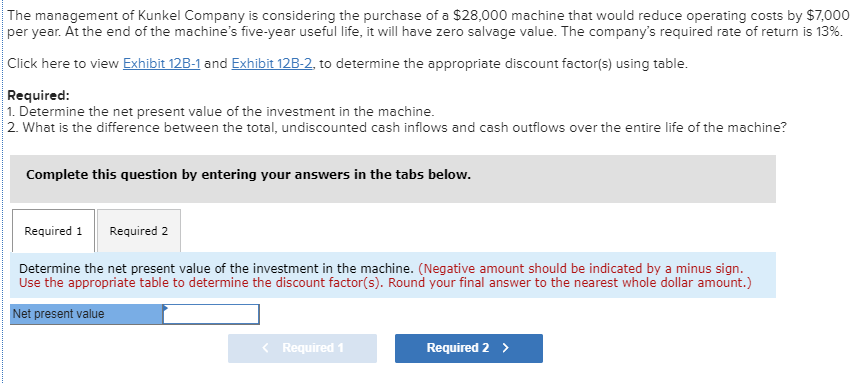

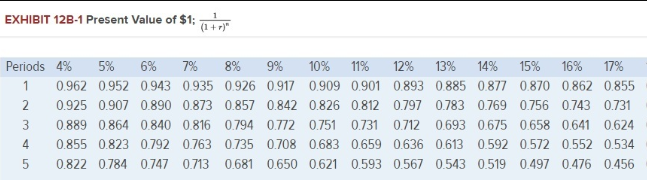

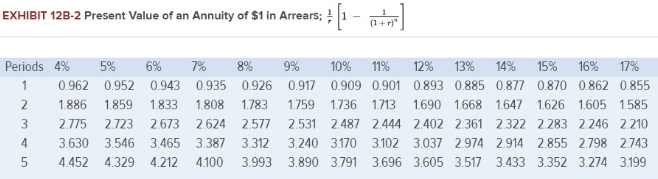

The management of Kunkel Company is considering the purchase of a $41,000 machine that would reduce operating costs by $9,000 per year. At the end of the machine's five-year useful life, it will have zero salvage value. The company's required rate of return is 12%. Click here to view Exhibit 12B1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using table. Required: 1. Determine the net present value of the investment in the machine. 2. What is the difference between the total, undiscounted cash inflows and cash outflows over the entire life of the machine? Complete this question by entering your answers in the tabs below. Required 1 Required 2 What is the difference between the total, undiscounted cash inflows and cash outflows over the entire life of the machine? (Any cash outflows should be indicated by a minus sign.) Total difference in undiscounted cash inflows and outflows The management of Kunkel Company is considering the purchase of a $28,000 machine that would reduce operating costs by $7,000 per year. At the end of the machine's five-year useful life, it will have zero salvage value. The company's required rate of return is 13%. Click here to view Exhibit 12B1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using table. Required: 1. Determine the net present value of the investment in the machine. 2. What is the difference between the total, undiscounted cash inflows and cash outflows over the entire life of the machine? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the net present value of the investment in the machine. (Negative amount should be indicated by a minus sign. Use the appropriate table to determine the discount factor(s). Round your final answer to the nearest whole dollar amount.) Net present value EXHIBIT 12B-1 Present Value of $1: 17 Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 1 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 2 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.812 0.797 0.783 0.769 0.756 0.743 0.731 3 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.731 0.712 0.693 0.675 0.658 0.641 0.624 4 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 0.613 0.592 0.572 0.552 0.534 5 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 0.543 0.519 0.497 0.476 0.456 EXHIBIT 128-2 Present Value of an Annuity of S1 in Arrears; 4 1 - utol Periods 4% 1 0.962 2 1886 3 2.775 4 3.630 5 4.452 5% 6% 0.952 0.943 1.859 1.833 2.723 2673 3.546 3.465 4.329 4.212 7% 0.935 1.808 2.624 3.387 4.100 8% 0.926 1.783 2.577 3.312 3.993 9% 10% 11% 12% 13% 14% 15% 16% 17% 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 1759 1736 1.713 1.690 1.668 1647 1626 1.605 1585 2.531 2.487 2444 2.402 2361 2.322 2283 2246 2210 3.240 3.170 3102 3.037 2.974 2.914 2.855 2.798 2743 3.890 3.791 3.696 3.605 3.517 3.433 3.352 3.274 3.199