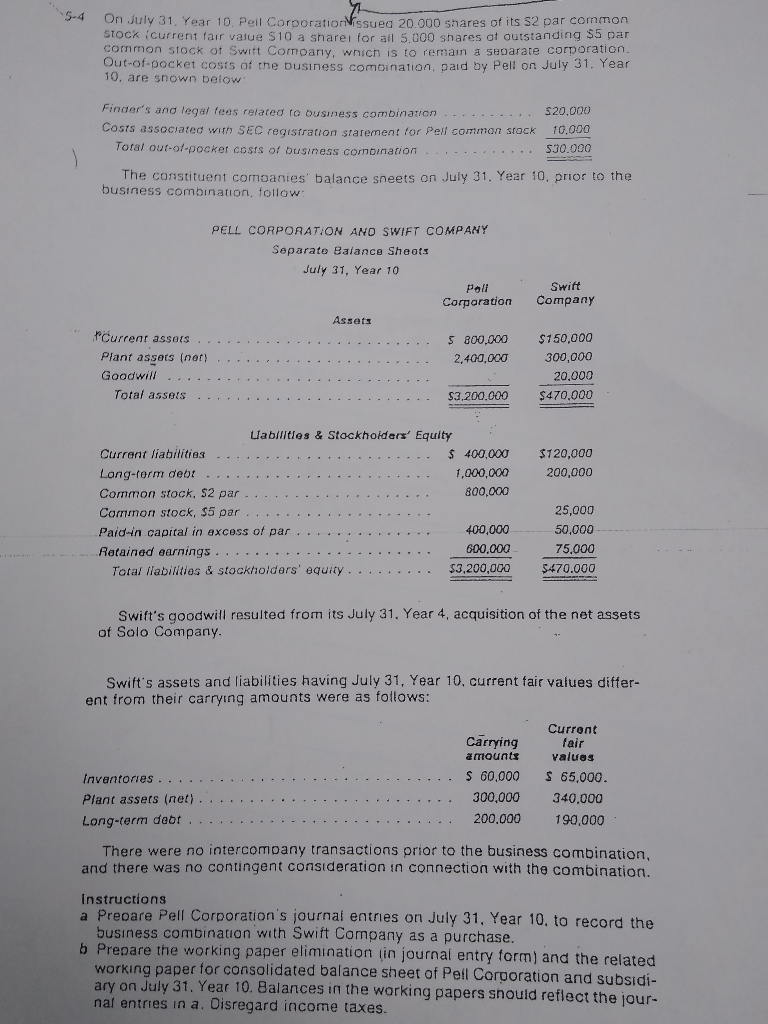

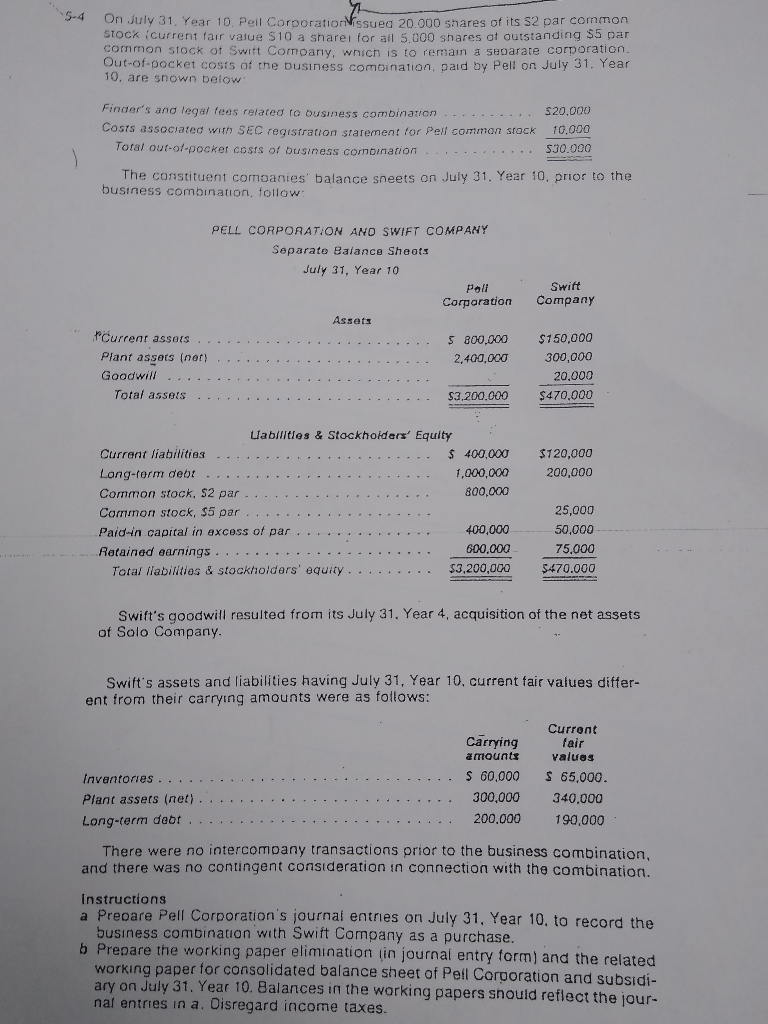

On July 31. Year 10. Pell Corporation issued 20.000 shares of its s2 par common STOCK current fair value $10 a share for all 5 000 shares of outstanding $5 par common stock of Swift Company, which is to remain a separate corporation. Out-of-pocket Cosis of the business combination, paid by Pell on July 31. Year 10. are shown below Anders and legal fees relared to business combination.. . Cosis associated with SEC registration starement for Pell common stock Toral out-of-pocker costs of business combination 20.00 10,000 SJU. The constituent companies' balance sheets on July 31. Year 10. prior to the business combination follow Swift Company PELL CORPORATION AND SWIFT COMPANY Separate Balance Sheets July 31, Year 10 Poli Corporation Assets Current assets ....... ......... S 800.000 Plant assets (non) ...... 2.400.000 Goodwill .................. Total assets ..... $3,200,000 $150,000 300,000 20.000 $470,000 $120,000 200,000 Uabilities & Stockholders' Equity Current liabilities ... ....... $ 400,000 Long-form debi ............... 1,000,000 Common stock, $2 par .......... 800.000 Cominon stock, $5 par.......... Paid-in capital in excess of par .............. 400,000 Retained earnings ............... 600,000 Total llabilities & stockholders' equity ......... $3,200,000 25,000 50,000 75.000 $470.000 Swift's goodwill resulted from its July 31. Year 4, acquisition of the net assets of Solo Company Swift's assets and liabilities having July 31, Year 10, current fair values differ- ent from their carrying amounts were as follows: Inventories ........... Plant assers (net) ............ Long-term daot Carrying amounts $ 60,000 300,000 200.000 Current fair values $ 65,000. 340,000 190.000 ... There were no intercompany transactions prior to the business combination and there was no contingent consideration in connection with the combination. Instructions a Prepare Pell Corporation's journal entries on July 31, Year 10. to record the business combination with Swift Company as a purchase. b Prepare the working paper elimination in journal entry form) and the related working paper for consolidated balance sheet of Pell Corcoration and subsidi- ary on July 31. Year 10. Balances in the working papers should reflect the jour- nal entries in a. Oisregard income taxes. On July 31. Year 10. Pell Corporation issued 20.000 shares of its s2 par common STOCK current fair value $10 a share for all 5 000 shares of outstanding $5 par common stock of Swift Company, which is to remain a separate corporation. Out-of-pocket Cosis of the business combination, paid by Pell on July 31. Year 10. are shown below Anders and legal fees relared to business combination.. . Cosis associated with SEC registration starement for Pell common stock Toral out-of-pocker costs of business combination 20.00 10,000 SJU. The constituent companies' balance sheets on July 31. Year 10. prior to the business combination follow Swift Company PELL CORPORATION AND SWIFT COMPANY Separate Balance Sheets July 31, Year 10 Poli Corporation Assets Current assets ....... ......... S 800.000 Plant assets (non) ...... 2.400.000 Goodwill .................. Total assets ..... $3,200,000 $150,000 300,000 20.000 $470,000 $120,000 200,000 Uabilities & Stockholders' Equity Current liabilities ... ....... $ 400,000 Long-form debi ............... 1,000,000 Common stock, $2 par .......... 800.000 Cominon stock, $5 par.......... Paid-in capital in excess of par .............. 400,000 Retained earnings ............... 600,000 Total llabilities & stockholders' equity ......... $3,200,000 25,000 50,000 75.000 $470.000 Swift's goodwill resulted from its July 31. Year 4, acquisition of the net assets of Solo Company Swift's assets and liabilities having July 31, Year 10, current fair values differ- ent from their carrying amounts were as follows: Inventories ........... Plant assers (net) ............ Long-term daot Carrying amounts $ 60,000 300,000 200.000 Current fair values $ 65,000. 340,000 190.000 ... There were no intercompany transactions prior to the business combination and there was no contingent consideration in connection with the combination. Instructions a Prepare Pell Corporation's journal entries on July 31, Year 10. to record the business combination with Swift Company as a purchase. b Prepare the working paper elimination in journal entry form) and the related working paper for consolidated balance sheet of Pell Corcoration and subsidi- ary on July 31. Year 10. Balances in the working papers should reflect the jour- nal entries in a. Oisregard income taxes