Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On July 6, 2018, Ryan Limited purchased equipment for $30,000 cash. Ryan's accounting year- end is December 31. At the time of acquisition, the

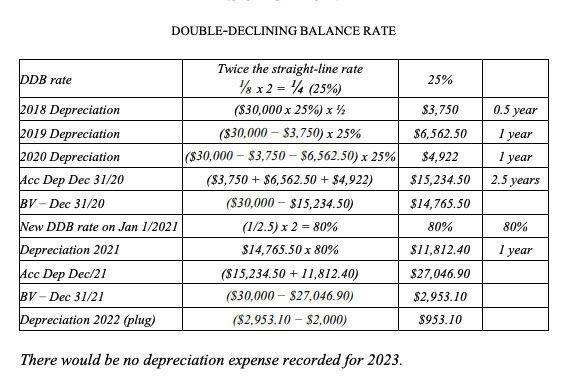

On July 6, 2018, Ryan Limited purchased equipment for $30,000 cash. Ryan's accounting year- end is December 31. At the time of acquisition, the equipment was expected to last 8 years with an estimated residual value of $1,200. Ryan used the straight-line method to depreciate the equipment. On January 1, 2021, Ryan changed the total estimated useful life of the equipment from 8 years to 5 years and the estimated residual value was increased from $1,200 to $2,000. Ryan's depreciation policy is to calculate depreciation to the nearest full month. Required: (a) Calculate depreciation expense for 2018, 2019, 2020, 2021, 2022, and 2023 using the straight-line method. (b) Calculate depreciation expense using the double-declining balance method. DDB rate 2018 Depreciation 2019 Depreciation DOUBLE-DECLINING BALANCE RATE 2020 Depreciation Acc Dep Dec 31/20 BV-Dec 31/20 New DDB rate on Jan 1/2021 Depreciation 2021 Acc Dep Dec/21 BV-Dec 31/21 Depreciation 2022 (plug) Twice the straight-line rate 18 x 2 = 14 (25%) ($30,000 x 25%) x ($30,000 $3,750) x 25% ($30,000-$3,750 - $6,562.50) x 25% ($3,750 +$6,562.50 + $4,922) 25% $3,750 0.5 year $6,562.50 1 year $4,922 1 year $15,234.50 2.5 years $14,765.50 (1/2.5) x 2 = 80% 80% 80% $14,765.50 x 80% $11,812.40 1 year ($15,234.50 + 11,812.40) $27,046.90 ($30,000-$27,046.90) $2,953.10 ($2,953.10 $2,000) $953.10 ($30,000-$15,234.50) There would be no depreciation expense recorded for 2023.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started