Answered step by step

Verified Expert Solution

Question

1 Approved Answer

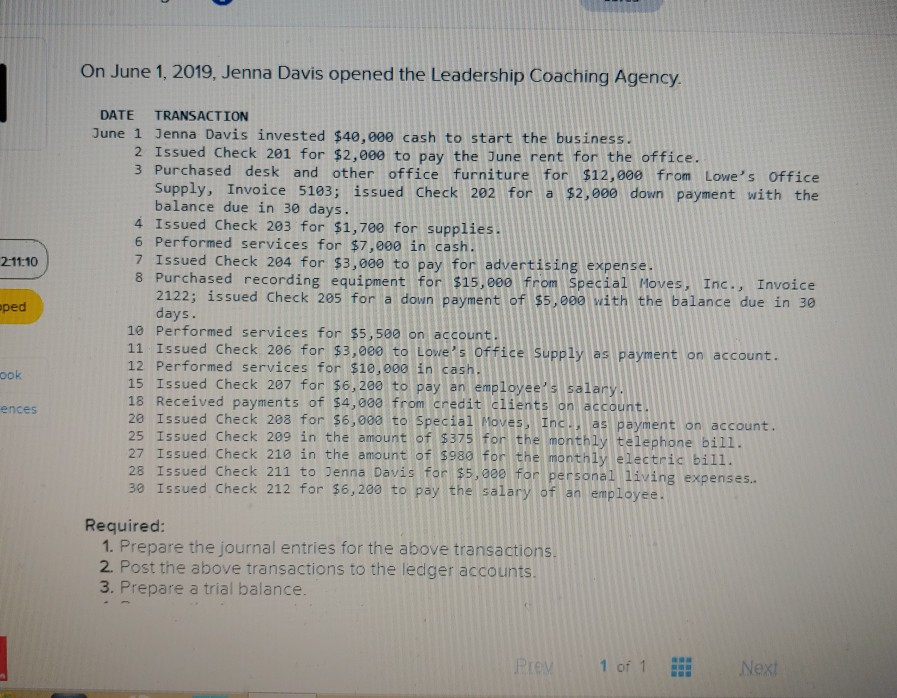

On June 1, 2019, Jenna Davis opened the Leadership Coaching Agency DATE TRANSACTION June 1 Jenna Davis invested $40,000 cash to start the business. 2

On June 1, 2019, Jenna Davis opened the Leadership Coaching Agency DATE TRANSACTION June 1 Jenna Davis invested $40,000 cash to start the business. 2 Issued Check 201 for $2,000 to pay the June rent for the office. 3 Purchased desk and other office furniture for $12,000 from Lowe's Office Supply, Invoice 5183; issued Check 202 for a $2,900 down payment with the balance due in 30 days. 4 Issued Check 203 for $1,700 for supplies 6 Performed services for $7,000 in cash 7 Issued Check 204 for $3,000 to pay for advertising expense. 8 Purchased recording equipment for $15, 000 from Special Moves, Inc., Invoice 211:10 2122; issued Check 205 for a down payment of $5,900 with the balance due in 30 ped days. 10 Performed services for $5,500 on account 11 Issued Check 206 for $3,000 to Lowe's Office Supply as payment on account. 12 Performed services for $10,000 in cash. 15 Issued Check 207 for $6,200 to pay an employee's salany 18 Received payments of $4,000 from credit clients on account. 2e Issued Check 208 for $6,000 to Special Moves, Inc.. as payment on account 25 Issued Check 209 in the amount of $375 for the monthly telephone bill 27 Issued Check 210 in the amount of $980 for the monthly electric bill. 28 Issued Check 211 to Jenna Davis for $5,00e for personal living expenses. 30 Issued Check 212 for $6,200 to pay the salary of an employee. 000 ook Required: 1. Prepare the journal entries for the above transactions 2. Post the above transactions to the ledger accounts 3. Prepare a trial balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started