Answered step by step

Verified Expert Solution

Question

1 Approved Answer

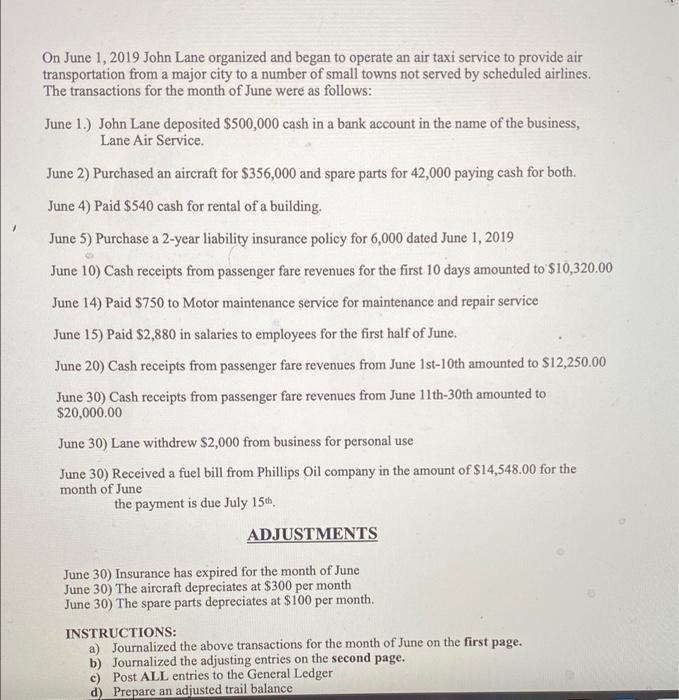

On June 1, 2019 John Lane organized and began to operate an air taxi service to provide air transportation from a major city to

On June 1, 2019 John Lane organized and began to operate an air taxi service to provide air transportation from a major city to a number of small towns not served by scheduled airlines. The transactions for the month of June were as follows: June 1.) John Lane deposited $500,000 cash in a bank account in the name of the business, Lane Air Service. June 2) Purchased an aircraft for $356,000 and spare parts for 42,000 paying cash for both. June 4) Paid $540 cash for rental of a building. June 5) Purchase a 2-year liability insurance policy for 6,000 dated June 1, 2019 June 10) Cash receipts from passenger fare revenues for the first 10 days amounted to $10,320.00 June 14) Paid $750 to Motor maintenance service for maintenance and repair service June 15) Paid $2,880 in salaries to employees for the first half of June. June 20) Cash receipts from passenger fare revenues from June 1st-10th amounted to $12,250.00 June 30) Cash receipts from passenger fare revenues from June 11th-30th amounted to $20,000.00 June 30) Lane withdrew $2,000 from business for personal use June 30) Received a fuel bill from Phillips Oil company in the amount of S14,548.00 for the month of June the payment is due July 15th, ADJUSTMENTS June 30) Insurance has expired for the month of June June 30) The aircraft depreciates at $300 per month June 30) The spare parts depreciates at $100 per month. INSTRUCTIONS: a) Journalized the above transactions for b) Journalized the adjusting entries on the second page. c) Post ALL entries to the General Ledger d) Prepare an adjusted trail balance month of June on the first page.

Step by Step Solution

★★★★★

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Date Particulars Debit Credit 01Jun19 Cash 500000 John Lane Capital To record inital ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started