Answered step by step

Verified Expert Solution

Question

1 Approved Answer

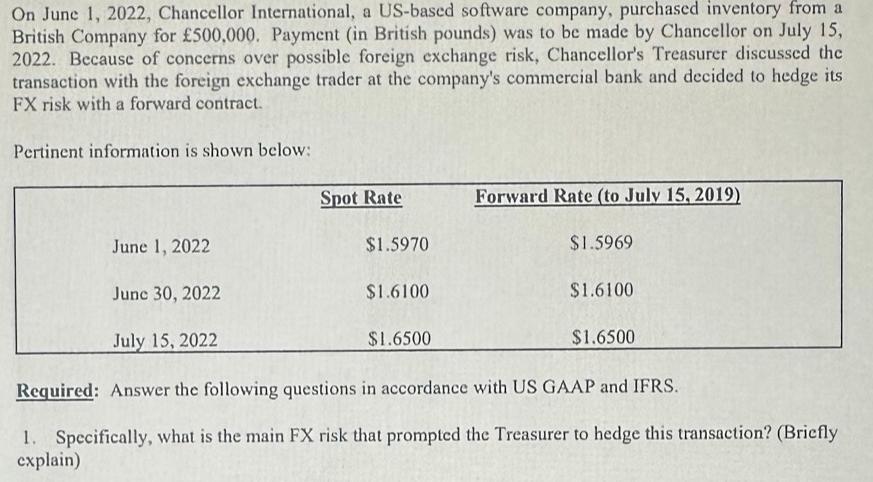

On June 1, 2022, Chancellor International, a US-based software company, purchased inventory from a British Company for 500,000. Payment (in British pounds) was to

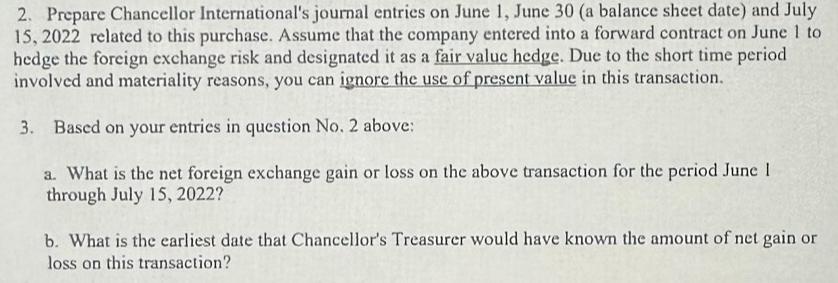

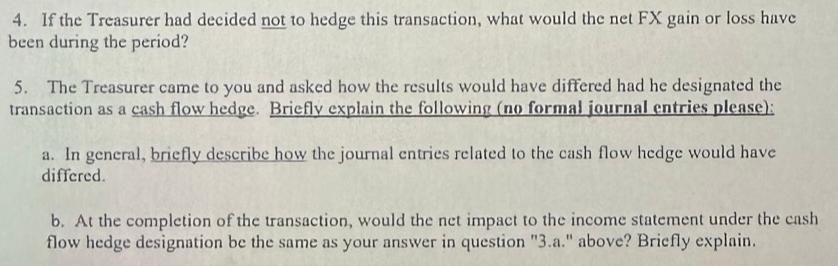

On June 1, 2022, Chancellor International, a US-based software company, purchased inventory from a British Company for 500,000. Payment (in British pounds) was to be made by Chancellor on July 15, 2022. Because of concerns over possible foreign exchange risk, Chancellor's Treasurer discussed the transaction with the foreign exchange trader at the company's commercial bank and decided to hedge its FX risk with a forward contract. Pertinent information is shown below: Spot Rate Forward Rate (to July 15, 2019) June 1, 2022 $1.5970 $1.5969 June 30, 2022 $1.6100 $1.6100 July 15, 2022 $1.6500 $1.6500 Required: Answer the following questions in accordance with US GAAP and IFRS. 1. Specifically, what is the main FX risk that prompted the Treasurer to hedge this transaction? (Briefly explain) 2. Prepare Chancellor International's journal entries on June 1, June 30 (a balance sheet date) and July 15, 2022 related to this purchase. Assume that the company entered into a forward contract on June 1 to hedge the foreign exchange risk and designated it as a fair value hedge. Due to the short time period involved and materiality reasons, you can ignore the use of present value in this transaction. 3. Based on your entries in question No. 2 above: a. What is the net foreign exchange gain or loss on the above transaction for the period June 1 through July 15, 2022? b. What is the earliest date that Chancellor's Treasurer would have known the amount of net gain or loss on this transaction? 4. If the Treasurer had decided not to hedge this transaction, what would the net FX gain or loss have been during the period? 5. The Treasurer came to you and asked how the results would have differed had he designated the transaction as a cash flow hedge. Briefly explain the following (no formal journal entries please): a. In general, briefly describe how the journal entries related to the cash flow hedge would have differed. b. At the completion of the transaction, would the net impact to the income statement under the cash flow hedge designation be the same as your answer in question "3.a." above? Briefly explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The main foreign exchange FX risk that prompted the Treasurer to hedge this transaction is the excha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started