Question

On June 1,2013 AEC Company paid $30,000 for 1,000 common shares and later that same year received a 10 percent stock dividend on Sep.1.2010.

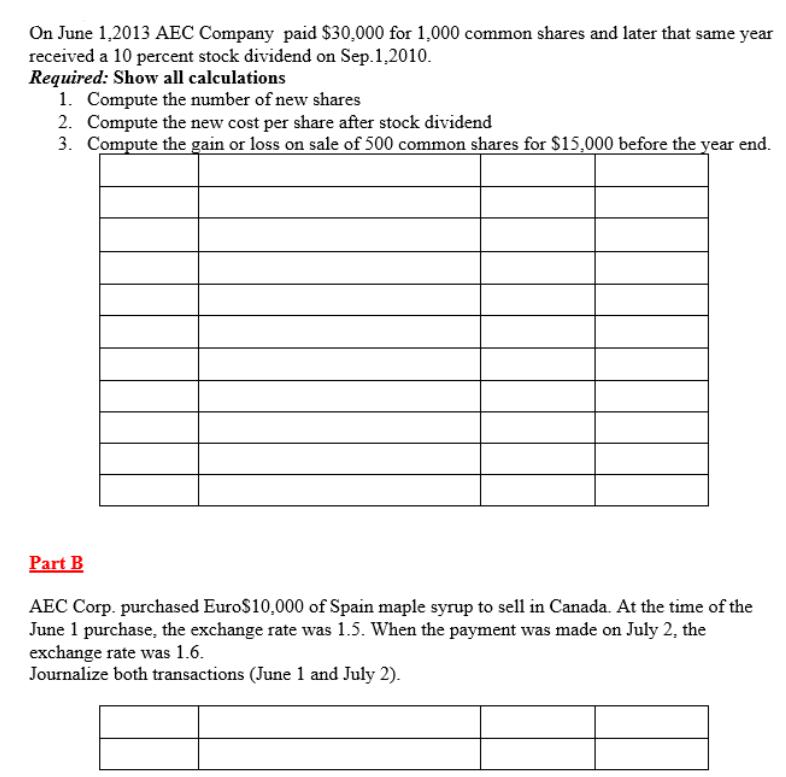

On June 1,2013 AEC Company paid $30,000 for 1,000 common shares and later that same year received a 10 percent stock dividend on Sep.1.2010. Required: Show all calculations 1. Compute the number of new shares 2. Compute the new cost per share after stock dividend 3. Compute the gain or loss on sale of 500 common shares for $15,000 before the year end. Part B AEC Corp. purchased Euro$10,000 of Spain maple syrup to sell in Canada. At the time of the June 1 purchase, the exchange rate was 1.5. When the payment was made on July 2, the exchange rate was 1.6. Journalize both transactions (June 1 and July 2).

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

A 1 The number of new shares after the 10 stock dividend is calculated as follows New shares 1000 sh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Accounting

Authors: Fred Phillips, Robert Libby, Patricia Libby

4th edition

978-0073369709, 73369705, 78025370, 978-0077444846, 77444841, 978-0078025372

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App