Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On June 3, 2023, Kitty Wilkinson received a bank statement from the bank for the month of May which showed an overdrawn balance of

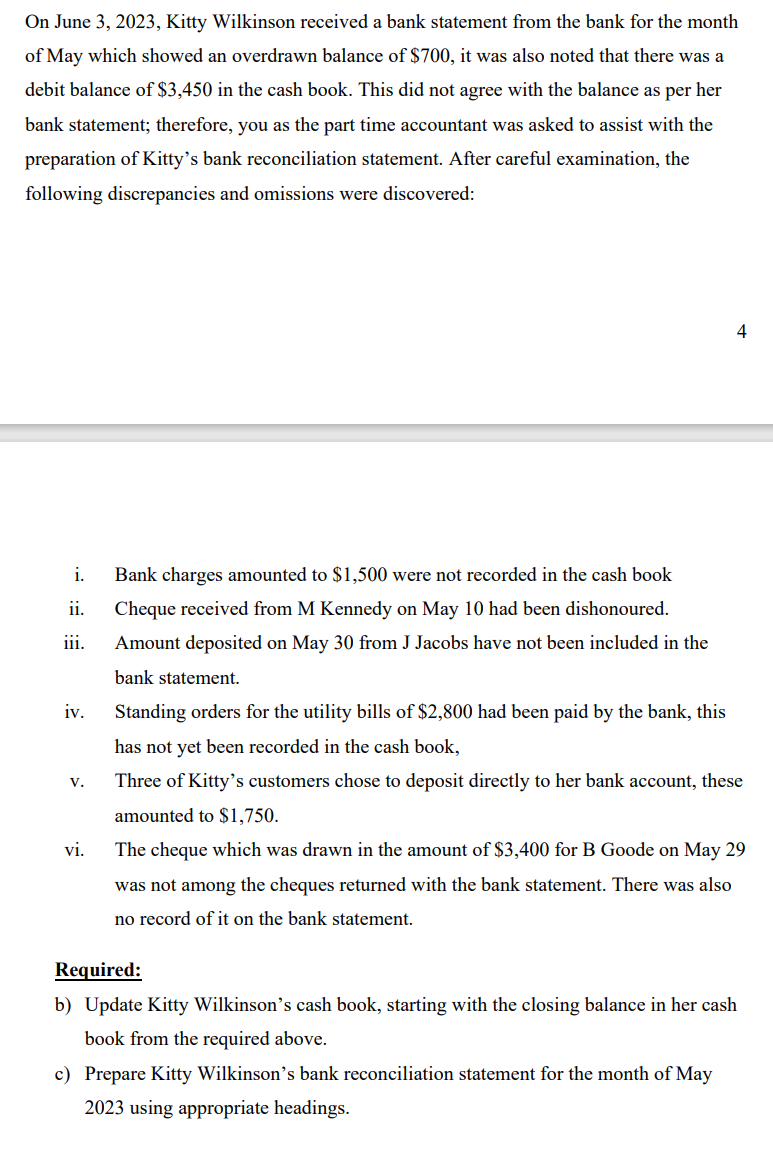

On June 3, 2023, Kitty Wilkinson received a bank statement from the bank for the month of May which showed an overdrawn balance of $700, it was also noted that there was a debit balance of $3,450 in the cash book. This did not agree with the balance as per her bank statement; therefore, you as the part time accountant was asked to assist with the preparation of Kitty's bank reconciliation statement. After careful examination, the following discrepancies and omissions were discovered: ii. i. Bank charges amounted to $1,500 were not recorded in the cash book Cheque received from M Kennedy on May 10 had been dishonoured. Amount deposited on May 30 from J Jacobs have not been included in the bank statement. iii. iv. V. vi. 4 Standing orders for the utility bills of $2,800 had been paid by the bank, this has not yet been recorded in the cash book, Three of Kitty's customers chose to deposit directly to her bank account, these amounted to $1,750. The cheque which was drawn in the amount of $3,400 for B Goode on May 29 was not among the cheques returned with the bank statement. There was also no record of it on the bank statement. Required: b) Update Kitty Wilkinson's cash book, starting with the closing balance in her cash book from the required above. c) Prepare Kitty Wilkinson's bank reconciliation statement for the month of May 2023 using appropriate headings.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

b Update Kitty Wilkinsons cash book Starting with the closing balance in the cash book from the give...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started