Answered step by step

Verified Expert Solution

Question

1 Approved Answer

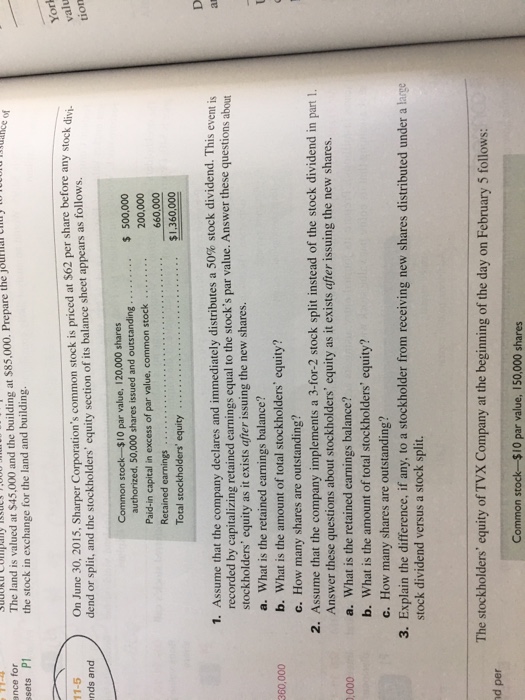

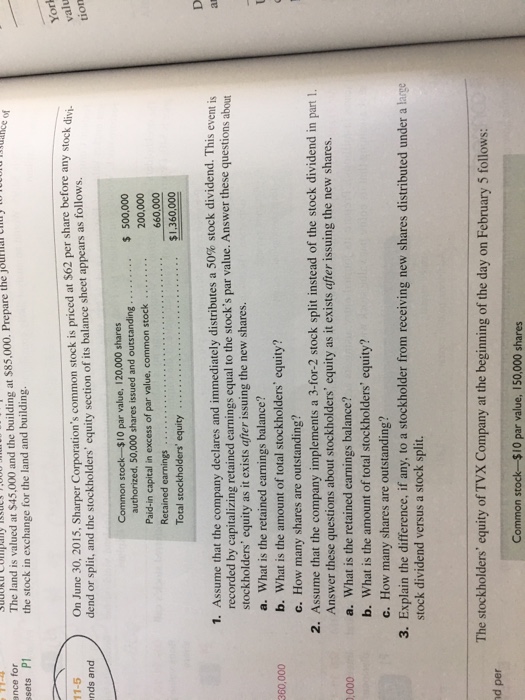

On June 30, 2015 sharp or corporations common stock is priced at $62 per share before any stock dividend or split and the stockholders equity

On June 30, 2015 sharp or corporations common stock is priced at $62 per share before any stock dividend or split and the stockholders equity section of its balance sheet appears as follows

ance for sets P 11-5 nds and 360,000 nd per The land is valued at $45,000 and ss5,000. Prepare the j8lllllllllll! at the building e Jou the stock in exchange for the land and building. On June 30, 2015, Sharper Corporation's common stock is priced at $62 per share before any stock di dend or split, and the stockholders' equity section of its balance sheet appears as follows. vi- Common stock-$10 par value, 120,000 shares 500,000 authorized. 50,000 shares issued and outstanding 200,000 Paid-in capital in excess of par value common stock 660,000 Retained earnings $I,360,000 Total stockholders' equity 1. Assume that the company declares and immediately distributes a 50% stock dividend. This event is recorded by retained earnings the value. Answer these questions about stockholders' equity as it exists after issuing the new shares. a. What is the retained earnings balance? b. What is the amount of total stockholders' equity? c. How many shares are outstanding? 2. Assume that the company implements a 3-for-2 stock split instead of the stock dividend in part l Answer these questions about stockholders' equity as it exists after issuing the new shares. a. What is the retained earnings balance? b. What is the amount of total stockholders' equity? c. How many shares are outstanding? 3. Explain the difference, if any, to a stockholder from receiving new shares distributed under a large stock dividend versus a stock split. The stockholders' equity of TVX Company at the beginning of the day on February 5 follows: Common stock $10 par value, 150,000 shares York valu tion

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started