On June 30, 2015, Wisconsin, Inc., issued $108,650 in debt and 24,200 new shares of its $10 par value stock to Badger Company owners

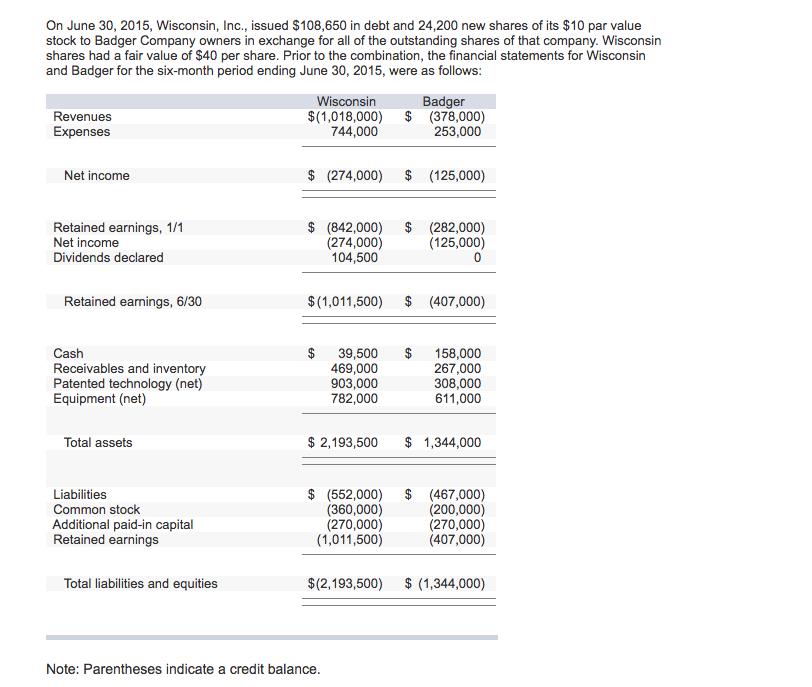

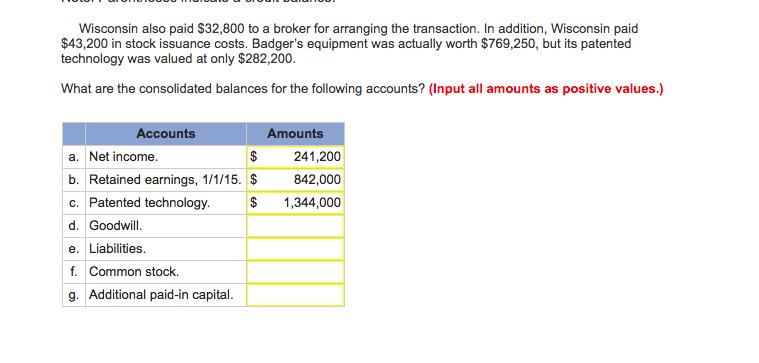

On June 30, 2015, Wisconsin, Inc., issued $108,650 in debt and 24,200 new shares of its $10 par value stock to Badger Company owners in exchange for all of the outstanding shares of that company. Wisconsin shares had a fair value of $40 per share. Prior to the combination, the financial statements for Wisconsin and Badger for the six-month period ending June 30, 2015, were as follows: Revenues Expenses Net income Retained earnings, 1/1 Net income Dividends declared Retained earnings, 6/30 Cash Receivables and inventory Patented technology (net) Equipment (net) Total assets Liabilities Common stock Additional paid-in capital Retained earnings Total liabilities and equities Wisconsin Badger $(1,018,000) $ (378,000) 744,000 253,000 $ (274,000) $ (125,000) $ (842,000) $ (282,000) (274,000) 104,500 (125,000) 0 $(1,011,500) $ (407,000) 39,500 469,000 903,000 782,000 $ (552,000) (360,000) (270,000) (1,011,500) $ 2,193,500 $ 1,344,000 $(2,193,500) Note: Parentheses indicate a credit balance. $ 158,000 267,000 308,000 611,000 $ (467,000) (200,000) (270,000) (407,000) $ (1,344,000) Wisconsin also paid $32,800 to a broker for arranging the transaction. In addition, Wisconsin paid $43,200 in stock issuance costs. Badger's equipment was actually worth $769,250, but its patented technology was valued at only $282,200. What are the consolidated balances for the following accounts? (Input all amounts as positive values.) Accounts Amounts a. Net income. $ 241,200 b. Retained earnings, 1/1/15. $ 842,000 c. Patented technology. $ 1,344,000 d. Goodwill. e. Liabilities. f. Common stock. g. Additional paid-in capital.

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Net income 27400032800 241200 Retained Earnings 1115 842000241200104500 978700 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started