Question

On June 30, 2016, Papa Phil Inc. leased 200 pizza ovens for its chain of restaurants from IC Leasing Corporation. The lease agreement calls for

On June 30, 2016, Papa Phil Inc. leased 200 pizza ovens for its chain of restaurants from IC Leasing Corporation. The lease agreement calls for Papa Phil to make semiannual lease payments of $562,907 over a three-year lease term, payable each June 30 and December 31, with the first payment on June 30, 2016. IC calculated lease payment amounts using a 10% interest rate. IC purchased the 200 pizza ovens from Pizza Inc. at their retail price of $3 million. Respond to the question with the presumption that the guidance provided by the proposed Accounting Standards Update is being applied.

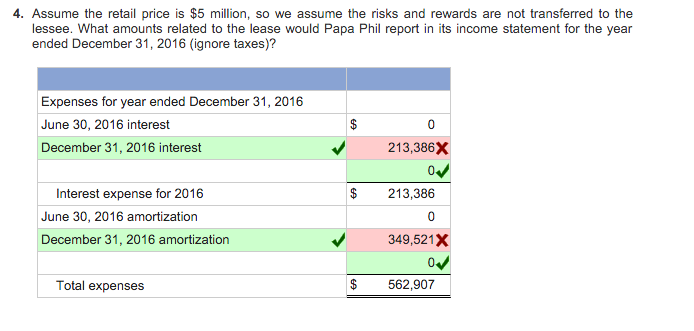

(1) Assume the retail price is $5 million, so we assume the risks and rewards are not transferred to the lessee. What amounts related to the lease would Papa Phil report in its income statement for the year ended December 31, 2016 (ignore taxes)? I ONLY NEED THIS QUESTION ANSWERED! Thanks!

please fill table below

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started